Vista 2Q25: Results Reinforce Overweight, But Cash Burn and Liquidity Weaken Buffer

Ramp-up execution supports the credit profile, and improved post-quarter-end liquidity eases near-term risk, though 2H25 free cash flow targets remain critical

Key Insights and Recommendations

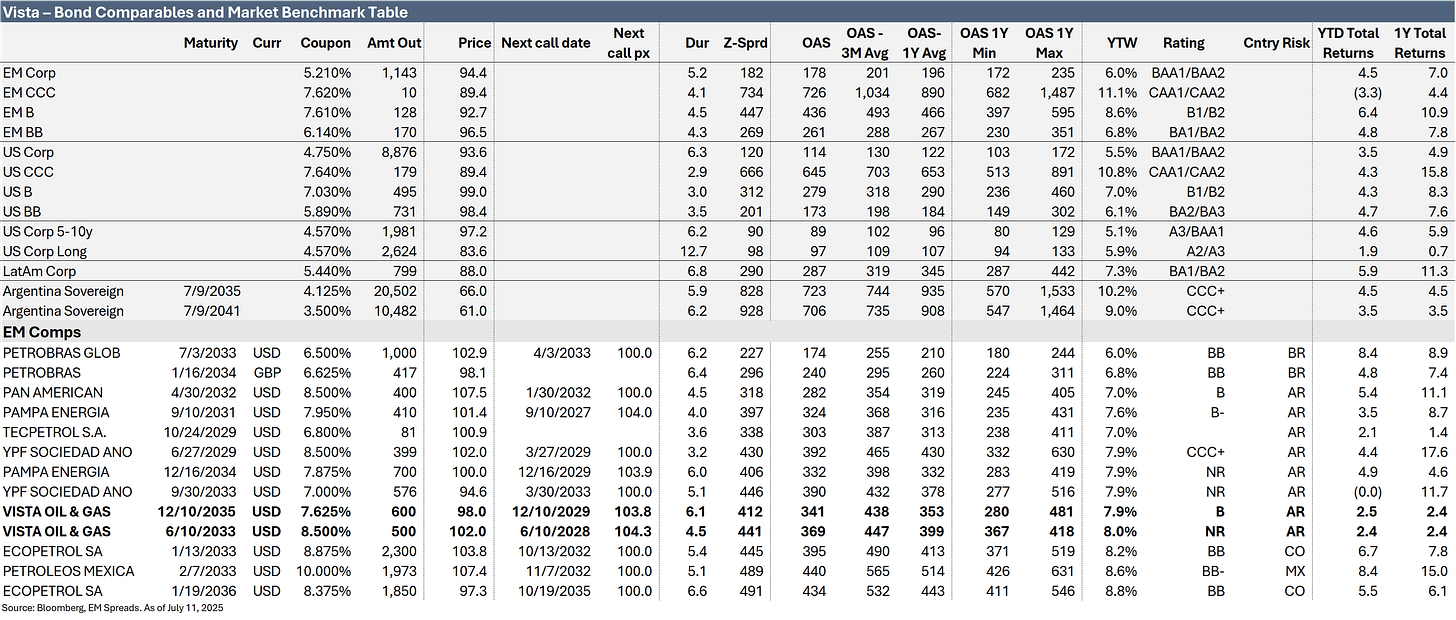

We maintain our Overweight recommendation on Vista Energy, with a preference for the 2033 notes, which offer a modestly higher yield despite lower duration risk.

Vista reported 2Q25 results marked by a strong operational ramp-up and the first quarter of consolidated results following the PEPASA acquisition. The company delivered adjusted EBITDA of $405 million, up 46.9% QoQ and 40.3% YoY, coming in 2.0% above consensus, supported by a 46% sequential increase in production to 118.0 Mboe/d. This reflected the inclusion of 50% of La Amarga Chica, which returned to 4Q24 production levels. Despite a 9.3% sequential decline in realized oil prices, adjusted EBITDA margin expanded 3.4 pp QoQ to 66.3%, driven by the elimination of trucking costs and continued operating efficiency. In 2Q25, 84% of domestic oil volumes were sold at export parity-linked prices, while the remaining 16% of total oil sales were exports. As a result, all of Vista’s oil volumes, both domestic and exported, were effectively sold at export parity pricing.