Vista Energy: Strong Reserves Growth Continues

We continue to prefer Vista for investors seeking exposure to Argentina’s energy sector

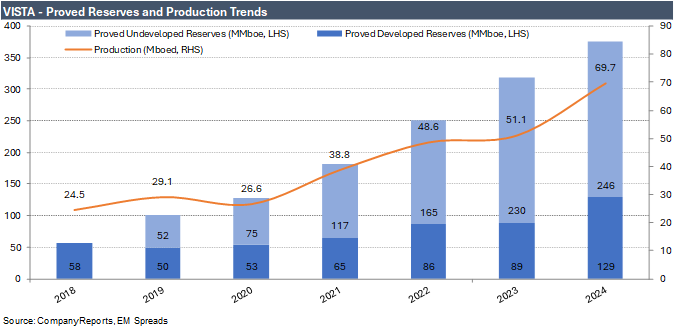

On February 18, 2025, Vista Energy reported that its P1 reserves grew by 56.7 MMboe, or 17.8% YoY, to 375.2 MMboe, resulting in a reserves replacement ratio of 323% and a reserve life of 14.7 years. The company’s reserves have expanded at a 36.7% CAGR over the past six years, increasing 6.5x since 2018. Over the same period, crude oil reserves grew 9.4x to 322.6 MMbbl, while natural gas reserves rose 2.2x to 52.7 MMboe.

Vista booked 400 proved well locations, with 156 (31%) classified as proved developed and 244 (61%) as proved undeveloped.

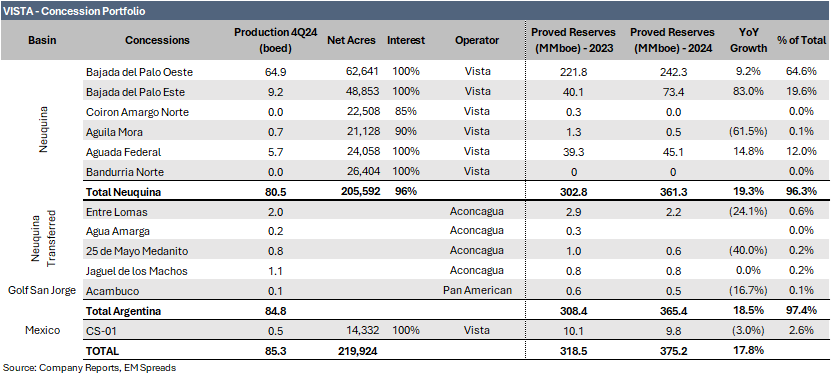

Reserves at the Bajada del Palo Oeste block increased 9.2% YoY to 242.3 MMboe, accounting for 64.6% of Vista’s total P1 reserves. The growth was primarily driven by higher activity, as the company tied in 34 new wells in 2024, bringing the total to 258 booked P1 locations. We highlight significant P1 reserve growth at Bajada del Palo Este, which rose 83.0% YoY to 73.4 MMboe, representing 19.6% of total P1 reserves. The company tied in 13 new wells, bringing the total to 64 booked P1 locations in 2024.

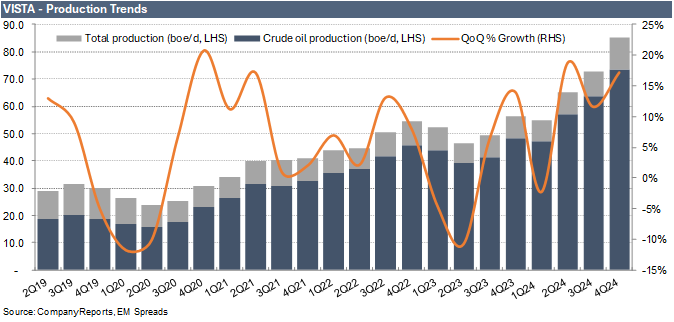

Total production increased 17.1% QoQ to 85.3 kbpd in 4Q24, up from 72.8 kbpd in 3Q24. This growth was primarily driven by a 15.7% sequential increase in crude oil production to 73.5 kbpd, a 27% QoQ rise in natural gas production to 1.81 MMm³/d, and a 4% sequential increase in NGL production to 0.4 kbpd.

For the full year 2024, total production averaged 69.7 kbpd, marking a 36.2% YoY increase. This growth reflects strong shale oil development and an activity ramp-up, with 50 new wells tied in during the year. Crude oil production reached 60.4 kbpd in 2024, up 39.5% YoY.

Trade Recommendation

Vista is a leading independent shale oil producer in Argentina, well-positioned to capitalize on the Vaca Muerta formation. With 375.2 MMboe in proved reserves and a strong inventory of wells, the company expects production to grow from 51 kboed in 2023 to 95–100 kboed by 2025 and 150 kboed by 2030, supported by consistent investment in upstream and midstream developments. However, its capital-intensive growth strategy is likely to result in negative free cash flow through 2025. Vista’s strong track record of reserve and production growth underscores its execution capabilities, while Argentina’s improving macroeconomic environment continues to bolster investor confidence.

Financially, Vista maintains low leverage (0.7x net leverage as of September 2024) and a high EBITDA margin (67.1%), supported by its low-cost production profile. The company exports 45.9% of its oil at international prices, benefiting from Argentina’s crude oil oversupply. Under the leadership of founder Miguel Galuccio, who holds a 7.9% stake, Vista has successfully navigated economic and political challenges.

Liquidity remains a key concern, with short-term debt exceeding cash and no committed USD credit facilities, exacerbated by Argentina’s capital controls. Potential support from its primary shareholder, Al Mehwar Commercial Investment LLC, and access to debt markets may help mitigate these risks. However, Vista remains exposed to sovereign risk, inflation, currency devaluation, and government intervention. Operational concentration and reliance on oil production also heighten its vulnerability to commodity price fluctuations and regulatory risks. Delays in key midstream projects, such as Oldelval and Vaca Muerta Sur, could further impact financial performance.

We believe Argentina’s improving fiscal position, slower FX depreciation, and rising USD reserves may support economic stability and increase confidence in the country’s credit profile. Against this backdrop, Vista remains focused on expanding its low-cost unconventional production and investing in midstream and export infrastructure.

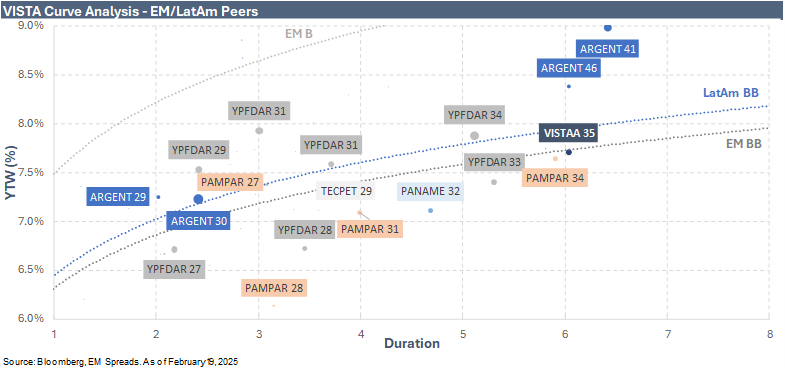

VISTAA (Caa1/BB-) 7.625% 2035 notes saw spreads tighten to 292 bps, down from 316 bps on February 2, 2025, and 11 bps below the December 4, 2024, pricing of 303 bps. In comparison, the broader EM Index contracted by 12 bps to 175 bps, the U.S. Index narrowed by 1 bps to 106, and the Latin America Aggregate Index tightened by 28 bps to 309 bps.

Argentine sovereign bonds have exhibited notable tightening over this period, with 2035 maturities trading at 701 bps, a substantial 928 bps lower than the highest point in the last 12 months of 1,629 bps. However, Argentine bonds are trading 131 bps wider than their tightest mark in the period. Current yields for VISTAA 7.625% 2035, yielding 7.7% for a 6.0-year duration, compare favorably to peers with similar credit ratings, including PANAME (B3/BB-) 8.500% 2032 notes yielding 7.1% for a 4.7-year duration, YPFDAR (Caa1) 7.000% 2033 notes yielding 7.4% for a 5.3-year duration, and PAMPAR (B) 7.950% 2031 notes yielding 7.6% for a 5.9-year duration.

Despite generating smaller revenues and EBITDA compared to most of its peers, Vista boasts a robust financial and business risk profile, supported by strong credit metrics, solid profitability, and its leadership position in Argentina's Vaca Muerta shale formation. The company benefits from a preferable oil-focused portfolio with an increasing export share, potential liquidity support from its major shareholder, and a consistent production and reserve growth track record. Additionally, Vista faces fewer sovereign and political risks than YPF. With solid execution on well tie-ins and expanding midstream capacity, Vista remains on track to meet its ambitious EBITDA and production targets. As a result, we continue to prefer Vista for investors seeking exposure to Argentina’s energy sector. We believe stronger operational performance and a reduction in country risk could drive bond outperformance over the next 9 to 12 months.

See Also:

Suzano (February 14, 2025): Suzano 4Q24: 2031s & 2032s Offer Value as Fundamentals Strengthen.

Cemex (February 7, 2025): Cemex 4Q24: A Solid EM Credit, But Tariff Overhang Limits Near-Term Potential.

Cemex & Pemex (February 5, 2025): U.S. Tariffs and Their Potential Impact on Cemex and Pemex.

Pemex (January 31, 2025): Lack of Concrete Action Weights on the Outperform Thesis.

Suzano (January 30, 2025) Initiation coverage report.

YPF (January 8, 2025): Recommendation on YPF's new USD 9NC4 unsecured notes.

Vista Energy (December 18, 2024): New issue snapshot.

YPF (December 3, 2024): Initiation coverage report.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.