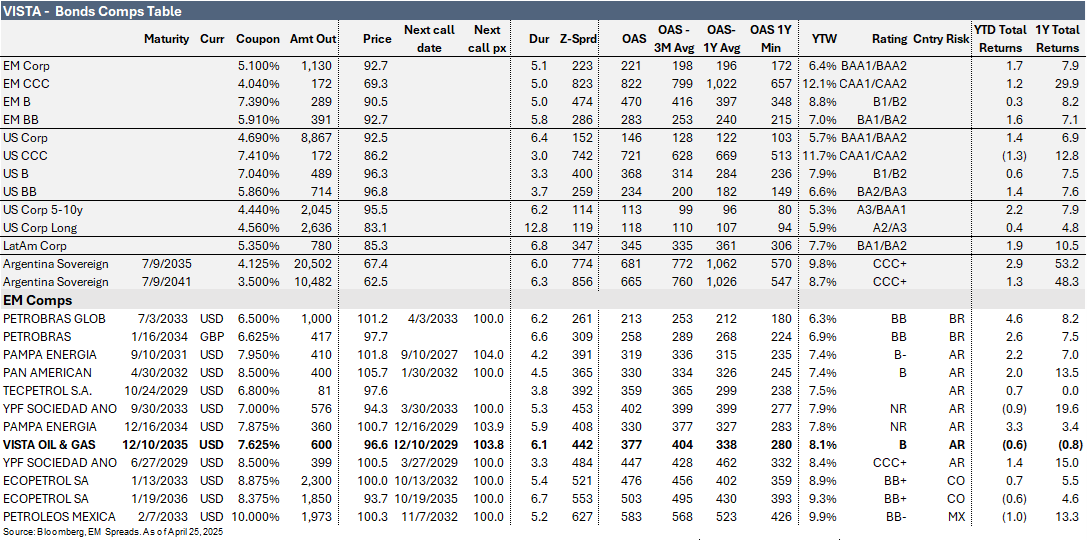

Vista 1Q25: Strategic Petronas Acquisition Strengthens Credit and Growth Outlook

In-line quarterly results. Strategic Petronas deal adds scale, low-cost barrels, and export capacity, boosting production and strengthening midstream position.

Key Insights and Recommendations

Vista reported 1Q25 results largely in line with expectations. The company generated an adjusted EBITDA of $275 million in the quarter, reflecting a 0.8% sequential improvement and modestly missing consensus expectations by 0.3%. The adjusted EBITDA margin expanded by 4.8 pp QoQ to 62.8%, primarily driven by higher realized prices and lower trucking volumes, representing a $14 million sequential reduction in selling expenses as the Oldelval expansion came online. Vista’s production declined 5.1% sequentially to 80.9 kbpd in 1Q25 as the company backloaded activity to optimize the use of the Oldelval pipeline expansion and minimize trucking. Financially, Vista maintains healthy credit metrics and a high EBITDA margin, supported by its low-cost production profile, while 78% of domestic volumes were sold at export parity-linked pricing, bringing the total share of oil volumes sold at export parity pricing to 90%.

From a credit perspective, the results reflected a 15.2% QoQ rise in Vista’s total debt balance, coupled with a 15.3% sequential increase in LTM interest payments, partially offset by a 5.0% sequential improvement in LTM EBITDA. Consequently, gross leverage increased modestly by 0.1x to 1.6x, net leverage worsened by 0.2x to 0.9x, and EBITDA coverage declined 0.9x to 9.0x as of March 2025. Nevertheless, credit metrics remain solid.

Petronas acquisition. Vista Energy announced the acquisition of 100% of Petronas E&P Argentina. We view the acquisition as a strategically sound move that aligns with Vista’s long-term growth strategy and materially enhances the company’s production profile, midstream capacity, and P1 reserves. The La Amarga Chica block has demonstrated consistent production growth at low operating costs, offering compelling growth potential. The transaction also improves Vista’s profitability and cash flow profile, with a pro forma EBITDA margin of 68%, and strengthens its portfolio of ready-to-drill locations in the core area of Vaca Muerta. The acquired assets are high-margin and low-breakeven, with meaningful potential synergies across existing operations. These synergies could help reduce capex requirements, which is particularly relevant in the current global macro and oil price environment.