Minerva 2Q25: Strong Results and Deleveraging Support Overweight Call

Favorable beef market conditions, tariff flexibility, and solid asset integration underpin credit strength. 2033s offer yield advantage with less duration risk.

Key Insights and Recommendations

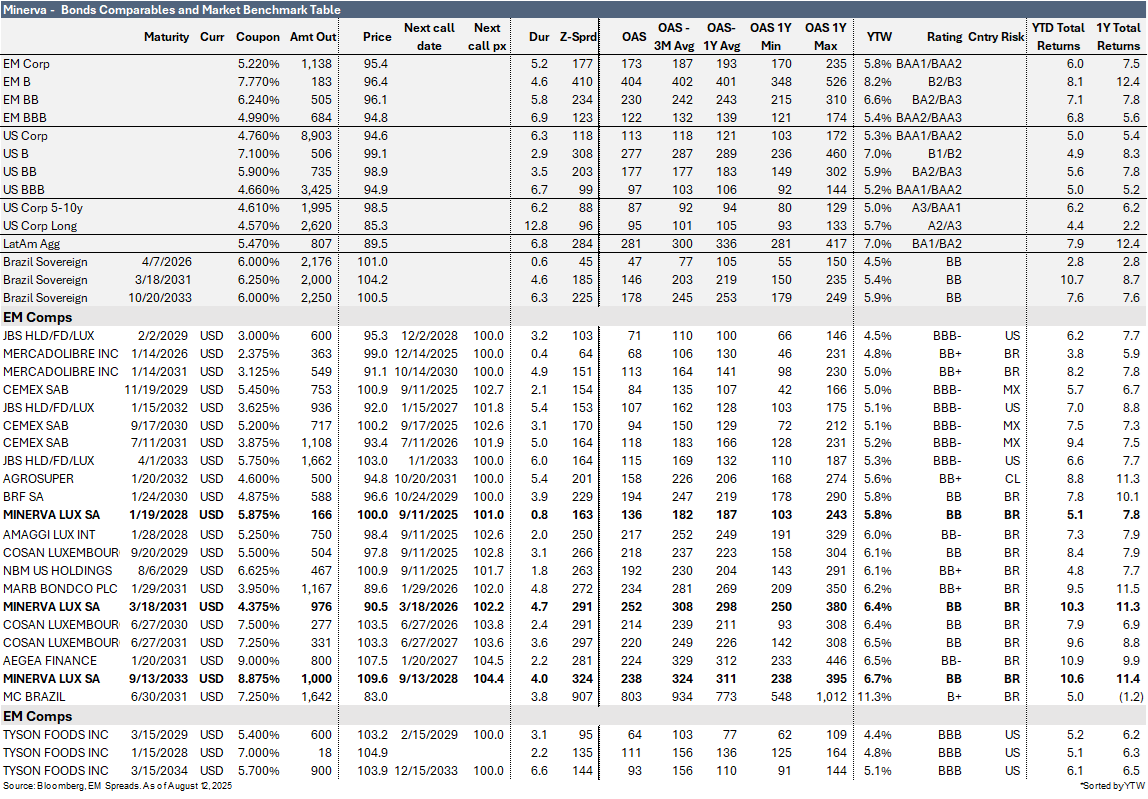

We maintain an Overweight on Minerva’s 2033 bonds, which offer a 6.7% yield for a 4.0-year duration, providing higher yield with less duration risk than the 2031 notes and fair relative value to benchmarks and comparable notes. The view is supported by favorable beef market conditions, the company’s ability to offset U.S. tariffs, its track record of deleveraging, and successful asset integration, which we expect will drive further spread compression over the next 9–12 months.