Pemex: Debt Strategy Extends Support, Spreads Tighten vs Mexico

Buyback and P-Caps reduce debt and bolster liquidity, supporting the credit, yet weak fundamentals cap further spread compression potential.

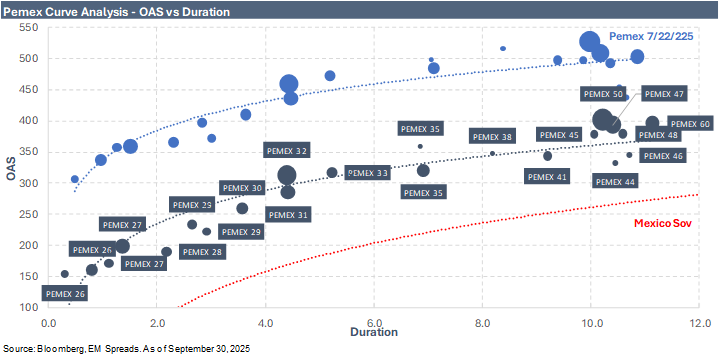

At current spread levels and with a steeper curve, we continue to recommend the PEMEX 6.700% 2032s, yielding 6.9% with a 4.4-year duration, as we see more value in the belly of the curve. For investors with higher duration appetite, we find the PEMEX 7.690% 2050s, yielding 8.6% with a 10.2-year duration, the most attractive on the long end, as they offer compelling carry and, at $90.9, provide further upside potential.

Mexico’s recent actions represent an extraordinary demonstration of support, effectively transferring Pemex’s refinancing burden onto the sovereign balance sheet. For credit markets, this justifies Pemex’s tighter 10Y spreads versus the sovereign and explains the sharp compression in the Pemex–Mexico spread. Since the July 22, 2025 announcement, Pemex’s 10Y spread has tightened by 136 bps to 355 bps, 80 bps below the 3-month average of 435 bps and 169 bps below the one-year average of 524 bps. As we have highlighted previously, spread compression in Pemex tends to follow tangible credit-positive measures, such as the government issuing debt to directly support the company.

That said, we believe further tightening will hinge on Pemex’s fundamentals, particularly improvements in oil production and cash generation. While government measures anchor near-term performance, investors are likely to increasingly focus on Pemex’s operational profile. We continue to see structural weaknesses, including declining upstream production and an unprofitable downstream segment, which significantly constrain cash generation and leave the company reliant on sovereign support. Pemex bonds should remain well-supported in the near term, but execution risks and fragile fundamentals cap medium-term upside.