YPF 1Q25: Margin Expansion and Strategic Progress Back Outperformance View

Improved margins, higher shale output, lower lifting costs, and progress on midstream infrastructure reinforce our positive view, despite modest leverage deterioration and negative free cash flow.

Key Insights and Recommendations

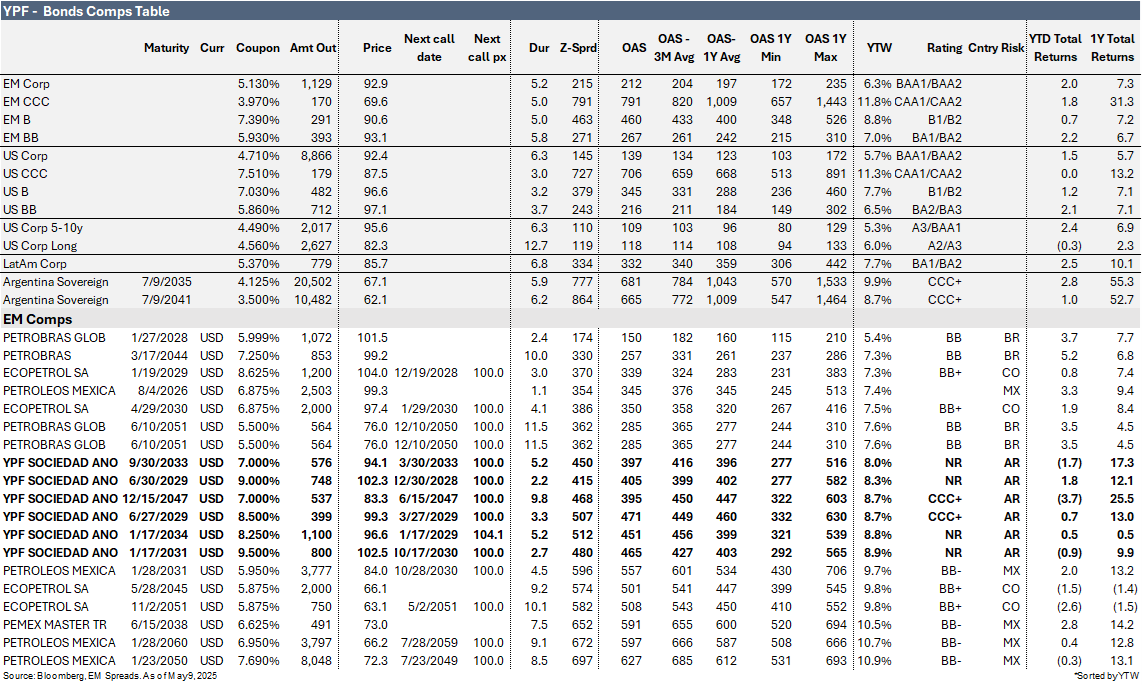

We maintain our Outperform recommendation on YPF (Caa1/B-/CCC), with a preference for the YPFDAR (Caa1/B-/CCC) 8.500% 2029s, YPFDAR 9.000% 2029s, YPFDAR 9.500% 2031s, and YPFDAR 8.250% 2034s.

YPF reported solid operating results in 1Q25, with total production volumes increasing 6.1% sequentially, driven by higher unconventional oil production (up 6.0% QoQ) and unconventional natural gas production (up 12.6% QoQ). Revenues declined 3.0% QoQ, pressured by a 2.9% drop in Downstream revenues, although Upstream revenue improved 5.0% over the same period. Despite the revenue decline, adjusted EBITDA rose 48.8% QoQ, exceeding consensus expectations by 9.2%, with EBITDA margin expanding 9.4 percentage points following a weak 4Q24. The improvement was supported by higher fuel prices, with realized crude oil prices averaging $67.9/b in 1Q25, up 3.4% QoQ, along with a 28% QoQ increase in refining and marketing margins, which reached $14.3/b. Cost savings from the divestment of mature fields also contributed, helping reduce lifting costs to $15.3/boe in 1Q25, down 11.8% QoQ. The cost of sales declined 11.4% QoQ, outpacing the drop in revenues and supporting gross margin expansion. As a result, Upstream EBITDA increased 28.2% QoQ, while Downstream EBITDA jumped 35.8% QoQ.

From a credit perspective, the results reflected a 5.6% increase in total debt, a 10.0% increase in net debt, and a 2.1% rise in LTM interest paid compared to the previous quarter. At the same time, LTM adjusted EBITDA remained stable sequentially, and LTM funds from operations improved by 4.0% over the period. As a result, gross leverage increased 0.1x sequentially to 2.2x as of March 2025, net leverage worsened by 0.2x to 1.9x, and cash interest coverage declined 0.1x to 4.1x. Liquidity remains weak, with short-term debt representing 165% of its cash position, further pressured by continued negative free cash flow. However, YPF has maintained relatively stable access to international capital markets. We also note that management expects net leverage to return to the 1.5x to 1.6x range after the company completes the mature fields transaction, but also considering the annual average Brent of $75.5/b.

Following the upgrade in Argentina’s sovereign rating, both Moody’s and S&P raised YPF’s credit ratings, with Moody’s upgrading it to Caa1 from Caa3 and S&P to B- from CCC.

Regarding YPF’s strategic opportunity, the company is advancing on multiple fronts to streamline operations and expand export capacity. Under its Mature Fields Exit Program, YPF is divesting 50 conventional blocks to reduce lifting costs and focus on shale development. As of early April 2025, 11 blocks had been transferred, 10 are advancing under a memorandum of understanding with the Santa Cruz provincial government, 23 are in the final stages of transfer, and 16 remain under negotiation. On midstream infrastructure, YPF completed the Oldelval pipeline expansion in April 2025, raising capacity from 330 kbpd to 540 kbpd. YPF owns approximately 25% of Oldelval and uses the pipeline to transport shale oil to its La Plata refinery, strengthening vertical integration. The company also began construction of the VMOS pipeline, which targets 550 kbpd of export capacity by the second half of 2027, with initial flows of 180 kbpd expected by the fourth quarter of 2026. YPF holds a 27% shipper commitment and is leading financing for the $3 billion project, structured with 70% debt and 30% equity. In LNG, YPF and its partners reached a final investment decision on a 2.45 MTPA floating LNG vessel expected to begin operations in 2027, and anticipate approving a second 3.5 MTPA vessel by July 2025. Additionally, YPF signed a memorandum of understanding with Eni to evaluate a third LNG project, which could bring total liquefaction capacity close to 30 MTPA across all phases

Additionally, Argentina’s improving macroeconomic environment supports a stronger sovereign credit profile. Rising U.S. dollar reserves and the recent easing of capital controls are enhancing credibility and bolstering confidence in the country’s ability to meet its debt obligations. In this context, we expect YPF to continue advancing its strategy of expanding lower cost unconventional production and investing in midstream infrastructure, while divesting from mature fields. Combined with reduced country risk, these efforts should drive outperformance in YPF bonds over the next 9 to 12 months.