Telecom to Price USD 2033 Unsecured Notes (IPT: mid-9%, Guidance: 9.5%)

We view the refinancing of the related loan as credit positive

Telecom Argentina is launching a USD benchmark-sized 2033 senior unsecured notes issuance, with expected B ratings from Fitch. Proceeds are expected to be used to pay, in whole or in part, the US$1.17 billion loan related to the Telefónica acquisition, cover transaction expenses, and, if any remain, for general corporate purposes.

The notes will amortize 50% and 50% annual installments in 2032 and 2033. Pricing is expected today, with initial price talk around the mid-9% area, now guided at 9.5%.

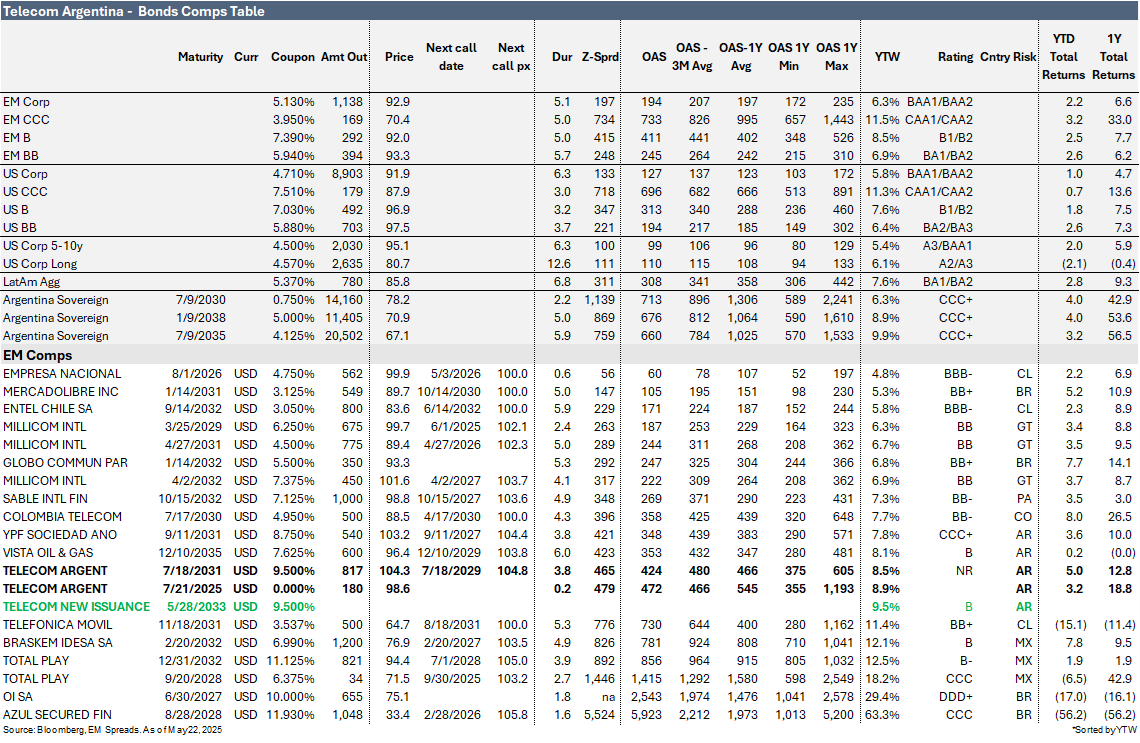

We recommend a BUY on the new TECOAR 2033 notes. At 9.500%, we find the bonds attractive relative to the TECOR 9.500% 2031 unsecured bonds, which yield 8.5% for a 3.8-year duration, despite the modest extension in maturity. We believe these bonds offer an appealing yield within Telecom’s debt capital structure and screen wide relative to the broader Telecom curve. This presents an attractive entry point for yield-focused investors comfortable with Argentina’s improving, though still fragile, macro backdrop.