Suzano 2Q25: Credit Resilient but Curve Positioning Shift

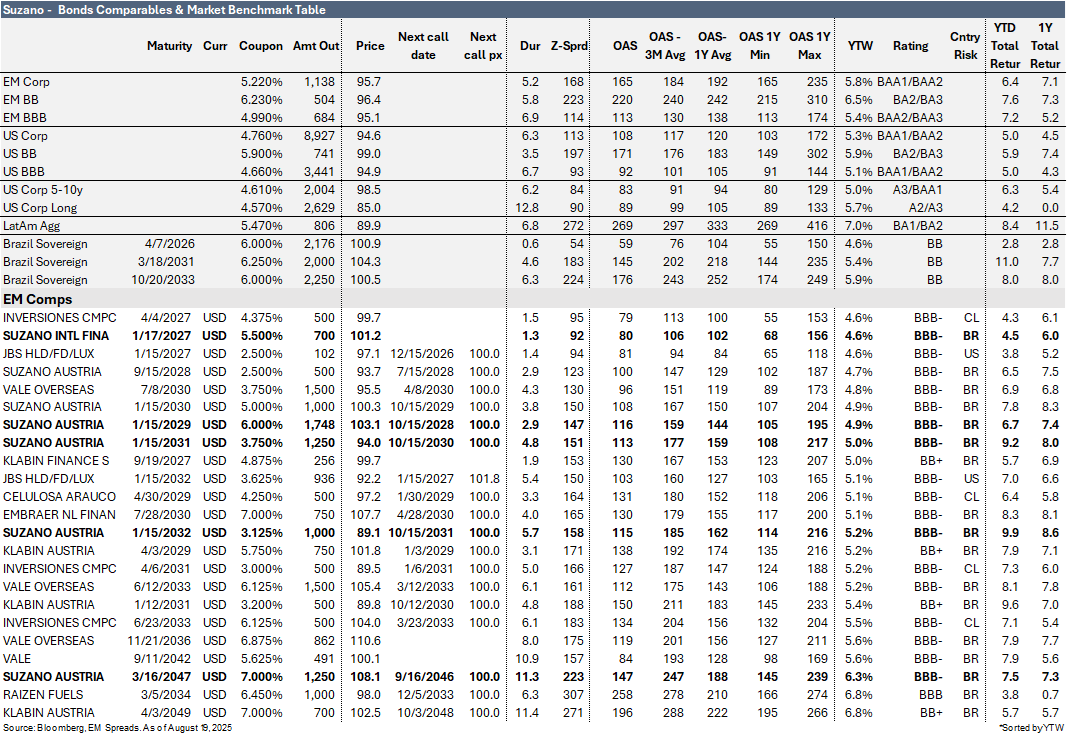

Credit profile underpinned by deleveraging commitment, cost efficiency, and positive cash generation, but tight spreads lead us to favor 2029s

Key Insights and Recommendations

We downgrade Suzano’s (Baa3/BBB-/BBB-) 2031s and 2032s to Neutral and upgrade the 2029s to Overweight, as these notes offer a comparable yield while meaningfully reducing duration risk. We continue to view Suzano’s business and financial risks positively, supported by expectations of healthier pulp prices, higher sales volumes, and lower costs with reduced reliance on third-party purchases. However, at current spread levels, we see limited further upside for the 2031 and 2032 bonds. Management’s focus on deleveraging, cost efficiency, and executing strategic initiatives should further reinforce the company’s credit profile.