Bond Market Snapshots

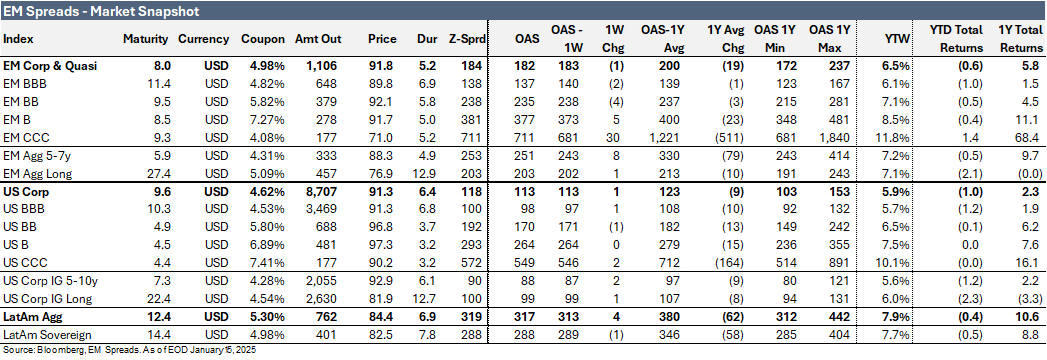

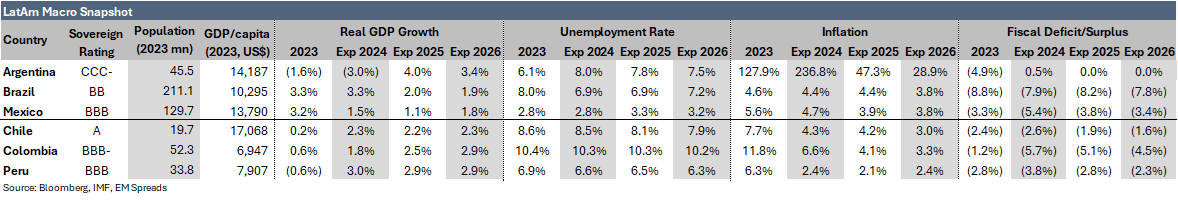

The LatAm Corporate Index widened by 4 bps to 317 bps in the week ended Wednesday, January 15, 2025, while the broader EM Index narrowed by 1 bps to 182 bps, and the broader US Index widened by 1 bps to 113 bps over the same period. The region’s equity markets had a mixed performance: Argentina’s Merval Index (in USD) declined by 2.8%, Brazil's Ibovespa Index rose by 2.5%, Mexico’s Mexbol Index increased by 1.2%, and the S&P 500 Index gained 0.5%. WTI and Brent crude are trading at US$80.5/bbl (+8.3%) and US$82.5/bbl (+6.8%), respectively. Meanwhile, yields on U.S. Treasuries climbed, with the 10Y yield up 4 bps to 4.65% and the 5Y yield up 1 bps to 4.45%.

Weekly News

1. YPF Priced $1.1bn Bond Due 2034 at 8.5% Yield

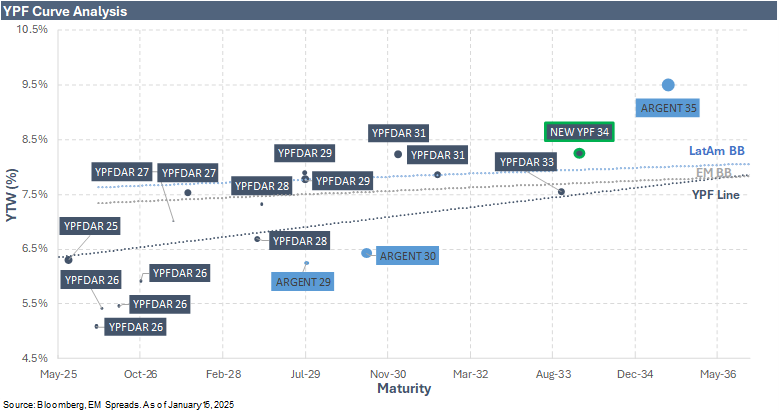

On January 8, 2025, YPF S.A. (Caa1/CCC/CCC) successfully priced a US$1.1 billion 9NC4 senior unsecured bond with an 8.25% coupon at 98.561, achieving a final yield of 8.5%. This represents a tightening from the initial price talk of around 8.75%. The issuance is Argentina’s largest corporate bond deal since YPF’s US$1.5 billion issuance in 2015. The bond will amortize in three tranches: 30% in 2032, 30% in 2033, and 40% at maturity. Proceeds will be allocated to refinancing and repaying existing debt (including the 2025 notes), investments in fixed assets, and acquisitions, including MASA. The issuance, governed by New York law, was arranged by BBVA, Deutsche Bank, Itaú BBA, and Santander, with Latin Securities acting as a joint bookrunner.

YPF informed investors it does not intend to issue another international bond this year, likely bolstering demand amid Argentina’s improving credit momentum. YPF’s ability to lower its dollar funding costs also reflects this positive sentiment. In January 2024, YPF priced its senior secured 2031 notes at 9.75%. By September, it issued unsecured 2031 notes at a lower yield of 8.75%.

Credit Impact: Positive

YPF’s issuance and tender offer of the 2025 bonds represents a strategic move to mitigate refinancing risks ahead of the 2025 bond maturity wall. The transaction enhances liquidity by extending USD-denominated maturities and securing longer-term funding during a period of substantial investment, which we expect to result in negative cash flow. The strong demand for this issuance underscores investor confidence despite YPF’s CCC credit profile, supported by its improved operating performance in 2024 and Argentina’s favorable macroeconomic conditions.

A successful tender offer would significantly reduce YPF’s short-term USD-denominated debt, further strengthening liquidity and lowering refinancing risks. The impact on interest expense should be negligible, as the company plans to exchange its 8.5% 2025 notes for new notes with a similar coupon.

We continue to recommend to “BUY” the new YPFAR 2034 8.250% 2034s unsecured bonds. With an 8.4% yield for a 5.3-year duration, we find the notes attractive relative to the YPFAR 7.000% 2033s unsecured bonds, which yield 7.6% for a 5.4-year duration, and the YPFAR 8.750% 2031s unsecured bonds, yielding 7.9% for a 3.9-year duration. We believe these bonds offer an appealing yield within YPF’s debt capital structure and are currently trading wide relative to the broader LatAm BB and EM BB curves. Meanwhile, YPF’s shorter-dated bonds are trading at or near par, limiting further upside potential.

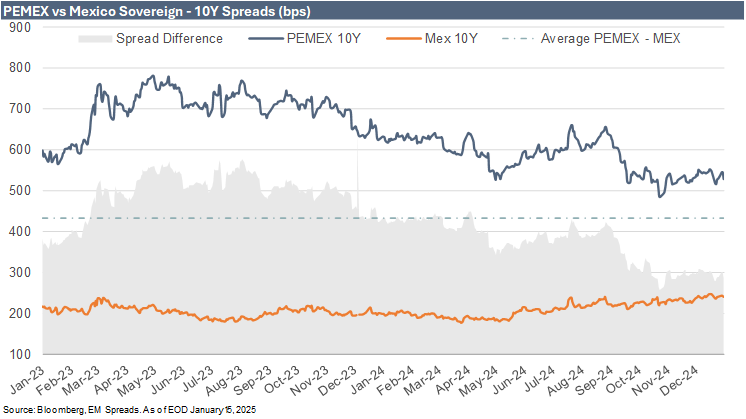

2. PEMEX Commits to Settling Supplier Debts by March

On January 15, 2025, Mexico’s President Claudia Sheinbaum announced during a press briefing that payments owed to suppliers by Pemex are expected to be completed by March 2025.

Pemex faces mounting pressure from suppliers and contractors over outstanding debts exceeding P$402.9 billion (US$19.6 billion). Despite partial payments made in December 2024, only covering only 3–5% of the total owed, many businesses, particularly in key oil-producing regions like Tabasco and Campeche, continue to struggle with liquidity issues. Over 120 companies with direct contracts, primarily based in Ciudad del Carmen, remain financially strained.

While local business leaders have acknowledged President Sheinbaum’s initial efforts to address Pemex’s payment obligations, they emphasize the urgency of a more substantial payment, anticipated in January, to stabilize operations and support economic recovery. The prolonged delays have resulted in widespread economic repercussions, including layoffs, operational disruptions, and heightened unemployment among subcontractors. Protests have erupted in Tabasco, with suppliers criticizing Pemex for failing to meet prior payment commitments.

The most recent official data, from September 2024, reported liabilities to suppliers of P$402 billion. However, updated figures have not been disclosed, adding to bondholder uncertainty. In response to the escalating crisis, the Mexican government has proposed measures to resolve the issue. President Sheinbaum announced that the Ministry of Finance will take charge of supplier payments, ensuring resolution by March 2025.

Credit Impact – Mixed

We view the ongoing liquidity crisis at Pemex as further confirmation of the company’s unsustainable capital structure. Persistent payment delays to suppliers and contractors underscore its strained cash flow and weak liquidity. As of September 2024, Pemex carried a substantial debt burden, with total debt amounting to $99.3 billion, including lease liabilities. The company’s gross leverage stands at 6.0x, net leverage at 5.7x, and negative FFO-to-debt and an interest coverage ratio of 1.9x.

Despite these challenges, Pemex has made some progress in reducing its debt, cutting net debt by $11.3 billion since September 2023, an encouraging sign for its credit profile. Nevertheless, liquidity remains a critical concern, with $18.6 billion in short-term debt, including lease liabilities, equating to nearly 400% of its cash position as of September 2024. Furthermore, the limited availability of credit lines suggests that some banks may be increasingly reluctant to extend financing to the company.

That said, we continue to believe that Pemex’s reclassification, stronger sovereign linkage, and its payment program to stabilize balances with suppliers and contractors will bolster its credit profile. The company’s financial stability remains heavily reliant on the strong likelihood of continued support from the Mexican government, which maintains a significantly stronger credit profile.

3. Moody’s Upgrades Ratings of Argentine Non-Financial Companies Following Country Ceiling Adjustment

On January 14, 2025, Moody’s upgraded the credit ratings of multiple Argentine non-financial corporations following an increase in Argentina’s sovereign country ceilings. The foreign currency ceiling was raised to Caa1 from Caa3, while the local currency ceiling improved to B3 from Caa1, citing enhanced economic policy predictability, reduced monetary and fiscal imbalances, and easing of cross-border payment restrictions.

Within our coverage, Vista Energy was upgraded to Caa1 from Caa2 with a stable outlook, and YPF SA was upgraded to Caa1 from Caa3 with a stable outlook. Another interesting upgrade was Pan America Energy to B3 from Caa1 and Telecom Argentina SA to Caa1 from Caa3, both with stable outlooks.

The upgrades reflect improved foreign currency liquidity and reduced government intervention, lowering transfer and convertibility risks. However, these companies remain heavily exposed to Argentina’s sovereign risk, limiting their rating upside unless the country’s macroeconomic environment and sovereign rating improve further.

Credit Impact - Minimal

Despite the positive developments from the upgrades, the credit impact on bonds issued by YPF and Vista Energy is expected to be minimal. In our view, the market had already begun pricing in Argentina’s improving macroeconomic environment prior to the rating adjustments. It is important to highlight that these companies remain deeply tied to Argentina’s sovereign risk. While the upgrades reduce near-term risks related to currency liquidity and cross-border payments, the ratings remain constrained by the country’s broader macroeconomic and political challenges.

Without further improvements in Argentina’s sovereign creditworthiness and the implementation of meaningful structural reforms, the upside potential for corporate credit ratings and bond performance will likely remain somewhat limited. That said, the upgrades reinforce the relative attractiveness of bonds from companies like YPF and Vista Energy within the context of Argentina’s credit landscape.

EM Spreads’ Most Recent Publications:

YPF (January 8, 2025): Recommendation on YPF's new USD 9NC4 unsecured notes.

Vista Energy (December 18, 2024): New issue snapshot.

YPF (December 3, 2024): Initiation coverage report.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.