Cemex 1Q25: Credit Strength Persists, but No Catalyst for Spread Compression

Credit profile supported by strong liquidity and discipline, yet macro and operational headwinds persist.

Key Insights and Recommendations

Cemex reported weak 1Q25 results. Revenues totaled $3.65 billion, reflecting a 7.4% YoY decline (l-t-l: -1% YoY), missing consensus expectations by 1.2%, primarily due to top-line deterioration in Mexico (down 25.3%) and the US (down 3.5%), partially offset by improvements in EMEA (up 2.3%) and SCAC (up 2.5%). The company generated adjusted EBITDA of $601 million in the quarter, reflecting declines of 11.7% QoQ and 17.7% YoY (l-t-l: -10%), missing consensus expectations by 3.3%. The EBITDA margin contracted to 16.5% in 1Q25 from 17.9% in 4Q24 and from 18.5% in 1Q24. The margin was supported by higher prices and lower energy and freight costs, offset by the impact of lower volumes, higher labor costs, and maintenance work. Cemex reaffirmed its guidance for flat EBITDA in 2025 despite the soft quarter, supported by cost-cutting initiatives targeting $150 million in EBITDA savings and improving trends expected in the second half of the year.

From a credit perspective, the results reflected a 4.1% sequential decline in LTM EBITDA, which was mostly offset by a 3.2% decrease in net debt and a 4.9% reduction in LTM interest paid. Consequently, gross leverage increased modestly by 0.1x to 2.9x, net leverage remained stable at 2.5x, and EBITDA coverage improved by 0.0.x to 4.3x as of March 2025. FFO to debt also showed modest improvement, increasing by 0.1 pp to 17.6% as of March 2025.

Weaker EBITDA and significantly higher expansion capex weighed on cash generation, offsetting the benefit of lower interest paid and taxes, and resulting in a net free cash outflow of $473 million in 1Q25. Including “other net” items, adjusted free cash flow was an outflow of $610 million in the quarter. However, after accounting for the $862 million inflow from asset sales, the company generated $252 million, which led to net debt reduction and relatively stable leverage metrics.

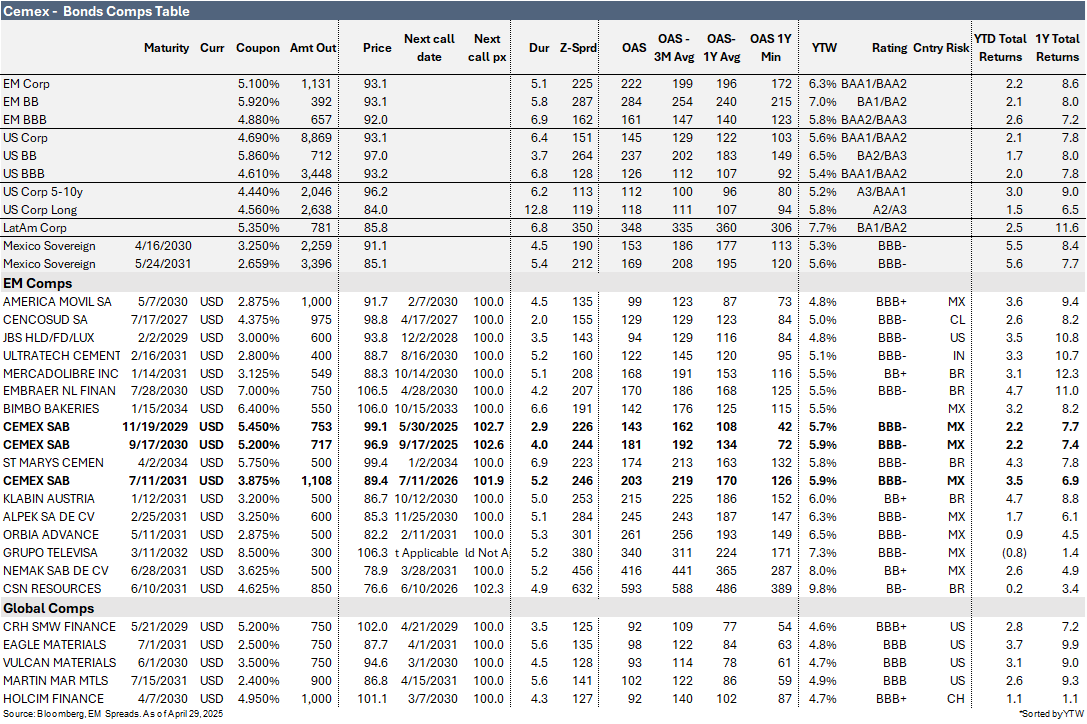

We continue to view Cemex as an attractive and resilient Latam credit, with a focus on profitability and deleveraging, supported by a management team that appears committed to maintaining healthy credit metrics, reducing debt, and improving free cash flow generation. However, we maintain our Market Perform recommendation, as we do not expect clear outperformance given the challenging outlook in the company’s two main markets, Mexico and the US, where volume demand is being affected by post-election dynamics in Mexico and weather-related issues in the US.