U.S. Tariff Escalation: Credit Implications for Brazilian Companies in Our Coverage

Brazilian Credits in Our Coverage Show Resilience, as U.S. Tariffs Likely to Have a Modest Impact Despite Limited Macro Policy Flexibility

The recent decision by the United States to raise reciprocal tariffs on all Brazilian imports to 50% from 10%, effective August 1, 2025, marks a material escalation in trade tensions and introduces downside risk for Brazilian exporters with significant exposure to the U.S. market. Brazil is currently the 15th largest trading partner of the U.S., with exports totaling $42.3 billion in 2024, according to Bloomberg.

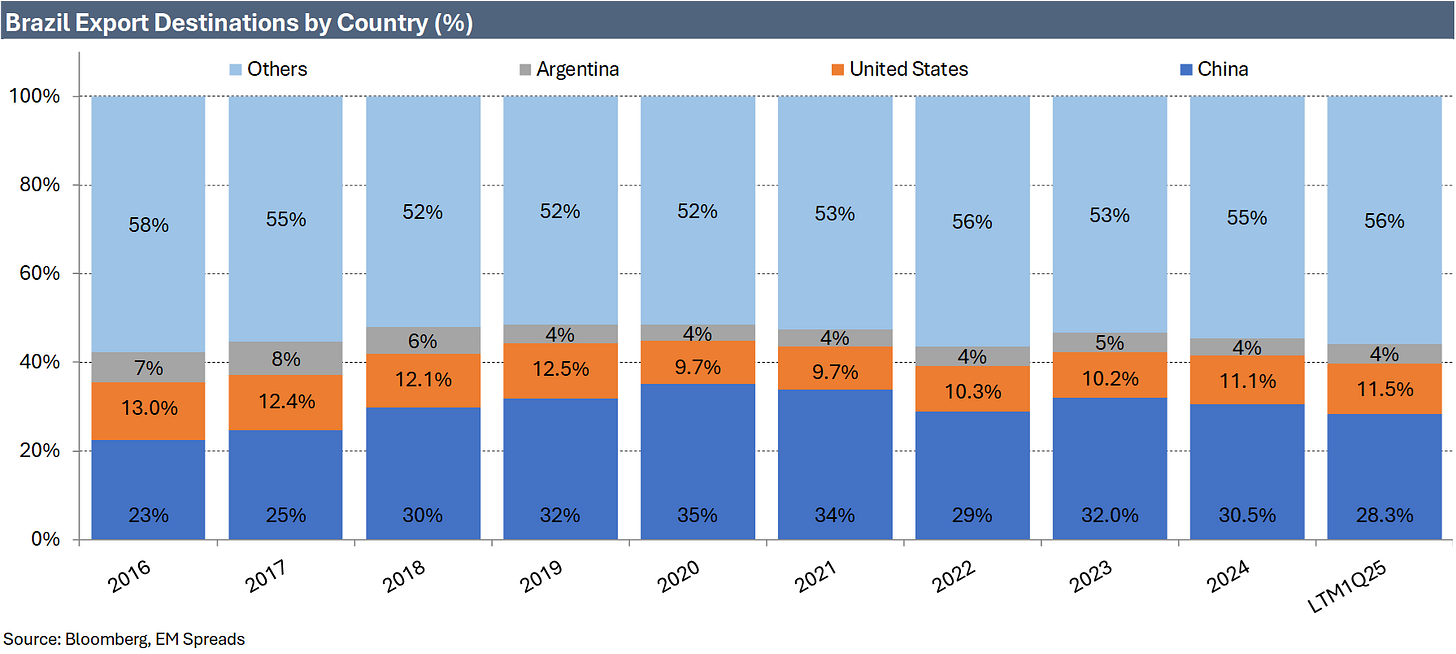

Despite this, Brazil’s economy has relatively limited direct exposure to U.S. tariffs, reflecting its diversified export base and commodity-heavy trade profile. In 2024, 11.5% of Brazilian exports were directed to the United States, up modestly from 11.1% in 2023. Key exports to the U.S. include crude oil, aircraft, iron and steel products, and agricultural goods such as orange juice and beef. While industrial sectors like aerospace, auto parts, and steel maintain active trade flows with the U.S., most of Brazil’s external revenues are tied to Asia, particularly China, which absorbed 30.5% of the country’s total exports in 2024, including a substantial share of its commodity exports.