MELI 2Q25: Constructive on Growth Prospects, Limited Spread Compression

Strong e-commerce and fintech momentum, but margin headwinds from marketing and shipping initiatives and current valuations limit further upside

Key Insights and Recommendations

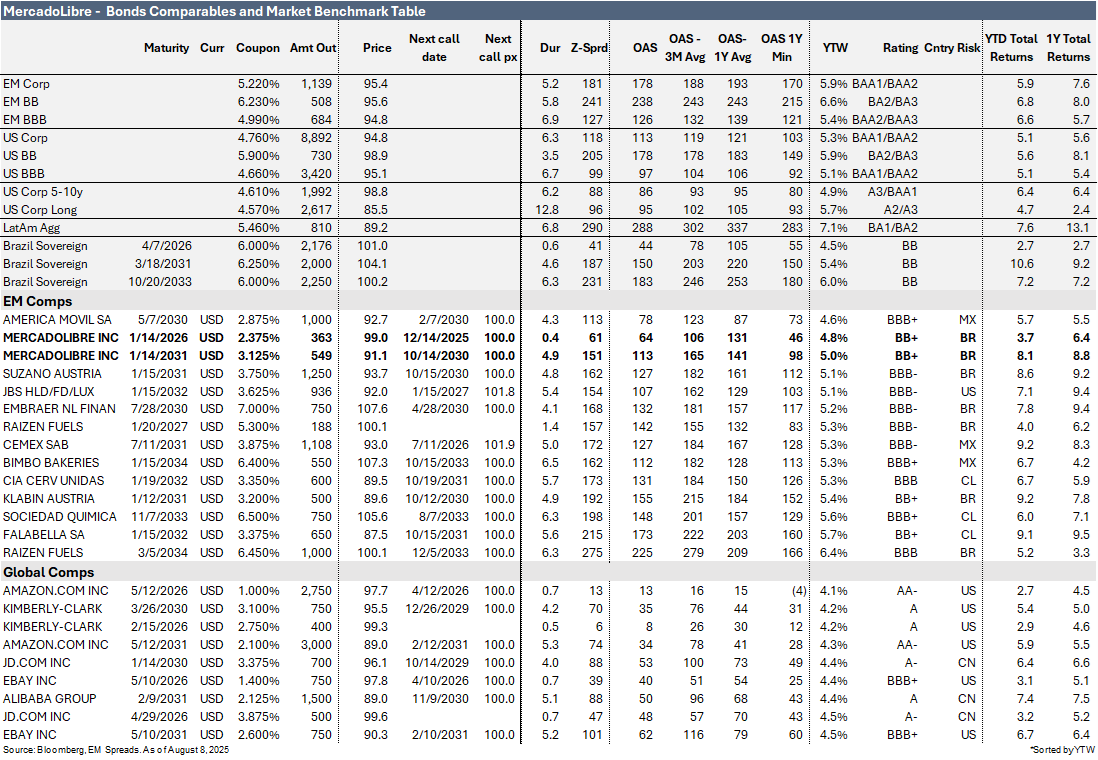

We maintain our Neutral recommendation on MELI’s 2031 bonds, as relative value comparisons place them close to fair value, albeit on the expensive side. While we remain constructive on MELI’s operating profile and growth prospects, we see limited potential for further spread compression over the next 9–12 months given persistent margin pressure from new marketing and shipping initiatives, higher debt, and a tighter liquidity profile.