MercadoLibre 2Q24: Fintech Credit Fuels Commerce Growth

We maintain our Outperform recommendation on MercadoLibre with a preference for MELI 2.375% 2026 bonds.

Executive Summary

We maintain our Outperform recommendation on MercadoLibre with a preference for MELI 2.375% 2026 bonds. We remain optimistic about the company’s overall financial and business risks.

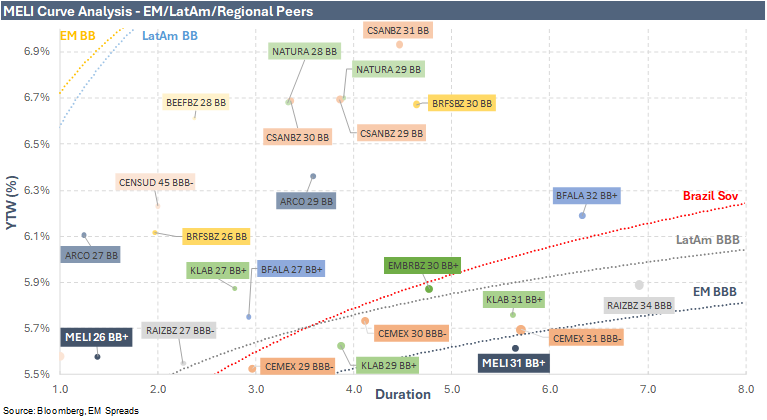

For EM investors, we prefer MELI 2.375% 2026 notes, which have a potential compression of 10-30 basis points. These bonds are trading wide compared to the Brazilian Sovereign, the EM BBB Index, and the LatAm BBB Index, offering a more favorable risk-return profile than the current spread levels on MELI 2031 3.125% notes, which are trading tight compared to the same benchmarks.

For US investors, MELI's risk-reward symmetry is particularly compelling. The 2031 bonds are trading wide to the broader US Index, yielding 1.1 percentage points higher than comparable global e-commerce and fintech peers. We think MELI’s geographic diversification, healthy liquidity, strong credit metrics, and positive outlook partially offset the risks associated with its LatAm exposure.

The company benefits from its leadership position and well-recognized name in the growing Latin American e-commerce and fintech sectors. It has a proven track record of navigating Latin America’s economic and political crisis. MELI’s diversified offering further supports our positive outlook, which provides a powerful competitive advantage that enhances customer retention and fuels growth, instilling confidence in its potential. MELI’s business profile is also strengthened by its significant presence across 18 countries in Latin America. The company’s credit story is bolstered by its commitment to a conservative balance sheet, strong operating performance, and strong credit metrics.

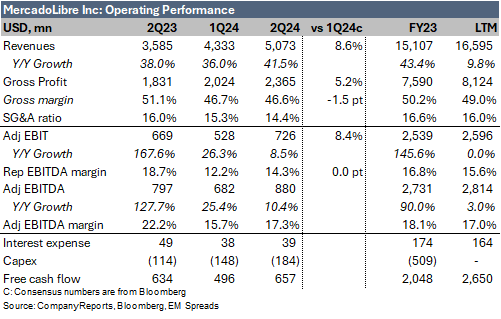

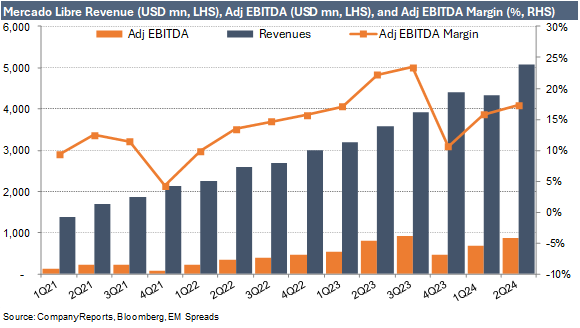

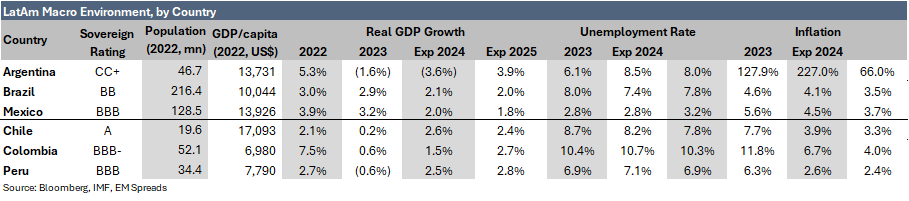

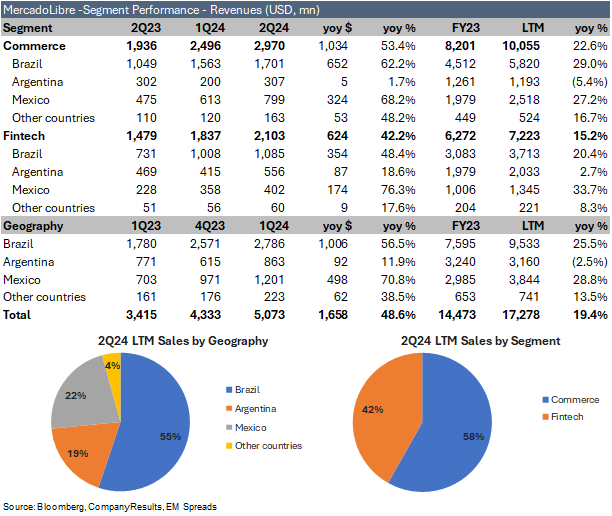

Revenues increased significantly by 41.5% (FX-neutral: 113%) to $5.1 billion in 2Q24. Both sectors, Commerce and Fintech, contributed to the improvement, with Commerce up by 53.4% yoy and Fintech up by 42.2% yoy. This growth was driven by a 20% yoy increase in Commerce GMV and a 36% improvement in Fintech TPV. Brazil (+56.5%) and Mexico (70.8%) had solid results, while Argentina grew by 11.9% yoy despite the country's macroeconomic challenges. As a result, revenues were 8.6% ahead of consensus expectations.

Mercado Libre 2Q24 EBIT was $726 million, up from $669 million in the same period last year. However, the EBIT margin contracted significantly by 440 bps to 14.3% from 18.7%. Higher bad debt provisions (-350 bps) for accelerating MELI’s credit book originations pressured the margin. Shipping reporting updates (-150 bps) and Mercado Pago interest income and expense reclassification (-240 bps) also limited the margin.

MELI ended the quarter with $5.4 billion of total debt, up $117 million sequentially. However, net debt was $976 million at the end of the quarter, a significant improvement over $1.4 billion as of March 2024. Gross leverage remained relatively stable at 1.8x as of June 2024, and net leverage improved by 0.2x sequentially to 0.3x. Adjusted FFO to debt was 31.3% as of June 2024, up from 30.5% as of March 2024, and adjusted interest coverage increased to 4.8x from 4.6x sequentially.

The credit story is limited by (1) the competitive landscape, especially the potential for large international competitors to increase their focus on Latin America; (2) regulatory risk, particularly in fintech as the industry proliferates in the region; (3) country risk, given that most of the company’s revenues are generated within high-risk countries; and (4) credit risk, as MELI operates within a risky segment of the credit market, concentrating on consumer credit/credit cards and small and medium-sized businesses.

Trade Recommendation

We continue to view MELI as an attractive emerging market credit story. The company’s leadership in Latin American e-commerce and fintech sectors positions it well to capture value and manage operational risk effectively. MELI benefits from a strong operating profile, solid geographic diversification across the LatAm region, and a healthy liquidity position supported by substantial cash generation. Despite macroeconomic headwinds in Argentina, MELI’s operating performance in 1H24 was encouraging, supported by MELI’s expansion into highly profitable segments such as credit and advertising and improvements in profitability linked to its developed logistics network. Given its strong competitive advantage, we like the company’s fundamentals and expect positive operating performance with healthy growth, which will likely result in improved credit metrics.

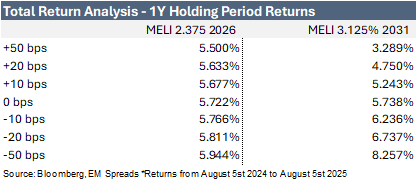

At current spread levels, we prefer MELI (Ba1/BB+/BB+) 2.375% 2026 bonds yielding 5.6% for the 1.4-year duration over MELI 3.125% 2031 bonds, which also yields 5.6% but with a 5.6-year duration. The broader EM Index yields 6.1%, the EM BB Index yields 6.6%, and the EM BBB Index yields 5.5%. We find the 2026s more attractive than the 2031 bonds, as the former are trading wider than the Brazilian Sovereign, Latin American BBB, and EM BBB curves, while the 2031 notes are trading tighter than these benchmarks. This also compares favorably to BB+ rated peers, such as EMBRBZ (BBB-/BB+) 2027 notes yielding 5.4% for the 2.3-year duration. Additionally, the 2026 notes trade wider to some IG-rated peers, such as JBSSBZ (Baa3/BBB-/BBB-) 2027 notes that yield 4.8% for the 2.3-year duration, and RAIZBZ (Baa3/BBB/) 2027 notes that yield 5.6% for the 2.3-year duration. Consequently, we see the potential downside on the 2031 notes as disproportionate to the limited incremental upside, as we view the positive impact of 2Q24 earnings as being largely reflected in the current spreads. In assessing the current risk/return, the existing prices do not sufficiently account for the intrinsic risk associated with MELI, such as operating in Latin America with significant exposures to high-risk countries like Argentina and Brazil. Additionally, the current spread levels do not appropriately compensate for the risk of generating all revenues in domestic Latin American currencies, exposure to regulatory challenges, and a potentially more competitive landscape. Given these considerations, we prefer MELI 2.375% 2026 bonds. We are somewhat uncomfortable with the current spread levels on MELI 3.125% 2031 bonds, which are trading tight compared to the region’s LatAm and EM indices and peers, while MELI 2026 notes are trading wide relative to these benchmarks.

When compared to the broader US market and its global peers in the e-commerce and fintech sectors, MELI's bonds offer a notably compelling risk-reward symmetry. The broader US Index yields 5.4%, with the US BBB Index at 5.1%. This makes MELI’s 2026 and 2031 notes relatively attractive, yielding 5.6%. In terms of valuation versus global peers, MELI 2031 notes appear wide compared to AMZN (A1/AA/AA-) 2031 bonds yielding 4.3% for the 6.1-year duration, EBAY (Baa1/BBB+/BBB+) 2031 notes yielding 4.7% for the 6.0-year duration, and BABA (A1/A+/A+) 2031 bonds yielding 4.6% for the 5.9-year duration. MELI 2026 bonds, which yield 5.6%, also stand out compared to global peers like AMZN 2026 bonds, yielding 4.2% for the 1.7-year duration, EBAY 2026 notes yielding 4.5% for the 1.7-year duration, and JD (baa1/A-/BBB+) 2026 yielding 4.6% for the 1.6-year duration. For investors comfortable with this dynamic, we view MELI as an attractive way to pick up yield in the e-commerce and fintech sectors.

Total Return Analysis

2Q24 Operating Performance

MercadoLibre (Ba1/BB+/BB+) 2Q24 revenues increased significantly by 41.5% (FX-neutral: 113%) to $5.1 billion from $3.6 billion in 2Q23. Both the Commerce and Fintech sectors contributed to the improvement, up by 53.4% yoy and 42.2% yoy, respectively. This was driven by Commerce GMV growth of 20% yoy and Fintech TPV improvement of 36%. Brazil (+56.5%) and Mexico (70.8%) posted solid results, with revenue increasing 56.5% and 70.8%, respectively, while Argentina grew by 11.9% yoy despite macroeconomic challenges. As a result, revenues were ahead of consensus expectations by 8.6%.

In 2Q24, gross profit was $2.4 billion, up 29.2% from $1.8 billion in 2Q23. The gross margin contracted by 450 bps to 46.6% from 51.1%, pressured mainly by significantly higher cost of goods sold (+54.4% yoy). Consequently, the gross margin came below market expectations of 48.1%.

MELI’s 2Q24 EBIT was $726.0 million, up from $669.0 million in the same period last year. However, the EBIT margin contracted significantly by 440 bps to 14.3% from 18.7%. Higher bad debt provisions (-350 bps) for accelerating MELI’s credit book originations pressured the EBIT margin. The margin was also limited by shipping reporting updates (-150 bps) and Mercado Pago interest income & expense reclassification (-240 bps). Geographically, the EBIT margin improved in Brazil, but the company mentioned that credit provisions and shipping expenses pressured the EBIT margin in Mexico. Adjusted EBITDA increased by 10.4% to $880.0 million in 2Q24 from $797.0 million in 2Q23. The adjusted EBITDA margin decreased to 17.3% from 22.2% in the same period, negatively impacted by these factors.

During the earnings call, management highlighted integrating AI and Gen-AI technologies to enhance operational efficiency. These initiatives are expected to optimize customer service, utilize advanced image enhancement tools, streamline internal reviews, and improve overall customer experience.

Macro Analysis

Despite MELI’s presence across 18 countries, the company generated 95.5% of its 2023 revenues in Brazil, Argentina, and Mexico. Between 2017 and 2023, Brazil averaged 57.1% of total revenues, Argentina averaged 24.2%, and Mexico averaged 13.3%. Consequently, these economies are key credit drivers for the company’s operating performance.

2Q24 Segment Results

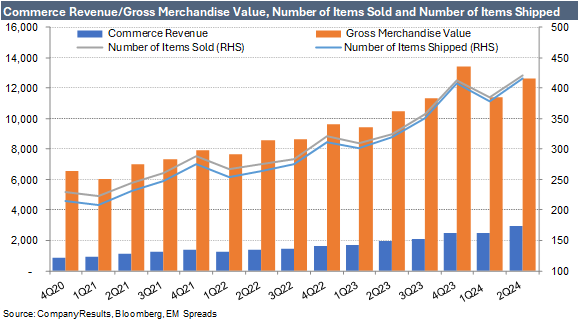

Commerce revenue (58% of LTM total revenues) improved by 53.4% yoy to $3.0 billion in 2Q24. The improvement was supported by higher gross merchandise volume (GMV), which increased by 20.4% yoy to $12.6 billion in the quarter. Items sold reached 421 million in 2Q24, up 29.5% compared to the same period in 2023, and items shipped reached 416 million, up 30.4% in the same period. Management cited its online experience as a significant growth driver, attracting offline retail to the platform, which resulted in a 19% increase in unique buyers, reaching 57 million in the quarter. Geographically, commerce revenues were primarily driven by Brazil, which saw a 62.2% increase, and Mexico, with a 68.2% increase. Both countries experienced strong GMV growth in the quarter, with Brazil up 36% yoy and Mexico up 30% yoy. Brazil also saw a 37% yoy increase in items sold, while items sold in Mexico grew by 30% yoy. Initiatives to incentivize consumption in Argentina returned items sold to positive territory. Additionally, Chile and Colombia posted their highest growth rates since 2021, while Argentina reversed the decline experienced in 1Q24.

MELI has been expanding its logistics network, improving the buyers' user experience by allowing faster shipping times and fewer late deliveries. In 2Q24, the company delivered 127.3 million packages on the same day or the next day, a 14.6% yoy increase, driven in part by the expansion of its fulfillment network, which reached 53%, up from 46% in 2Q23. The advertising business penetration increased to 2.0% of GMV in the quarter, up from 1.9% sequentially and 1.6% in 2Q23. The take rate expanded by 5.1 percentage points to 23.5% from 18.4% in 2Q23 (1Q24: 22.0%). We note that 3.9 percentage points of the overall improvement were driven by higher shipping revenues, where MELI is considered principal, with revenues booked on a gross basis. Higher advertising penetration and a lower Argentina mix also supported the take rate.

Fintech revenues (42% of LTM total revenues) were $2.1 billion in 2Q24, up 42.2% from $1.5 billion in 2Q23. Total payment volume (TPV) increased to $46.3 billion from $42.1 billion in 2Q23, driven by higher acquiring TPV, which rose 23.9% yoy to $33.7 billion. Argentina, Brazil, and Mexico showed faster growth sequentially. Argentina experienced growth in USD despite the peso's devaluation, while Brazil and Mexico accounted for more than 60% of Acquiring TPV.

Mercado Pago reached 52.0 million active users in 2Q24, up from 37.9 million in the same period in 2023. All significant countries showed strong growth trends, with Brazil growing ahead of the average. Mercado Pago in Argentina continued to see positive momentum, driven by the strength of its value proposition in the current inflationary environment.

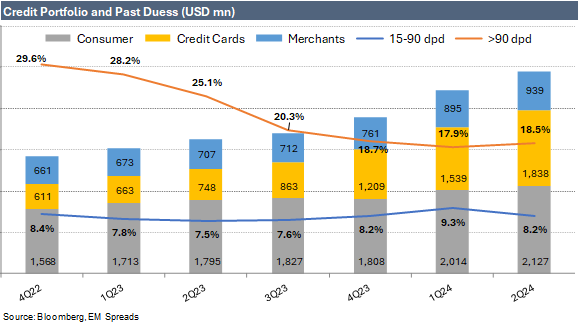

Mercado Credito’s portfolio increased significantly to $4.9 billion in the quarter from $3.3 billion in 2Q23 (1Q24: $4.4 billion), with originations growing 78.5% yoy to $5.6 billion. The credit card segment remains a significant growth driver, with the company issuing 1.6 million new cards in Brazil and Mexico during the quarter and upselling existing users to more extensive credit lines in Brazil. Consequently, credit card TPV surged to $1.8 billion in 2Q24 from $748 million in 2Q23. Mercado Credito also experienced robust demand for its loan products, adding over 6 million new users to its Consumer portfolio and 1 million new users in its Merchant portfolio compared to the same period last year. Net interest margin after losses (NIMAL), which is credit revenues minus provision for doubtful accounts minus funding costs, decreased to 31.1% in 2Q24 from 36.8% in 2Q23 (1Q24: 31.5%). This decrease was primarily due to the increased share of lower-NIMAL credit cards in the portfolio, which increased to 37.5% from 23.0% in the same period (1Q24: 34.6%) and accelerating originations.

Mercado Fondo's total assets under management increased significantly to $6.6 billion in 2Q24 from $3.1 billion in 2Q23 (1Q24: $5.5 billion). Mercado Fondo’s value proposition emphasizes the remunerated account, which pays interest immediately upon deposits with immediate liquidity. This feature is particularly valuable in countries with high inflation, where otherwise, money in the account rapidly loses value. This strategy has substantially improved user numbers and assets under management in Argentina and Brazil. Consequently, MELI announced in July that it would extend this strategy to Mexico, recognizing a robust opportunity in that country. Additionally, MELI plans to apply for a banking license in Mexico, enabling the company to scale the business. MELI’s 15-90 days non-performing loans (NPL) decreased sequentially to 8.2% in 2Q24 from 9.3% in 1Q24 (2Q23: 7.5%). However, NPLs over 90 days increased to 18.5% in the quarter from 17.9% in 1Q24 (2Q23: 25.1%) due to the aging of past-due cohorts from the previous quarter. The largest component of the credit portfolio is consumer credit, totaling $2.1 billion or 43.4%, followed by credit cards at $1.8 billion or 37.5% and credit to merchants at $895 million or 19.1% of the credit portfolio.

Fintech’s take rate decreased to 4.5% in 2Q24 from 4.8% in 2Q23 (1Q24: 4.5%), primarily due to Argentina and Brazil's move upmarket strategy. While management communicated this strategy positively, it required more competitive spreads than traditional banks, somewhat pressuring the company’s take rate.

Financial Profile and Liquidity

MELI ended 2Q24 with $5.4 billion in total reported debt, down $125 million from $5.5 billion as of June 2023 but up $117 million sequentially. Of this, $2.3 billion was short-term debt. As of June 2024, cash and cash equivalents were $2.8 billion, up $239 million sequentially, and significantly higher than $1.9 billion as of June 2023. Short-term investments, excluding time deposits and foreign government debt securities restricted and held in guarantee, increased by $98 million to $1.3 billion as of June 2024 (June 2023: $1.4 billion). Long-term investments, excluding investments held in VIEs due to securitization transactions and equity securities held at cost, increased by $171 million to $338 million as of June 2024 (June 2023: $68 million). As a result, net debt was $976 million at the end of the quarter, an improvement over $1.4 billion as of March 2024 (June 2023: $2.2 billion). During the quarter, MELI did not spend capital on acquisitions or dividends.

Improved adjusted EBITDA of $880 million in 2Q24, comfortably covered $184 million of capex and $39 million of interest expense, resulting in $657 million of free cash flow. After accounting for $483 million in changes in working capital, $163 million in income tax, and $1 million in share repurchases, net free cash flow totaled $977 million. Operating cash flow was strong at $1.9 billion in 2Q24, up from $1.4 billion in the same period in 2023. This robust performance more than comfortably covered the $184 million capex, resulting in a free operating cash flow of $1.7 billion.

Capex in 2Q24 was $184 million, up from $114 million in 2Q23, bringing the total capex for 1H24 to $332 million. MELI invested $151 million in information and technology assets across Brazil, Argentina, and Mexico and $149 million in shipping premises and offices in these countries. The company continues to invest in hardware and software licenses essential for enhancing and updating its platform, technology, and internally developed computer software. We expect MELI to maintain its investments in future capex, which are mainly related to information technology and logistics network capacity.

MELI’s interest expense was $39 million in 2Q24, down from $49 million in 2Q23. It is important to note that MELI reclassified Mercado Pago's interest income and expense lines from below income from operations to above income from operations, significantly reducing interest expenses. Excluding the reclassification, interest expense in 2023 was $378 million compared to $174 million when including the reclassified items. The difference between interest expense and cash interest paid was significant in 2023, with cash interest paid reported at $608 million. Cash interest paid is not reported quarterly.

We incorporated the debt-to-tangible equity ratio into our analysis to better monitor MELI’s growing credit risk exposure. In 2Q24, tangible equity increased to $3.5 billion, up from $3.2 billion in 1Q24 (2Q23: $2.1 billion).

MELI’s liquidity remains healthy. The company has $2.3 billion in short-term debt, covered by $2.8 billion in cash and cash equivalents. Total liquidity was $4.5 billion, which includes a cash position of $2.8 billion, short-term investments of $1.3 billion, and $400 million revolver credit availability. Note that short-term investments exclude $2.8 billion related to the Central Bank of Brazil's mandatory guarantee. Our total liquidity position excludes MELI's $1.0 billion in restrictive cash as of June 2024 (March 20244: $1.2 billion). Restricted cash is a mandatory reserve under various local central bank regulations. As of June 2024, MELI’s total liquidity covered short-term debt by 1.9x, an improvement from 1.7x as of March 2024 (2Q23: 1.5x). Short-term debt includes $629 million in bank loans, $923 million in deposit certificates, and $4424 million in collateralized debt to fund credit origination.

As a result, key credit metrics improved during the quarter:

Gross leverage remained relatively stable sequentially at 1.8x as of June 2024 (June 2023: 2.5x)

Net leverage improved to 0.3x as of June 2024 from 0.5x as of March 2024 (June 2023: 1.0x)

Adjusted cash interest coverage increased to 4.8x in 2Q24 from 4.6x in 1Q24 (2Q23: 4.9x)

Adjusted FFO to debt improved to 31.3% as of June 2024 from 30.5% as of March 2024 (June 2023: 22.3%)

Debt to tangible equity was 1.5x as of June 2024, down from 1.6x as of March 2024 (June 2023: 2.7x)

Recent News

Mercado Pago Seeks a Banking License in Mexico, and MELI Opens its First Fulfillment Center in Texas

In May 2024, MELI announced that it would engage in discussions with Mexican authorities to establish and operate as a Multiple Banking Institution. This initiative aims to broaden the range of products MELI offers in the country and tap into a large unbanked population, presenting a significant opportunity for Mercado Pago to provide comprehensive online banking services. While Mercado Pago currently operates in Mexico under an IEPE fintech license, a banking license would enhance its offerings by enabling the acceptance of payroll deposits and eliminating restrictions on the amount it can hold, thus opening new avenues for growth.

In April 2024, MELI announced its plans to add 8,200 new jobs in Mexico, further solidifying its commitment to that market. Additionally, in May 2024, MELI opened its first fulfillment center in Texas, US, allowing US sellers to offer their products to Mexican buyers through the company’s marketplace.

As MELI operations expand in Mexico, it will significantly reduce the company’s country risk exposure. This is particularly reassuring given that Mexico benefits from an investment-grade country credit rating, considerably higher than MELI’s other key countries, such as Brazil and Argentina, with high-yield country ratings. Moreover, Mexico’s economy benefits from its trade agreement between Mexico, the United States, and Canada, bolstered by global supply-chain reorganization and geopolitical changes, further strengthening our positive view of MELI’s credit story.

S&P Ratings Updates MercadoLibre’s Outlook to Positive from Stable

On June 24, 2024, S&P revised MELI’s credit rating outlook to positive from stable and affirmed its BB+ issuer credit rating. The rating agency's decision was influenced by MELI's potential for business growth, strong operating performance, and solid credit metrics, all supported by a robust balance sheet. S&P's direct communication with MELI’s management reinforced the agency’s view that management is committed to maintaining a conservative balance sheet, thereby solidifying this positive outlook.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.