YPF 2Q25: Encouraging Strategic Progress Supports Overweight View

Mature field divestments, lower lifting costs, and infrastructure build-out bolster credit profile, though liquidity strain, negative cash flows and political/legal risks persist.

Key Insights and Recommendations

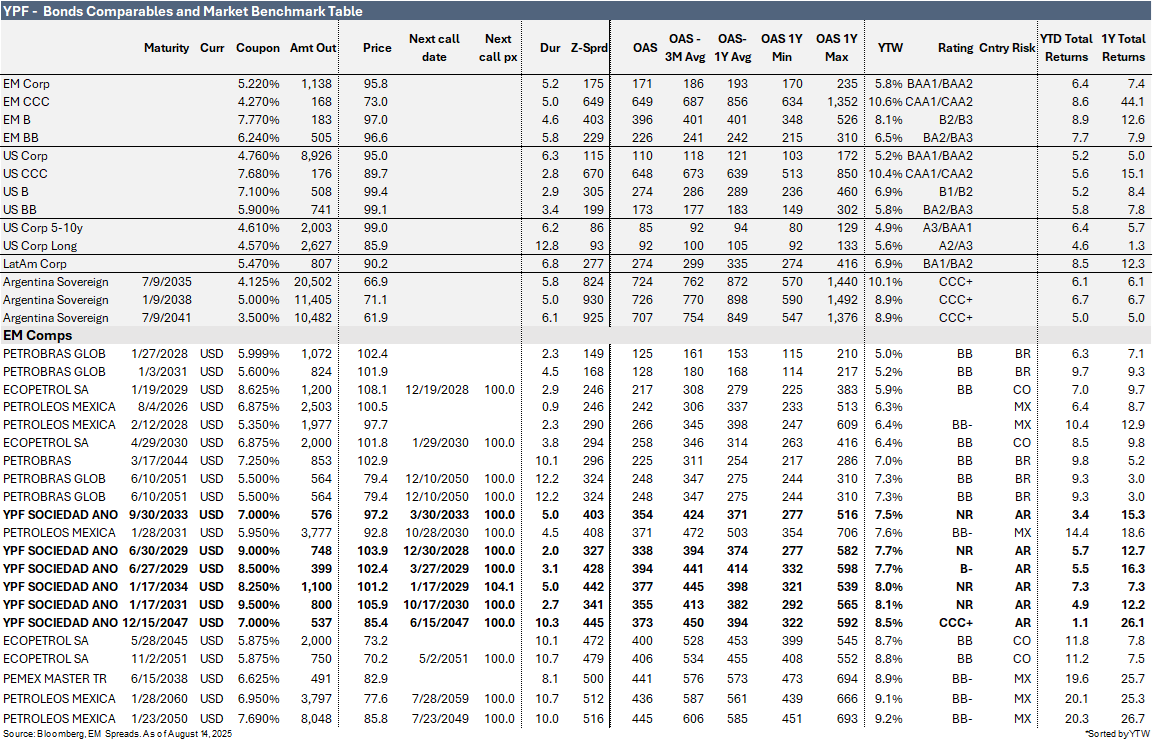

We maintain an Overweight view on YPF (B2/B-/CCC+), supported by mature field divestments, lower lifting costs, and a strategic focus on expanding unconventional production and midstream/export infrastructure. These initiatives, along with a more favorable macroeconomic backdrop, should strengthen the credit profile and support bond outperformance. Risks include the October 2025 midterm elections and the unresolved Petersen/Eton Park legal dispute. We favor the YPFDAR 9.500% 2031 notes (8.1% yield, 2.7-year duration) and the 9.000% 2029 notes (7.7% yield, 2.0-year duration) for their attractive yields and limited duration risk.