Market Snapshot

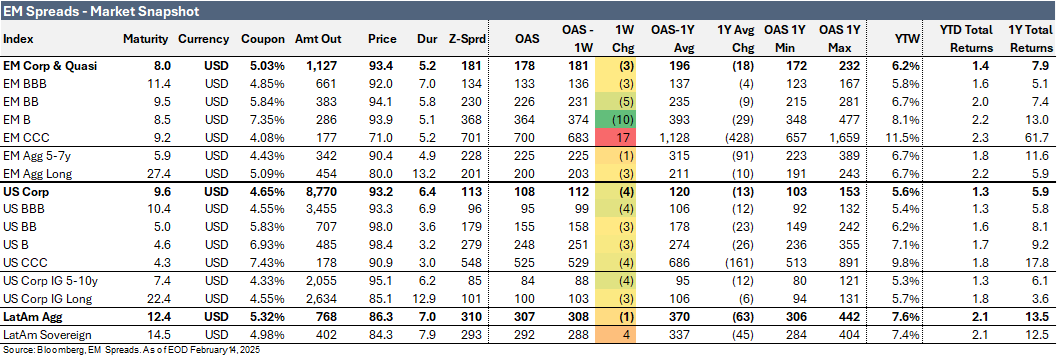

The LatAm Aggregate Index contracted modestly by 1 bps to 307 bps in the week ending Friday, February 14, 2025. Meanwhile, the broader Emerging Market Index tightened by 3 bps to 178 bps, while the broader U.S. Index narrowed by 4 bps to 108 bps. Notably, the EM B Index tightened by 10 bps to 364 bps, and the EM CCC Index widened significantly by 17 bps to 683 bps, following a 20 bps expansion the previous week.

Equity markets in the region showed mixed performance. Argentina's Merval Index declined 1.2%, Brazil's Ibovespa Index gained 2.9%, and Mexico's Mexbol Index rose 2.4%. In the U.S., the S&P 500 Index advanced 1.5% for the week.

In commodities, WTI crude oil traded at $74.70 per barrel (+0.1% weekly), while Brent crude settled at $70.70 per barrel (-0.4%).

Turning to bond yields, U.S. Treasuries saw modest declines. The 10-year yield fell 2 bps to 4.48%, while the 5-year yield also declined 2 bps to 4.33%. In Latin America, the yield on the 10-year Mexican government bond dropped 6 bps to 6.36%, the 10-year Brazilian government bond fell 3 bps to 6.63%, and the 10-year Argentine government bond rose 20 bps to 10.61% over the week.

Argentina Records Lowest Inflation in 4.5 Years

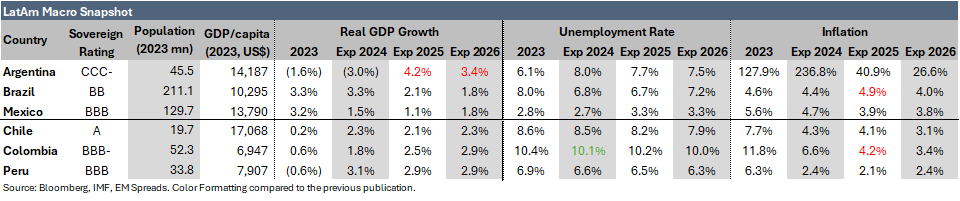

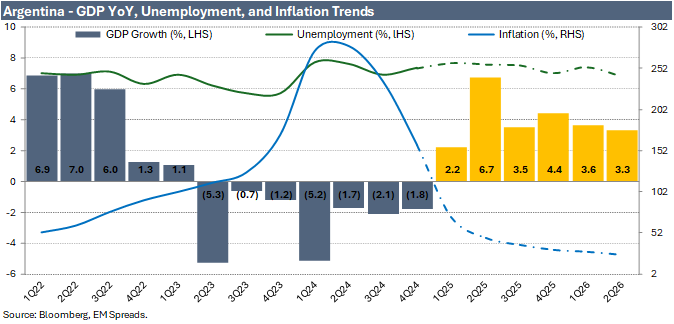

Argentina's inflation rate slowed to 2.2% in January, the lowest monthly figure in 4.5 years, according to INDEC. This follows four consecutive months of sub-3% inflation and a YoY rate of 84.5%, marking the first time it has fallen below 100% in two years. President Javier Milei's measures, including drastic spending cuts and public sector layoffs, helped the country achieve its first budget surplus in a decade in 2024, contributing to the slowdown in inflation. However, they have also deepened Argentina's recession and increased poverty. Still, unemployment has remained relatively stable, staying below 8%.

The government remains committed to its fiscal strategy, with Economy Minister Luis Caputo hailing the ongoing disinflation process. The government forecasts a 5.0% GDP rebound and a budgetary surplus in 2025. Market expectations also point to significant GDP improvement, with projected growth of 2.2% in 1Q25, 6.7% in 2Q25, and an annual increase of 4.4% in 2025 and 3.4% in 2026. Inflation is also expected to decline sharply, reaching 40.9% in 2025 and 26.6% in 2026.

Weekly News

1. Suzano 4Q24: 2031s & 2032s Offer Value as Fundamentals Strengthen

On February 14, 2025, we published our Suzano 4Q24 results report.

We upgraded Suzano’s 2031s and 2032s to Outperform, while maintaining the rest of the curve at Market Perform. Despite additional industry supply, tight market conditions persist due to low stock levels, maintenance-related production cuts, and operational disruptions. Healthy pulp prices, higher sales volumes, controlled costs, and a focus on deleveraging should support Suzano’s cash generation and credit profile in 2025, with this trend likely continuing as no major new supply is expected. Management downplayed U.S. tariff risks, noting that tariffs have applied only to paper, not pulp, and that U.S. hardwood shortages and a lack of domestic pulp investment reduce the likelihood of future tariffs. Suzano’s export focus also mitigates concerns over Brazil’s economic outlook.

Within Suzano’s capital structure, we prefer the 3.750% 2031 and 3.125% 2032 bonds, which compare favorably to select regional peers, the broader EM BBB Index, and the US BBB Index. Additionally, these notes trade below par at $90.1 and $84.6, respectively, while most of Suzano’s curve remains priced above par.

2. Cemex Announces CEO Transition and Senior Management Reshuffle

On February 10, 2025, Cemex announced that CEO Fernando A. González will retire after over 35 years at the company, with Jaime Muguiro, currently President of Cemex USA, set to take over as CEO effective April 1, 2025. González, who has led Cemex for more than a decade, is credited with steering the company to an industry leadership position in sustainability, innovation, and digitalization while also regaining investment-grade ratings. Chairman Rogelio Zambrano expressed confidence in Muguiro’s ability to drive Cemex’s continued growth, citing his extensive experience across the company’s global operations.

Alongside the CEO transition, Cemex is implementing a broad senior-level reorganization effective April 1, 2025. Key appointments include Jesus Gonzalez as President of Cemex USA, Sergio Menendez as President of Cemex Mexico, and Jose Antonio Cabrera as President of Cemex Europe, Middle East, and Africa. Additionally, Alejandro Ramirez will lead Cemex South, Central America, and the Caribbean, while Ricardo Naya will be Executive Vice President of Sustainability and Operations Development. These changes reflect Cemex’s commitment to leadership development and long-term strategic priorities.

3. YPF & Vista: Argentina to Lift Currency Controls by January 1, 2026

In a recent interview, President Javier Milei announced that Argentina plans to eliminate its complex system of currency controls, known locally as the "cepo," by January 1, 2026. These controls, which have been in place since 2019, have restricted access to U.S. dollars and have impacted economic activities. Milei indicated that securing a new financing agreement with the International Monetary Fund (IMF), currently under negotiation, could expedite this timeline. He emphasized that even without IMF assistance, the government is committed to lifting the cepo by the start of 2026. Economists note that the success of Milei's economic program is closely tied to effectively removing these controls, as they play a significant role in the country's disinflation strategy.

This development is expected to impact Argentina’s oil and gas sector positively. Companies like YPF and Vista stand to benefit from improved stability in dividend payments and a likely increase in rig supply, which could reduce drilling costs. Meanwhile, Raízen may find better conditions to sell its Argentine fuels business, supporting its deleveraging efforts. The certainty of this timeline could be key in shaping investor sentiment and capital flows into Argentina’s energy market.

4. Minerva Revises Structure of Uruguay Transaction Following Antitrust Review

On February 11, 2025, Minerva submitted a revised request to Uruguay’s antitrust authority, the Comisión de Promoción y Defensa de la Competencia (Coprodec), concerning its previously announced acquisition of three industrial plants from Marfrig Global Foods S.A. in Uruguay.

Following Coprodec’s initial decision to reject the transaction in its original form, Minerva has restructured its proposal, now seeking approval for the acquisition of two plants, located in San José and Salto, while committing to the immediate resale of the third facility, located in Colonia, to the Allana Group. This revised transaction structure aims to address regulatory concerns while maintaining Minerva’s strategic objectives in the region. The Company has reiterated its commitment to keeping shareholders and the broader market informed of any material developments related to the transaction, particularly with respect to regulatory review and approval processes.

See Also:

Suzano (February 14, 2025): Suzano 4Q24: 2031s & 2032s Offer Value as Fundamentals Strengthen.

Cemex (February 7, 2025): Cemex 4Q24: A Solid EM Credit, But Tariff Overhang Limits Near-Term Potential.

Cemex & Pemex (February 5, 2025): U.S. Tariffs and Their Potential Impact on Cemex and Pemex.

Pemex (January 31, 2025): Lack of Concrete Action Weights on the Outperform Thesis.

Suzano (January 30, 2025) Initiation coverage report.

YPF (January 8, 2025): Recommendation on YPF's new USD 9NC4 unsecured notes.

Vista Energy (December 18, 2024): New issue snapshot.

YPF (December 3, 2024): Initiation coverage report.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.