CSN 2Q25: Stable Credit Metrics and Attractive Carry Support Overweight

Wide spreads, resilient credit metrics, strong liquidity, and deleveraging initiatives position 2031s and 2032s for price upside despite market dynamics headwinds and concerning cash burn.

Key Insights and Recommendations

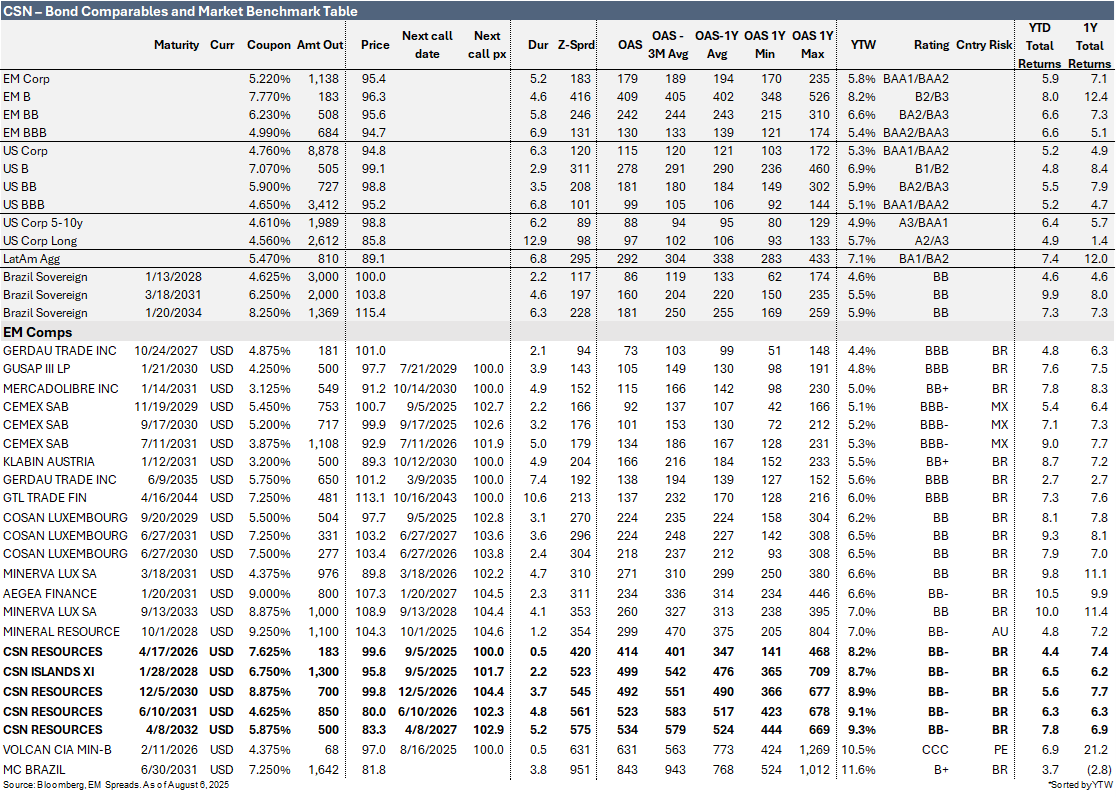

We maintain our Overweight recommendation, favoring the CSNBZ 4.625% 2031s (yielding 9.1%, priced at $80.0) and CSNBZ 5.875% 2032s (yielding 9.3%, priced at $83.3) for their attractive carry, potential price upside, and wide spreads versus the LatAm BB curve. We believe CSN’s credit metrics will remain broadly stable, while spread compression could be supported by Brazilian protectionist measures on steel imports, a possible recovery in steel prices from Chinese production cuts, asset sales, anticipated domestic rate cuts, and improving global trade sentiment.