Weekly News & Views - Feb 28, 2025

Vista Energy - Mercado Libre - Telecom Argentina - Suzano - Cemex

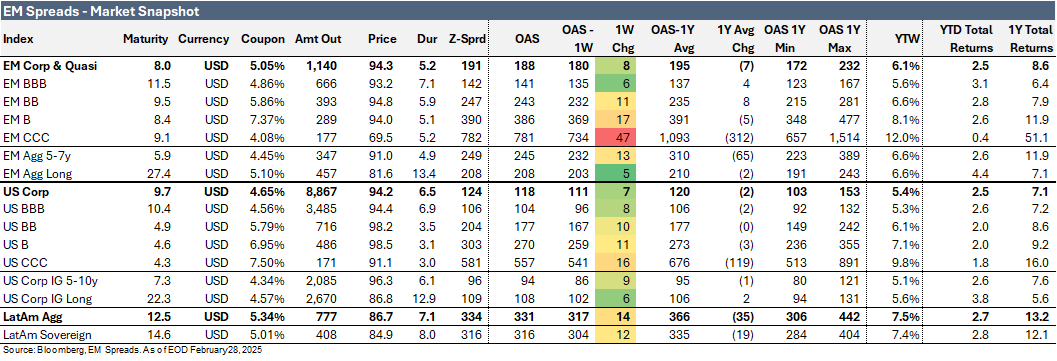

Market Snapshot

The LatAm Aggregate Index expanded by 14 bps to 331 bps in the week ending Friday, February 28, 2025. Meanwhile, the broader Emerging Market Index widened by 8 bps to 188 bps, while the broader U.S. Index also increased by 7 bps to 118 bps. Notably, the EM CCC Index widened significantly by 47 bps to 781 bps, following a 34 bps expansion the previous week.

Equity markets in the region showed negative performances. Argentina's Merval Index declined 6.7%, Brazil's Ibovespa Index fell 3.4%, and Mexico's Mexbol Index decreased 2.6%. In the U.S., the S&P 500 Index was down 1.0% for the week.

In commodities, WTI crude oil traded at $69.8 per barrel (-0.9% weekly), while Brent crude settled at $72.8 per barrel (-2.2%).

Turning to bond yields, U.S. Treasuries saw significant declines. The 10-year yield fell 22 bps to 4.21%, while the 5-year yield declined 25 bps to 4.02%. In Latin America, the yield on the 10-year Mexican government bond dropped 22 bps to 6.17%, the 10-year Brazilian government bond fell 8 bps to 6.58%, while the 10-year Argentine government bond increased 32 bps to 11.18% over the week.

Weekly News

Vista Energy 4Q24: Solid Expectations Despite Short-Term Cost Headwinds

On February 27, 2025, we published our report on Vista Energy 4Q24 results.

We maintain our Outperform recommendation on Vista Energy. We view Vista as an attractive option for investors seeking exposure to Argentina's energy sector. The company’s robust credit metrics, solid profitability, and leading market position support its financial and business risk profile. We expect improving macroeconomic conditions in Argentina to benefit Vista’s operations. Additionally, its focus on expanding unconventional, lower-cost production and investing in infrastructure should further strengthen its credit profile and drive outperformance in its bonds over the next 9–12 months.

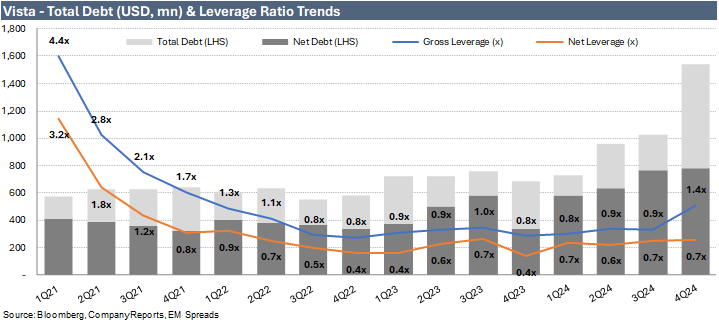

Vista’s 4Q24 results were mixed but largely in line with expectations. Adjusted EBITDA declined 11.9% sequentially to $273 million, coming in slightly below market estimates, primarily due to temporary trucking costs that should ease with new pipeline capacity in 2Q25. Despite this, the company maintained strong production and reserves growth, supported by solid execution in well tie-ins and midstream expansion. Financially, Vista remains well-positioned with low leverage and high margins, benefiting from its low-cost production model. Net oil revenues at export parity prices accounted for 73% of total revenues.

From a credit perspective. The results reflected a higher debt balance, primarily driven by the $600 million issuance in December, along with increased interest payments and taxes, while LTM EBITDA declined 1.3%. However, liquidity improved significantly, strengthening the company’s ability to meet maturities and capital expenditures in 2025. Leverage metrics remained solid, despite gross leverage rising 0.5x to 1.4x as of December 2024, while net leverage remained stable sequentially at 0.7x. Notably, cash interest coverage declined 7.4x QoQ to 9.9x as of December 2024.

MELI 4Q24: Strong Results, While Leverage Remains Stable Amid Higher Debt

On February 24, 2025, we published our Mercado Libre 4Q24 results report.

We maintain our Outperform recommendation on MercadoLibre, with a preference for MELI 2.375% 2026 bonds. We remain optimistic about MELI’s financial and business risk profile. If the company achieves investment-grade status in the short term, we believe its fundamental strengths are already reflected in current spreads. However, we estimate approximately 10 basis points of incremental upside from a technical bid.

MELI delivered strong 4Q24 results. Revenues were up 37.4% YoY, driven by robust growth across key metrics including an 8.2% increase in GMV (56% FX-neutral) and a 32.5% rise in TPV (49% FX-neutral). Items sold increased by 27.1% and unique active buyers surged 23.7%, with fulfillment penetration reaching 95.1%. This performance supported Commerce and Fintech revenue growth of 44.4% and 28.6% YoY, respectively, with notable regional contributions from Brazil (+32% FX-neutral GMV), Mexico (+28% FX-neutral GMV), and Argentina (+18% in items sold). The quarter also saw sequential improvements in NIMAL and NPLs and a solid credit portfolio performance, culminating in an adjusted EBITDA of $972 million, a 21.2% YoY increase that exceeded market expectations by 23.9%.

From a credit perspective. The results were marked by a 5.5% sequential improvement in LTM EBITDA and positive cash generation, with adjusted free cash flow of $680 million, although there was a $393 million sequential increase in net debt outstanding to $4.1 billion. As a result, gross leverage and net leverage remained stable at 2.1x and 0.6x, respectively.

Telecom Argentina’s $1.25bn Telefónica Buyout Reshapes Market

On February 24, 2025, Telecom Argentina agreed to acquire Telefónica Móviles Argentina for $1.25 billion, consolidating the country’s telecom industry into a two-player mobile market alongside América Móvil’s Claro. The deal follows a competitive bidding process and aligns with Telefónica’s broader strategy of reducing its exposure to Latin America.

Telecom secured $1.17 billion in financing from BBVA, Deutsche Bank, Santander, and ICBC to fund the purchase. The company plans to invest in fiber optic expansion, 5G deployment, and digital services, reinforcing its long-term commitment to Argentina.

Regulatory approval remains a key hurdle, as the acquisition could leave 70% of telecom services under a single operator. Enacom and Argentina’s antitrust authority are expected to review potential market concentration risks. Remedies could include network-sharing obligations or spectrum returns.

Telecom Argentina has a history of industry consolidation, having merged with Cablevisión in 2018. With this latest acquisition, the company will control nearly 47% of the broadband market, strengthening its position in both fixed and mobile segments.

The move marks a significant shift in Argentina’s telecom landscape, with regulatory scrutiny likely to shape the final terms of the transaction.

Fitch Revises Suzano’s Outlook to Positive, Affirms ‘BBB-’ Rating

On February 25, 2025, Fitch revised Suzano’s outlook to positive and affirmed its BBB- rating. The revision reflects expectations that Suzano’s net leverage will fall below 3.0x by 2026, supported by strong operating cash flow and increased capacity from the recently completed Ribas mill.

Suzano maintains a leading global position in pulp production, with a 19% market share in market pulp and 36% in hardwood pulp. The company’s low-cost structure and strong free cash flow underpin its investment-grade status. Fitch expects EBITDA of $4.7 billion in 2025 and $6.2 billion in 2026, with FCF projected to reach $1.7 billion by 2026.

Leverage peaked at 3.8x in 2024 during the Ribas mill completion but is forecast to decline to 3.0x in 2025 and below that level thereafter. This provides flexibility for potential medium-sized acquisitions. Fitch projects hardwood pulp prices to stabilize at $600 per tonne in 2025, with gradual increases expected through 2028 due to limited capacity expansions.

Suzano’s cash reserves of $3.6 billion, alongside a $1.275 billion revolving credit facility, provide ample coverage for debt maturities through 2026. The company’s forestry assets, valued at $3.8 billion, remain a key pillar of its investment-grade profile.

A further upgrade could be triggered if Suzano maintains net debt/EBITDA below 3.0x through the pulp cycle or diversifies outside Brazil. Conversely, sustained leverage above 3.5x or net debt exceeding $17 billion could prompt a downgrade.

Suzano’s ‘BBB-’ rating pierces Brazil’s ‘BB+’ country ceiling due to strong export revenues, offshore cash holdings, and liquidity coverage exceeding 1.5x hard currency debt service. The outlook revision reinforces Suzano’s trajectory toward a higher credit rating, supported by operational strength and disciplined capital management.

Argentina Challenges $16.1 Billion YPF Judgment in New York Court

On February 26, 2025, the Argentine government formally submitted its response in a New York court, contesting a motion related to the long-running legal dispute over the 2012 expropriation of oil company YPF. The motion, filed by the non-governmental organization Republican Action for Argentina (RAFA), seeks to overturn a prior ruling that ordered Argentina to pay $16.1 billion, plus interest, in compensation to plaintiffs who claim financial losses from the nationalization.

In its filing, Argentina reaffirmed its stance that U.S. courts lack jurisdiction over the matter, arguing that the claims should not be adjudicated in the United States. The government also underscored its commitment to transparency regarding the acquisition of YPF shares by the Eskenazi family, signaling its willingness to cooperate with U.S. authorities on any related investigations.

This legal battle carries substantial financial implications for Argentina, which is already navigating a difficult economic landscape. A ruling against Argentina would add significant strain to the country’s financial obligations and could impact investor confidence. The outcome of the case will be closely watched, as it may shape Argentina’s future legal and financial standing in international markets.

Crédit Agricole CIB Closes $1.2 Billion Sustainability-Linked Export Prepayment Facility with Suzano

On February 28, 2025, Crédit Agricole CIB finalized a $1.2 billion Sustainability-Linked Export Prepayment Facility with Suzano International Finance B.V., reinforcing its leadership in sustainable financing. Acting as the Sustainability Structuring Agent, Joint Lead Arranger, and Bookrunner, Crédit Agricole CIB structured the facility around a key performance indicator (KPI) focused on biodiversity conservation.

The KPI measures the expansion of ecological corridors connecting priority areas in Brazil’s Cerrado, Atlantic Forest, and Amazon biomes, aiming to enhance biodiversity through strategic land-use planning. These efforts align with Suzano’s updated Sustainability-Linked Financing Framework, which has been validated by S&P’s Second Party Opinion.

Crédit Agricole CIB executives emphasized the facility’s role in advancing corporate biodiversity commitments, with Suzano continuing its pioneering efforts in sustainability-linked financing. This deal strengthens Crédit Agricole CIB’s relationship with Suzano and underscores its broader commitment to sustainable finance.

Cemex Announces Fourth Installment of $120M Cash Dividend

On February 28, 2025, Cemex confirmed the upcoming payment of the fourth and final installment of its previously declared $120 million cash dividend. The installment, totaling $30 million, will be distributed to holders of Cemex Ordinary Participation Certificates (CPOs) and American Depositary Shares (ADSs) as of the March 10, 2025 record date.

The previous three installments were paid in June, September, and December 2024. The fourth payment, amounting to approximately $0.000689 per share, $0.002067 per CPO, and $0.020670 per ADS, will be finalized and announced by March 7, 2025. Payments to CPO holders will be made on March 11 in Mexican pesos at the exchange rate determined by Banco de México, while ADS holders are expected to receive funds around March 18, 2025. The last day to acquire CPOs and ADSs with dividend rights is March 7, 2025.

The dividend is sourced from Cemex’s Net Tax Profit Account (CUFIN) as of December 31, 2013, ensuring no tax withholding.

See Also:

Vista Energy (February 27, 2025): Vista Energy 4Q24: Solid Expectations Despite Short-Term Cost Headwinds

Mercado Libre (February 24, 2025): MELI 4Q24: Strong Results, While Leverage Remains Stable Amid Higher Debt

Vista Energy (February 19, 2025): Vista Energy: Strong Reserves Growth Continues

Suzano (February 14, 2025): Suzano 4Q24: 2031s & 2032s Offer Value as Fundamentals Strengthen.

Cemex (February 7, 2025): Cemex 4Q24: A Solid EM Credit, But Tariff Overhang Limits Near-Term Potential.

Cemex & Pemex (February 5, 2025): U.S. Tariffs and Their Potential Impact on Cemex and Pemex.

Pemex (January 31, 2025): Lack of Concrete Action Weights on the Outperform Thesis.

Suzano (January 30, 2025) Initiation coverage report.

YPF (January 8, 2025): Recommendation on YPF's new USD 9NC4 unsecured

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.