Venezuela Post-Maduro: Regime Change Reopens Credit Optionality

Credit upside improves as sanctions engagement reopens, yet cash control and PDI overhang complicate recovery paths

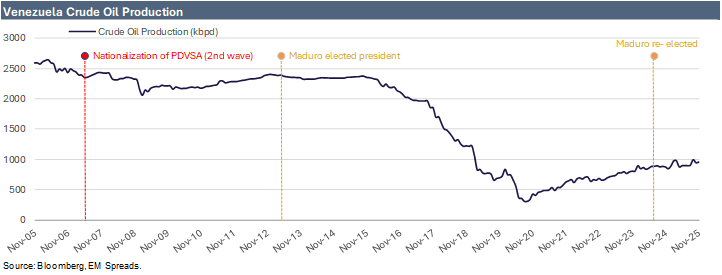

The removal of Nicolás Maduro and the designation of an interim authority marked a decisive rupture with the prolonged political paralysis that has defined Venezuela since the 2017 default. From a market perspective, that break alone was sufficient to trigger a sharp rally across defaulted Venezuelan sovereign bonds and PDVSA debt, as investors reassessed the probability of renewed engagement with the U.S. and, eventually, a path toward restructuring. We view this initial repricing as rational. Eliminating the tail risk of indefinite stalemate carries intrinsic value in a credit that had effectively been frozen by sanctions, legal uncertainty, and the absence of a credible interlocutor. However, we do not think this move should be read as confirmation of near-term normalization or a clean transition toward debt sustainability. The rally reflects a reopening of optionality rather than resolution.

The political configuration that is now emerging matters materially for credit. The interim framework appears explicitly designed to prioritize stability, control, and bilateral coordination with the U.S., rather than an immediate, opposition-led electoral transition. Notably, there is no defined election timeline, and the durability and international legal standing of the interim arrangement remain unresolved, with U.S. policy posture still framed around leverage and conditional engagement rather than full normalization. Senior U.S. officials have signaled a willingness to work pragmatically with elements of the existing Chavista structure, while simultaneously downplaying near-term elections and keeping deeper political recognition and normalization contingent on cooperation and outcomes. From a fixed income perspective, this setup increases the probability of incremental, transactional progress, but it also embeds legitimacy risk and reversibility into the process. A prolonged interim period may allow for selective policy actions such as targeted sanctions relief or expanded operating licenses, but it also leaves bondholders exposed to delays, policy fatigue, or partial rollbacks if political cooperation deteriorates. That distinction is critical because it directly shapes both the timing and the ultimate recovery path for creditors.

Recent U.S. actions suggest that engagement is being structured less as a broad normalization process and more as a tightly controlled oil monetization mechanism. The U.S. has indicated that Venezuelan crude and products are being marketed through authorized channels, with proceeds settling into U.S.-controlled accounts and disbursements occurring at U.S. discretion. The framework is described as beginning immediately with an initial tranche of oil sales and continuing on an indefinite basis. In our view, this materially clarifies the nature of early engagement: barrels may flow, but cash control remains externalized.