MercadoLibre: Analyzing the Market Reaction to S&P’s Outlook Change

S&P revised its outlook to positive

On June 24, 2024, S&P revised MELI’s credit rating outlook to positive from stable and affirmed its BB+ issuer credit rating. The rating agency's decision was influenced by MELI's potential for business growth, strong operating performance, and credit metrics, all supported by a robust balance sheet. S&P's direct communication with MELI’s management led the agency to believe that management is committed to a conservative balance sheet, further solidifying this positive outlook.

The rating agency thinks capital adequacy is more relevant for MELI than most corporations and incorporated the debt-to-tangible equity ratio into its analysis. S&P expects MELI to maintain FFO to debt above 50%, debt to EBITDA between 0.5x and 1.0x, and debt to tangible equity below 1.0x, which implies a solid operating performance in the period.

As we mentioned in our initiation report in May 2024, MELI issued its 2026 and 2031 dual-tranche notes in January 2021. Since then, the company’s key credit metrics have improved significantly, supported by improved operating performances, resulting in credit metrics that are considerably stronger than its peers in the high-yield rating category. Among other factors, the company’s rating is somewhat limited by its significant country risk exposure, primarily from non-investment-grade countries like Brazil and Argentina, where it generated 52.5% and 22.4% of its revenues in 2023. Credit rating agencies have maintained MELI’s ratings unchanged since the debt issuance at Ba1/BB+/BB+, with a stable outlook up to this point. The 2023 numbers below include the recent reclassifications:

Gross leverage declined to 1.6x as of December 2023 from 6.1x as of YE20 (2022: 3.5x)

FFO to debt increased to 37.1% as of YE23 from 5.0% in 2020 (2022: 16.3%)

EBITDA cash interest coverage improve modesty to 5.3x in 2023 from 5.2x in 2020 (2022: 6.3x)

Adjusted EBITDA margin expanded to 21.4% in 2023 from 7.0% in 2020 (2022: 14.9%)

FFO increased to $2.0 billion in 2023 from $86.1 million in 2020 (2022: 882.0 million)

Market Reaction

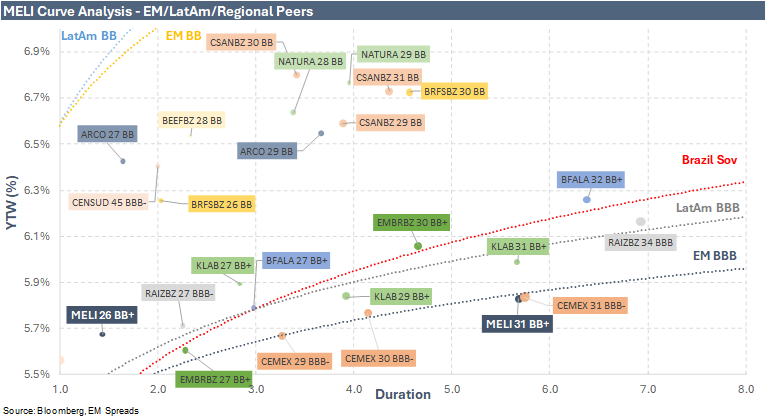

Looking at the spread movements, the 2026 bond has tightened 33 bps since the outlook change on June 24, 2024, while the 2031 bond has expanded by 10 bps. As a result, 2026 and 2031 bonds are trading around 106 bps and 173 bps, respectively, yielding 5.7% and 5.9%. This is tight compared to the bonds’ one-year average of 163 bps and 236 bps. For comparison’s sake, the broader EM Index remained stable since June 24 and contracted by 77 bps in the last twelve months, while the broader US Index tightened by 4 bps since June 24 and 43 bps in the previous twelve months. The broader LatAm Index contracted 1 bps since June 24 and 13 bps in the last twelve months. The Brazilian Sovereign bonds maturing in 2026 are trading around 77 bps, 22 bps wider than a year ago, and have expanded 6 bps since June 24, while the Brazilian Sovereign bonds maturing in 2031 are trading around 191 bps stable compared to a year ago and contracted 5 bps since June 24. Since our trade recommendation on May 21st, 2024, with a preference on the MELI (Ba1/BB+/BB+) 2.375% 2026, the notes have contracted 12 bps while the 2031 notes expanded 13 bps.

In the last year, the 2031 notes have been trading, on average, around 62 bps tighter to the Emerging Markets BB Index and around 46 wider to the Emerging Markets BBB Index. However, since May 2, 2024, when MELI announced its 1Q24 results, the notes have traded around 73 bps tighter to the EM BB Index and 27 bps wider to the EM BBB Index. Since June 24, 2024, when S&P announced its outlook change on MELI to positive from stable, the 2031 notes remained relatively stable, trading around 70 bps to the EM BB Index and 30 bps wider to the EM BBB Index. Consequently, we can conclude that the outlook change was somewhat priced in MELI’s spread levels. As discussed in our initiation report, MELI’s bonds have arguably already been trading at the investment grade level, supported by the company’s solid credit metrics for the rating category.

Trade Recommendation

We continue to see MELI as an attractive emerging market credit story. Its leadership position in the Latin American e-commerce and fintech industries puts the company in a solid position to extract value and minimize operating risks. MELI benefits from a strong operating profile, sound geographic diversification within the LatAm region, and a healthy liquidity position with sound cash generation. Despite the macro headwinds in Argentina, the company’s operating performance in 1Q24 was encouraging, coupled with MELI’s expansion in highly profitable segments such as credit and advertising and the profitability improvements associated with the developed logistics network. Considering its strong competitive advantage, we like the company’s fundamentals and expect positive operating performance with healthy growth, resulting in improved credit metrics.

At current spread levels, we prefer MELI (Ba1/BB+/BB+) 2.375% 2026 bonds yielding 5.7% for the 1.4-year duration. We find the 2026s more attractive than the 2031s, considering that the notes are trading wider than the Brazilian Sovereign, LatAm American BBB, and EM BBB curves. This also compares favorably to BB+ rated peers, such as EMBRBZ (BBB-/BB+) 2027 notes yielding 5.7% for the 2.3-year duration. The 2026 notes also trade wider to some IG-rated peers, such as JBSSBZ (Baa3/BBB-/BBB-) 2027 notes that yield 5.2% for the 2.4-year duration, and RAIZBZ (Baa3/BBB/) 2027 notes that yield 5.7% for the 2.3-year duration. All things considered, we prefer MELI 2.375% 2026 bonds, as we are uncomfortable with the current spread levels on MELI 3.125% 2031 bonds, which are trading tight compared to the LatAm and EM indices and peers, while MELI 2026 notes are trading wide to the same benchmarks.

Total Return Analysis

For more details on MELI, please find our latest publication, which includes trade recommendations.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.