Minerva 3Q24: Acquisitions Keep Uncertainty High

We maintain our Underperform recommendation

Executive Summary

We maintain our Underperform recommendation. We expect the company to encounter challenges in free cash flow generation, which will pressure credit metrics and hinder post-acquisition deleveraging. Net leverage will likely increase around 4x, and interest coverage is anticipated to remain weak over the next 6 to 9 months. However, we recognize substantial value in Minerva’s acquired assets. Despite these concerns, we view Minerva’s overall business profile, favorable market trends, track record incorporation acquisition, and stable margins as supportive of the credit.

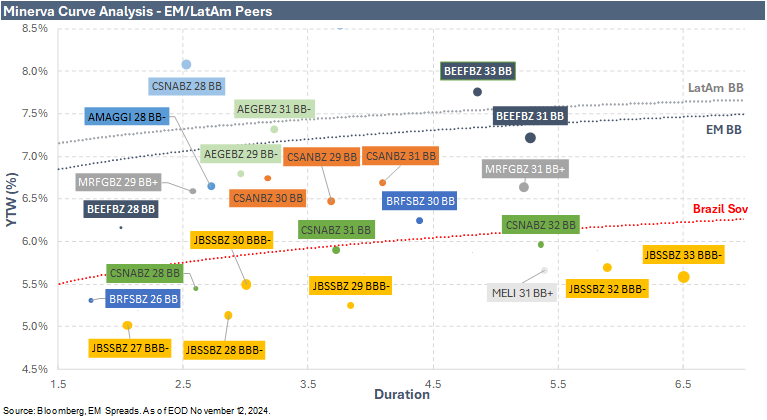

We find Minerva's (BB/BB) 8.875% 2033 bonds, yielding 7.8% with a 4.9-year duration, more attractive than the 4.375% 2031 bonds yielding 7.3% for a 5.3-year duration or the 5.875% 2028 bonds yielding 6.2% for a 2.0-year duration. The 2033 notes are the only ones within Minerva’s capital structure that do not trade tight to the LatAm BB and EM BB curves. However, we believe a better entry point for these notes may emerge based on our expectation of a weakening credit profile in the short term.

On October 28, 2024, Minerva Foods completed the acquisition of Marfrig Global Foods' assets in Brazil, Argentina, and Chile, totaling R$6.8 billion. This strategic move expanded Minerva's operations to 46 industrial units across seven countries, enhancing its daily slaughter capacity to 41,789 cattle and 25,716 sheep.

Favorable Export Market Dynamics: We expect the market for beef exports in South America to remain robust over the next 6–12 months, driven by a global beef supply and demand imbalance. Minerva also benefits from a regional structural cost advantage, supported by strong cattle availability and resilient export demand. However, cattle costs increased significantly by around 20% QTD, representing a notable headwind.

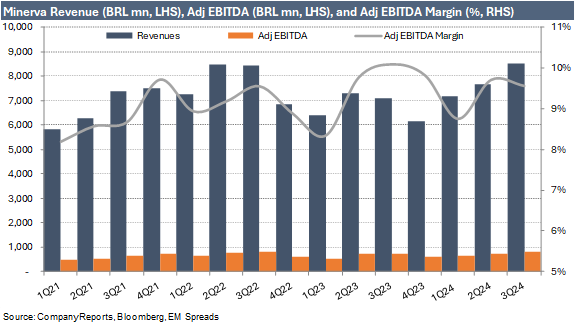

3Q24 Results: Minerva reported solid 3Q24 results, with EBITDA increasing 13.9% YoY to R$813 million, 2% above consensus market expectations. Revenue rose by 20.3% YoY to R$8.5 billion, exceeding consensus expectations by 4%. This growth was primarily driven by strong performance across regions.

Brazil reported strong quarterly results, with gross revenue increasing 15.1% YoY to R$4.3 billion. The YoY improvement was driven by a 7.7% increase in volumes to 192k tons and a 6.9% rise in average prices to R$22.6/kg.

LatAm Countries (excluding Brazil) saw revenues increase by 25.7% YoY to R$3.7 billion in 3Q24. This YoY improvement was driven by a 16.5% increase in volumes to 161k tons and a 7.9% rise in average prices to R$22.8/kg.

Debt and Leverage: Minerva ended the quarter with R$24.2 billion in adjusted total debt, excluding the R$1.5 billion down payment to Marfrig on August 28, 2023. Adjusted net debt declined by R$701 million to R$7.4 billion as of September 2024. Gross leverage improved to 8.7x as of September 2024, down from 9.1x in June, while net leverage decreased to 2.6x from 3.0x. Adjusted interest coverage declined by 0.1x sequentially to 1.0x in September 2024.

Strong Liquidity: Minerva's liquidity remains strong at R$11.1 billion, adjusted for the R$5.7 billion used for the Marfrig acquisition, providing a robust buffer against economic volatility. Additionally, the company’s debt maturity profile is solid, with cash covering all maturities through 2030.

The credit story is limited by (1) Minerva’s high gross leverage and tight interest coverage, (2) elevated concentration in a single protein, (3) the inherent volatility of the industry coupled with demand dependency on demographics and economic conditions, (4) foreign currency risk and overall high-country risk as the company operates within many high-risk countries, (5) environmental risk.

Trade Recommendation

We continue to view Minerva as an attractive credit story in emerging markets, bolstered by its leadership in South American beef exports and structural cost advantage. The company has a strong track record of integrating acquisitions, achieving expected margin levels, and committing to deleveraging its balance sheet post-acquisition. Over the past decade, Minerva has maintained stable EBITDA margins of between 9% and 10%, despite the inherent volatility of the industry, severe economic downturns, and political crises, reflecting the resilience of its business profile. Additionally, Minerva is poised to benefit from favorable global beef export dynamics in the short to medium term, which should support South American beef exporters like Minerva. However, higher cattle prices in Brazil could limit these export benefits. Minerva’s strong liquidity position and well-structured debt amortization further strengthen its credit profile.

Minerva reported solid 3Q24 results, with EBITDA 2% above consensus market expectations, healthy cash generation, and net leverage decreasing to 2.6x. However, the recent acquisition of assets from Marfrig is now central to the credit story. We remain cautious due to anticipated challenges in free cash flow generation, which we expect to be pressured by the capital required to integrate the new assets and the significant interest expenses the company is already facing. Our expectation of deteriorating credit metrics, with net leverage around 4x and interest coverage around 1x, suggests a weakening of Minerva’s balance sheet and overall credit profile. Additionally, limited visibility on the financials of the acquired assets adds to the uncertainty, making it difficult to form a more constructive view of the acquisition's impact on Minerva’s credit standing and ability to deleverage post-acquisition. Considering these factors, we believe there may be a better entry point into the credit once there is greater clarity on the acquisition's implications, particularly given the potential delays in acquiring the assets in Uruguay.

Since the US$1.0 billion 8.875% 2033 notes issuance on September 13, 2023, Minerva's bonds have experienced notable spread tightening. The 2028, 2031, and 2033 bonds have tightened by 116 bps, 73 bps, and 96 bps, respectively. Additionally, since the release of Minerva’s 3Q24 results on November 7, 2024, these bonds have further tightened by 9 bps, 24 bps, and 30 bps, respectively. Currently, the 2028, 2031, and 2033 bonds are trading around 146 bps, 287 bps, and 296 bps, respectively, which is significantly tighter than their one-year average. Comparatively, the broader EM Index has contracted by 77 bps to 177 bps over the last twelve months, while the broader US Index has tightened by 62 bps to 103 bps, and the broader LatAm Index has declined significantly by 136 bps to 332 bps. Brazilian Sovereign bonds maturing in 2028 are trading around 81 bps, 4 bps tighter than a year ago and 36 bps tighter than their one-year average, while Brazilian Sovereign bonds maturing in 2033 are trading around 179 bps, 38 bps lower than a year ago and 64 bps tighter than their one-year average.

At current spread levels, we find Minerva's (BB/BB) 8.875% 2033 bonds, yielding 7.8% with a 4.9-year duration, more attractive than the 4.375% 2031 bonds yielding 7.3% for a 5.3-year duration or the 5.875% 2028 bonds yielding 6.2% for a 2.0-year duration. The 2033 notes are the only ones within Minerva’s capital structure that do not trade tight to the LatAm BB and EM BB curves. However, we believe there may be a better entry point into the notes in the future based on our expectation of a weakening credit profile in the short term. Once we have more visibility into the credit implications of the acquisition and the deleveraging time horizon, we will take a longer-term view of Minerva’s bonds.

Update on the Acquisitions

CADE Approval: On October 8, 2024, the Brazilian Antitrust Authority (CADE) approved Minerva's acquisition of industrial and commercial establishments from Marfrig Global Foods S.A. in Brazil.

Transaction Completion: On October 28, 2024, Minerva finalized the acquisition of Marfrig’s assets in Brazil, Argentina, and Chile, paying R$5.7 billion. This total includes R$5.3 billion as the base price for 13 industrial units and a distribution center, R$265 million in price adjustments based on the CDI rate, and R$91 million in additional adjustments. With an initial payment of R$1.5 billion in August 2023, Minerva's total investment in the transaction amounts to R$6.8 billion. Following this acquisition, Minerva now operates 46 industrial units across seven countries, achieving a daily slaughter capacity of 41,789 cattle and 25,716 sheep.

Uruguayan Antitrust Authority Decision: On October 30, 2024, the Uruguayan antitrust authority (Coprodec) upheld its disapproval of Minerva’s acquisition of Marfrig’s three industrial units in Uruguay. Minerva is reviewing this decision and plans to appeal, as it remains open to further administrative and judicial challenges.

During the earnings call, management highlighted that the company had been operating the acquired plants for the past few days, though it was still too early for a comprehensive assessment. Minerva is prioritizing export strategies and operational adjustments to enhance profitability. Management indicated that the ramp-up process is expected to take four to five quarters to complete fully.

Implications of the Acquisitions

Minerva has a strong track record of integrating acquired assets and achieving expected margin levels. However, this transaction presents a significant challenge, as it involves the simultaneous incorporation of 13 to 16 plants (excluding those in Uruguay). These geographically diverse facilities will substantially expand the company's slaughtering capacity, but they also increase execution risk and the potential for unexpected issues. The complexity of integrating these facilities and optimizing their capacities simultaneously introduces a higher level of risk than smaller transactions. Furthermore, some of Marfrig’s plants are inactive, while others are located close to existing Minerva facilities, which may complicate capacity optimization. Additionally, the increased beef production could exert downward pressure on prices and challenge the company’s ability to realize anticipated margin expansion. Lastly, the acquisition increases Minerva’s exposure to China, introducing event risk in the event of trade barriers, as seen in 2021 and 2023.

On the positive side, the acquisition will significantly boost Minerva’s capacity and establish operations in Chile, where the company currently only has a commercial presence. The increased volume is expected to help dilute fixed costs, while operational synergies could drive substantial margin expansion as the new plants are integrated. Management projects these synergies will enhance the EBITDA margin by 150 to 200 basis points within the first 18 months. Additionally, the acquired assets come with licenses for the Chinese market and certifications for other lucrative regions, such as the US and Israel.

Based on Minerva’s projected figures, the initial transaction, including the Uruguayan assets, was expected to generate R$1.5 billion in EBITDA. Excluding the Uruguayan assets, our calculations estimate that the acquired plants will generate approximately R$1.28 billion in EBITDA. These plants were purchased for R$6.8 billion, likely to negatively impact Minerva’s net leverage, recorded at 2.6x as of September 2024. Integrating these assets is expected to take at least 12 to 15 months, applying prolonged pressure on Minerva’s credit metrics. Additionally, the increased interest expense from acquisition financing, including the US$1.0 billion 8.875% 2033 issuance and the R$1.5 billion down payment made in 3Q23, along with the working capital requirements for the ramp-up phase, will further weigh on the company’s financial performance.

At this point, we remain cautious about the credit impact of the acquisition, given our expectation of constrained free cash flow generation, which will be pressured by the capital required to integrate the new assets alongside substantial interest expenses. We anticipate a deterioration in credit metrics, with net leverage approaching 4x and weak interest coverage, likely resulting in a weaker balance sheet and credit profile. Additionally, the limited visibility into the financials of the acquired assets adds to the uncertainty, making it challenging to adopt a more constructive view of the acquisition’s impact on Minerva’s credit standing.

However, we recognize substantial value in Minerva’s acquired assets, as the company is likely to realize meaningful synergies that should support sustained EBITDA margin expansion, particularly through G&A and commercial synergies. Furthermore, the consolidated entity should benefit from input and logistics synergies, enhancing its bargaining power and operational efficiency.

3Q24 Operating Performance

In 3Q24, Minerva’s net revenues rose by 20.3% YoY and 10.9% sequentially to R$8.5 billion, exceeding consensus expectations by 4%. This growth was primarily driven by strong performance across regions, with revenues up 54.8% YoY in Colombia, 41.0% in Paraguay, 23.5% in Australia, 16.5% in Argentina, 15.1% in Brazil, and 9.3% in Uruguay. Additionally, 3Q24 revenues benefited from a 16.9% YoY increase in cattle slaughter volumes, though down slightly by -0.2% QoQ to 1,097 thousand heads compared to 938 thousand heads in 3Q23 (2Q24: 1,099k heads). Year-to-date, slaughter volumes are up 15.4% compared to the same period last year. However, lamb slaughter volumes saw a sharp decline of -19.7% YoY and -5.3% QoQ to 908 thousand heads for the quarter, with YTD lamb slaughter volumes down -4.6% compared to 9M23.

Gross profit reached R$1.8 billion in 3Q24, up 20.9% YoY and 6.5% QoQ from R$1.5 billion in 3Q23 and R$1.7 billion in 2Q24. While the gross margin remained stable at 20.9%, it declined by 85 bps sequentially. The cost of goods sold rose by 12.1% sequentially, outpacing revenue growth to R$6.7 billion. Management noted that animal availability was favorable during the quarter.

In 3Q24, adjusted EBITDA increased by 13.9% YoY and 9.2% QoQ to R$813 million, up from R$714 million in 3Q23 and R$745 million in 2Q24. However, the adjusted EBITDA margin contracted by 53 bps YoY and 15 bps QoQ. Notably, EBITDA exceeded market expectations by 2%.

We remain optimistic about the upcoming quarters, given the ongoing global beef supply and demand imbalance, which we expect will continue to support a favorable environment for South American beef exporters like Minerva. The U.S. is experiencing one of its worst beef cycles while demand remains resilient, impacting the entire global beef industry. China is also beginning to face restrictions on its domestic production, increasing its demand for beef imports and adding further pressure to global supply. Looking ahead, we expect Minerva to benefit from favorable beef export market dynamics as the company directs more than 60% of its volumes to export markets. This should be supported by robust beef export volumes in Brazil, a QTD BRL depreciation of 5.6%, and QTD beef prices improving by approximately 21%. However, cattle costs also increased significantly by around 20% during the quarter, representing a notable headwind.

3Q24 Segment Results

Brazil (48% of LTM sales) reported solid quarterly results, with gross revenue increasing 15.1% YoY to R$4.3 billion in 3Q24, up from R$3.8 billion in 3Q23. This also represents a 16.2% sequential increase from R$3.7 billion in 2Q24. The YoY improvement was driven by a 7.7% increase in volumes to 192k tons and a 6.9% rise in average prices in Brazil to R$22.6/kg. Sequentially, volumes in Brazil grew by 9.2%, and average prices improved by 6.5%.

Domestic Market: The positive performance in Brazil was primarily driven by the domestic market, which accounts for 57% of LTM sales in the country. Domestic revenues rose significantly, up 31.5% YoY and 3.1% QoQ, to R$1.6 billion in 3Q24 from R$1.2 billion in the same period last year. This growth was supported by a 15.7% YoY and 11.6% sequential increase in volumes to 77.6k tons, along with a 13.6% YoY rise in average prices to R$20.7/kg. However, average prices decreased by 7.6% sequentially.

Export Market: Revenues from the Brazilian export market, which accounts for 43% of LTM sales, declined by 16.5% YoY and 2.2% sequentially to R$2.1 billion in 3Q24. The top line was impacted by significantly lower average prices, which dropped by 18.8% YoY and 9.1% QoQ to R$18.6/kg in 3Q24, offsetting a volume increase of 2.9% YoY and 7.5% sequentially to 114.4k tons. Export volumes were limited by a strong domestic market, which encouraged the company to retain more volumes within the country.

Revenues from LatAm countries, excluding Brazil, which account for 40% of LTM sales, increased by 25.7% YoY to R$3.7 billion in 3Q24. This YoY improvement was driven by a 16.5% increase in volumes to 161k tons and a 7.9% rise in average prices to R$22.8/kg. Sequentially, revenues grew modestly by 2.1%, with volumes improving by 2.2%, offsetting a slight decline in average prices of 0.1%.

Domestic Markets in Other LatAm Countries: Domestic markets, accounting for 71% of LTM sales in the region, saw revenues decrease by 2.6% YoY to R$1.1 billion in 3Q24. The top line was negatively impacted by significantly lower prices, which dropped by 21.5% YoY to R$16.4/kg, offsetting a substantial 24.1% increase in volumes to 65.9k tons. Sequentially, domestic revenues remained relatively stable, increasing by 0.7%, supported by a 6.6% volume improvement that offset a 5.5% reduction in average prices.

Regional Export Revenues: Revenues from regional exports, which contribute 29% of LTM sales for this segment, reached R$2.6 billion in 3Q24, increasing by 42.8% YoY and 2.7% sequentially. The strong YoY performance was driven by an 11.8% improvement in volumes to 95.2k tons and a 27.8% increase in average prices to R$27.3/kg. Sequential growth was supported by a 3.4% increase in average prices, which offset a 0.7% decline in volumes.

Revenues generated in Paraguay reached R$1.3 billion in 3Q24, up 41.0% YoY and 4.6% sequentially. The YoY increase was driven by an 11.1% rise in volumes to 57.1k tons and a 26.9% increase in average prices to R$23.4/kg. Sequentially, the top-line increase was supported by a 7.3% rise in average prices, which offset a 2.6% decline in volumes.

In Uruguay, revenues rose 9.3% YoY but declined by 2.9% QoQ to R$882 million. The YoY increase was driven by a 12.7% rise in average prices to R$24.9/kg, offsetting a 3.0% volume decline to 35.4k tons. The sequential decrease was due to a 17.1% drop in volumes, partially offset by a 17.1% increase in average prices.

In Argentina, revenues reached R$1.1 billion in 3Q24, up 16.5% YoY but down 3.9% sequentially from R$927 million in 3Q23 and R$1.1 billion in 2Q24. Volumes increased by 3.6% YoY and 5.2% sequentially to 42.6k tons, while average prices improved by 12.4% YoY to R$25.3/kg. However, average prices declined by 8.6% QoQ. Considering the macroeconomic environment, we believe Minerva had a solid quarter in the country.

Revenues in Colombia were R$380 million, marking a significant increase of 54.8% YoY and 29.6% QoQ. During the quarter, volumes jumped 179.6% YoY and 63.5% sequentially, offsetting a decline in average prices of 44.6% YoY and 20.7% QoQ to R$14.6/kg.

Australia (7% of LTM sales) reported revenues of R$417 million in 3Q24, up 23.5% YoY and 6.6% sequentially. Volumes surged 80.9% YoY and 7.9% QoQ to 31.3k tons, while average prices decreased by 31.7% YoY and 1.3% QoQ to R$19.6/kg. Other revenues, accounting for 4% of LTM gross revenues, improved by 11.9% YoY and 64.8% sequentially to R$417 million.

Financial Profile

Minerva ended 3Q24 with R$24.2 billion in adjusted total reported debt, excluding the R$1.5 billion down payment to Marfrig made on August 28, 2023. Since the acquisition had not been finalized as of September 2024, it did not yet contribute any EBITDA to the company. Adjusted total reported debt decreased by R$395 million sequentially. As of September 2024, cash and cash equivalents totaled R$16.8 billion, comprising R$5.6 billion in cash and R$11.2 billion in short-term investments, an improvement of R$305 million sequentially. Consequently, adjusted net debt declined by R$701 million to R$7.4 billion as of September 2024, down from R$8.1 billion in June 2024 (December 2023: R$7.4 billion).

The improved adjusted EBITDA of R$813 million in 3Q24 was insufficient to cover the combined R$148 million in capex and R$776 million in interest expenses, resulting in a free cash outflow of R$111 million for the quarter. Interest expenses surged to R$776 million, significantly higher than the R$355 million reported in 3Q23 (2Q24: R$733 million), primarily due to increased gross debt and the negative impact of currency depreciation on USD-denominated interest. After accounting for R$605 million in working capital changes, a R$12 million tax inflow, and R$5 million share repurchases, net free cash flow totaled R$505 million.

Funds from operations (adjusted EBITDA minus interest expense and income taxes) totaled R$48.3 million in 3Q24, down sharply from R$461 million in 3Q23 (2Q24: R$5 million). Adjusted EBITDA barely covered the R$776 million in interest expenses and benefited from an income tax inflow of R$12 million.

Free operating cash flow (cash from operations minus capex) was R$1.7 billion in 3Q24, up from R$980 million in 3Q23 (2Q24: R$567 million). Cash from operations increased to R$1.9 billion in 3Q24, compared to R$1.2 billion in 3Q23 (2Q24: R$766 million). This increase was primarily supported by positive trade payables of R$509 million and other payables of R$910 million, benefiting from improved performance related to client advances.

As a result, key credit metrics were mixed sequentially, with higher EBITDA and a lower debt balance benefiting leverage but increased interest expenses affecting interest coverage and FFO:

Gross leverage decreased to 8.7x as of September 2024 from 9.1x as of June 2024 (December 2023: 7.8x).

Net leverage was 2.6x as of September 2024 compared to 3.0x as of June 2024 (December 2023: 2.9x).

Interest coverage declined to 1.0x as of September 2024 from 1.1x as of June 2024 (December 2023: 1.6x).

FFO to gross debt turned negative to -0.7% as of September 2024 from 1.0% as of June 2024 (December 2023: 4.9%).

Liquidity

We assess Minerva’s liquidity as strong. As of September 2024, the company had R$4.4 billion in short-term debt, representing 18.2% of total debt and 26.3% of its cash position. This short-term debt was well-covered by total liquidity of R$16.8 billion, which includes R$5.6 billion in cash and R$11.2 billion in short-term investments. Minerva’s liquidity covered its short-term debt by 3.8x as of September 2024, down from 4.6x in June 2024 (December 2023: 3.3x). However, Minerva used R$5.7 billion in October 2024 to acquire Marfrig’s assets, reducing the company’s liquidity to R$11.1 billion. This adjusted liquidity still covers short-term debt by 2.5x, providing a protective buffer against industry economic cycles.

Minerva faces significant foreign currency risk, with over 77% of its total debt denominated in U.S. dollars. In 3Q24, approximately 62% of revenues came from exports, with 6% to the European Union and 18% to NAFTA, both regions with hard currencies. To mitigate this risk, Minerva hedges at least 50% of its long-term foreign currency debt and maintains most of its cash in foreign-denominated bank accounts. These hedges help protect the balance sheet against significant exchange rate volatility.

Minerva’s debt amortization profile is healthy, with cash and cash equivalents covering all maturities up to 2030, as detailed in the chart below. This solid debt maturity profile enhances flexibility by reducing risks associated with economic cycles and potential short-term disruptions. Most U.S. dollar-denominated bonds are very long-term, which helps minimize overall credit and refinancing risks.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.