MELI 1Q25: Impressive Growth, Little Room for Further Spread Compression

MercadoLibre beat 1Q25 expectations with strong regional growth, though credit-fueled expansion pushed debt higher. Credit metrics remain healthy.

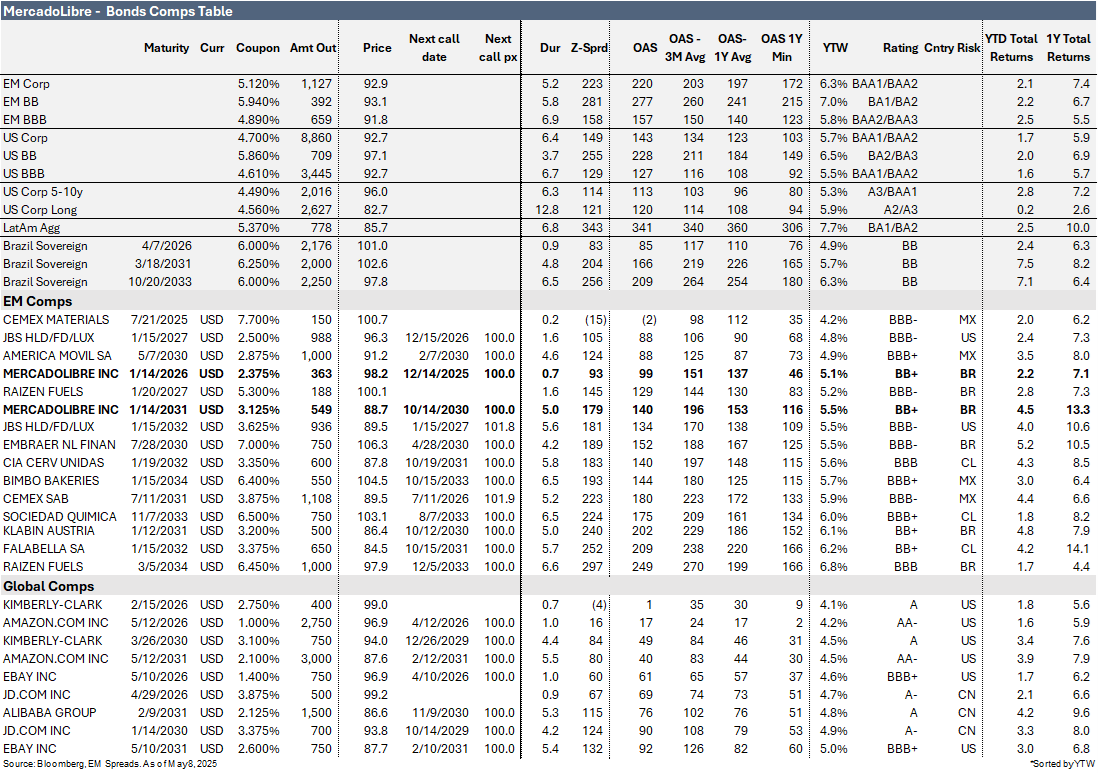

Key Insights and Recommendations

MercadoLibre reported another solid set of results in 1Q25. Revenues increased 37.0% YoY (FX-neutral up 64% YoY), supported by a 17.3% increase in GMV (FX-neutral up 40% YoY) and 43.2% growth in TPV (FX-neutral up 72% YoY). Healthy growth across key markets drove revenues 7.9% above market expectations, with both Commerce and Fintech posting strong YoY growth of 32.3% and 43.3% respectively. The highlight was the continued recovery and strong performance in Argentina, which generated $1.4 billion in revenues, reflecting a 124.7% YoY increase. We note that NIMAL declined sequentially to 22.7% in 1Q25, mostly due to a higher share of lower-NIMAL credit cards in the portfolio, which rose to 42% in 1Q25 from 32% in 1Q24. NPLs increased sequentially to 8.2% but remained within the same range observed over the past 12 months. The company generated adjusted EBITDA of $935 million in the quarter, up 37.1% YoY and exceeding consensus expectations by 16.2%. EBITDA margins remained stable and healthy at 15.8%.

From a credit perspective, the results were marked by a 12.8% sequential increase in total debt and a 35.7% increase in net debt, partially offset by a 7.8% improvement in LTM EBITDA. Operating cash flow was $1.0 billion in 1Q25, down 31.8% YoY, while capital expenditures increased 83.8% YoY, resulting in free operating cash flow of $759 million, down 44.4% YoY and 71.0% QoQ. Adjusted free cash flow was a $10 million outflow, down from $160 million in 1Q24 and $680 million in 4Q24. As a result, net debt increased by 0.2x to 0.8x as of March 2025, though it remains at very healthy levels. However, liquidity remained adequate but showed signs of deterioration, with total liquidity covering short-term debt by 1.1x. This coverage declined from 1.3x in December 2024 and 1.7x in March 2024, driven by a 25.5% QoQ increase in short-term debt.

We continue to view MELI as an attractive emerging market credit story and remain constructive on its financial and business risk profile. The company’s leadership in the Latin American e-commerce and fintech sectors positions it well to capture value and manage operational risks effectively. MELI benefits from a strong operating profile, solid geographic diversification across the region, and a healthy liquidity position supported by substantial cash generation. Given its competitive advantage, we remain optimistic about the company’s fundamentals and expect continued growth and positive operating performance, which should support further improvements in credit metrics.