Pemex: Bond Buyback Offer Highlights Sovereign Support and Debt Relief

US$9.9bn sovereign-backed tender eases liquidity pressure and supports liability management goals

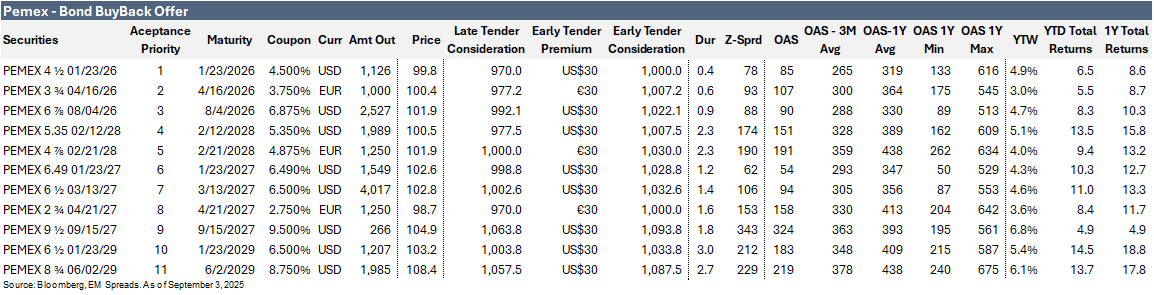

On September 2, 2025, Pemex announced the launch of a buyback offer of up to US$9.9 billion across 11 bonds. The program targets front-end maturities, specifically USD-denominated bonds due 2026–2029 and EUR-denominated bonds due 2026–2028. A priority framework will govern acceptance of tenders, beginning with the 4.500% 2026s, followed by the EUR 3.750% 2026s and the USD 6.875% 2026s. The offer includes an Early Tender Premium of 30 per 1,000, with withdrawal and early tender deadlines set for September 15 and final expiration on September 30.

Pemex may exercise an Early Settlement Right after the Early Tender Date, subject to conditions. Consideration will be paid in cash plus accrued interest, with proration applied if tenders exceed the cap. The buyback follows Mexico’s recently announced sovereign-backed financing to support Pemex, including the July–August issuance of pre-capitalized securities and related treasury-collateralized funding, which authorities have signaled will help cover 2025–2026 maturities.