Market Snapshot

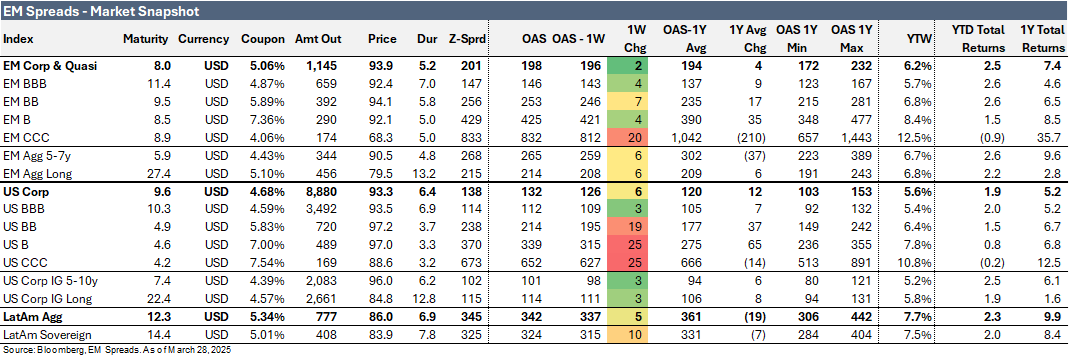

The LatAm Aggregate Index widened by 5 bps to 342 bps in the week ending Friday, March 28, 2025. The broader Emerging Market Index increased by 2 bps to 198 bps, while the U.S. Aggregate Index also widened by 6 bps to 132 bps. Notably, the US B and US CCC Indices posted the largest increases, rising by 25 bps to 339 bps and 652 bps, respectively. The EM CCC Index also widened, increasing by 20 bps to 805 bps.

Equity markets in the region showed mixed performances. Argentina's Merval Index decreased 2.3%, Brazil's Ibovespa Index declined 0.3%, while Mexico's Mexbol Index rise 1.0%. In the U.S., the S&P 500 Index was down 1.5% for the week.

In commodities, WTI crude oil traded at $69.4 per barrel (+1.6% weekly), while Brent crude settled at $73.6 per barrel (+2.0%).

Turning to bond yields, U.S. Treasuries saw mixed performances. The 10-year yield remained stable at 4.25%, while the 5-year yield declined by 2 bps to 3.98%. In Latin America, the yield on the 10-year Mexican government bond increased 2 bps to 6.27%, the 10-year Brazilian government bond rise 4 bps to 6.56%, while the 10-year Argentine government bond increased 10 bps to 11.41% over the week.

Argentina’s $20 Billion IMF Deal Could Calm Markets Ahead of Midterms

Argentina’s Economy Minister Luis Caputo announced that the government is finalizing a new $20 billion agreement with the International Monetary Fund (IMF), aimed at shoring up central bank reserves and easing investor concerns. While the IMF executive board’s approval may take several weeks, the announcement provides a degree of near-term relief to financial markets rattled by recent volatility and speculation.

The fresh funds are expected to support President Javier Milei’s economic stabilization plan, including efforts to gradually remove capital controls and restore market access. Although full disbursement details are still pending, investors will closely track how much of the $20 billion becomes available immediately. Analysts estimate that between $8.5 billion and $10 billion is required to maintain Argentina’s gross reserves through the October midterm elections.

Caputo also noted that the IMF program, combined with support from the Inter-American Development Bank and CAF, would nearly double Argentina’s central bank reserves from $26.2 billion to close to $50 billion. The central bank recently spent $737 million, roughly 2.7% of total reserves, over the past week in a bid to defend the peso amid ongoing speculation around the IMF deal.

Despite the announcement, significant risks remain. The Milei administration faces a delicate policy mix: keeping capital controls in place to manage currency pressures, stabilizing inflation to preserve political support, and rebuilding enough reserves to support macroeconomic stability. Businesses and investors alike will continue to weigh those risks ahead of October’s key vote.

EM Spreads comment: While the upcoming IMF deal marks a critical step in Milei’s reform agenda, the ultimate impact will depend on the structure of disbursements, the pace of policy implementation, and political stability heading into midterms.

Weekly News

Pemex Monthly Report: February

On March 27, 2025, we published our Pemex monthly report.

In February 2025, Pemex's crude oil exports rebounded 33.0% MoM to 710 bpd, driven by stronger shipments to the U.S. (60% share), mainly of Maya heavy crude. However, exports remained 24.6% lower YoY. The recovery followed a sharp 43.9% YoY drop in January due to crude quality issues, which have since been resolved, according to President Sheinbaum.

Pemex is seeking to diversify export markets, including to Asia and Europe, amid potential U.S. trade risks. On the production side, crude and condensate output rose 0.5% MoM but declined 10.5% YoY due to field depletion. Refining also faced setbacks: the new Olmeca refinery processed just 6,797 bpd after zero output in January, while total domestic refining edged up 0.8% MoM to 898 bpd, still down 4% YoY. Pemex aims to sustain 1.8 million bpd production during Sheinbaum’s term, with a focus on domestic processing to meet local fuel demand.

Our Take and Recommendation

The February rebound in Pemex's crude exports offers some relief following January's dismal performance, but the YoY decline underscores persistent operational and structural issues. While the resolution of crude quality problems may help stabilize export volumes, the company’s overexposure to the U.S. market, which accounts for over 60% of total exports, remains a vulnerability amid geopolitical and trade uncertainties. Efforts to diversify export destinations are prudent but likely to take time to materialize. On the production front, the marginal MoM increase masks a broader downward trend driven by field depletion, highlighting the urgency of upstream investment. Refining performance continues to lag expectations, particularly at the Olmeca facility, casting doubt on Pemex’s ability to meet its self-sufficiency goals. The partial repayment of supplier debt is a positive signal, but the company’s overall financial profile remains stretched, with high debt levels and weak free cash flow.

We note that while Pemex’s bonds offer an attractive carry, we do not find them compelling given the deteriorating operating and credit metrics, with current production levels likely to pressure 1Q25 results and the absence of a clear financial plan. However, we view the government’s recent steps to address debt owed to suppliers and contractors as a constructive development. What we think would be supportive of the credit is further indication that the federal government is issuing debt to buy back Pemex bonds, but doing so in a way that results in a net reduction of Pemex’s bond debt and interest costs. Additionally, we think Mexico overall, and Pemex in particular, are significantly exposed to potential U.S. tariffs, which would have a meaningful impact on the company. Therefore, if Mexico manages to clearly avoid U.S. tariffs, that would be a positive for the credit.

Minerva Positioned to Benefit from China’s Shift in Protein Imports

Minerva stands out as a prime beneficiary of recent trade tensions between the U.S. and China, as Beijing imposes new import tariffs on U.S. poultry, beef, and pork, while delaying or denying hundreds of U.S. protein export permits. These developments are shifting global protein trade flows, particularly in beef, toward South America and Australia, where Minerva is well-positioned to gain market share.

China’s 10% beef import tariff and uncertainty around U.S. export licenses could create significant short-term supply gaps. With Brazil, Argentina, and Uruguay already accounting for more than 75% of China’s beef imports in 2024, Minerva, which sources over 90% of its production from Latin America and generates around 60% of revenue from exports, is poised to capitalize.

EM Spreads Comment: We think Minerva remains the cleanest way to play the Chinese beef import story in Latin America. Its cross-border slaughtering and export-oriented model allow it to arbitrage cattle availability and price differences across Brazil, Argentina, Uruguay, Paraguay, and Colombia. China remains one of its largest destination, accounting for 12% of 4Q24 beef exports. With the pending acquisition of Marfrig’s assets expected to consolidate Minerva’s leadership in the region, we believe stronger Chinese demand and a tighter U.S. supply outlook could support earnings momentum in 2025.

Minerva’s geographic diversification across key South American cattle-producing countries, combined with its long-standing export relationships with China, provides it with the flexibility and resilience to adapt quickly to shifting demand. This is especially relevant as the company prepares to integrate Marfrig’s regional operations, which could add scale and expand its export reach.

Cemex: Stable Outlook Affirmed Despite Hybrid Reclassification Dragging Metrics

On March 28, 2025, S&P Global affirmed its ‘BBB-’ issuer credit rating and stable outlook on Cemex (Baa3/BBB-/BBB-) despite revising the equity treatment of the company’s $2 billion hybrid bonds following updated criteria. The decision strips the instruments of their previous “intermediate” equity content due to a sliding step-up feature, effectively increasing S&P-adjusted net debt by $1 billion and pressuring Cemex’s credit metrics for 2025.

S&P now expects adjusted debt to EBITDA to reach 2.8x and FFO to debt to decline to 23.6% in 2025, around 0.3x higher and 3.4% lower, respectively, than the prior review. Still, both remain comfortably within the 3.0x and 20% thresholds required to maintain the rating. S&P emphasized Cemex’s prudent financial policy and commitment to preserving investment grade through the cycle. Cemex’s 2025 EBITDA is forecast to remain broadly stable at $3.2 billion on slightly weaker revenue of $16.1 billion (-1% YoY), reflecting lower volumes in Mexico, softness in the U.S., modest recovery in EMEA, and limited pricing power in dollar terms. Margin expansion will be supported by operating efficiencies, higher local-currency prices, and ongoing cost savings.

Strong cash flow generation remains a key credit strength. S&P projects operating cash flow of $2.1 billion and FOCF near $1.0 billion in 2025, with $120 million earmarked for dividends. The agency expects Cemex to prioritize balance sheet strength and quickly scale back investments or returns to shareholders if needed.

Upside to the rating remains constrained for now but could materialize if Cemex demonstrates sustained deleveraging (adjusted debt to EBITDA <2.5x), stronger FFO to debt (>30%) and consistent FOCF to debt above 15%, supported by solid demand and stable liquidity.

YPF Launches “Vaca Muerta Institute” to Support Shale Growth

YPF is doubling down on long-term shale development with the creation of the “Vaca Muerta Institute,” a new technical training center in Neuquén designed to certify between 2,000 and 3,000 workers per year. The announcement comes as Argentina’s national oil company deepens its collaboration with CGC, following a $75 million deal granting CGC a 49% stake in the Aguada del Chañar block, with YPF retaining operatorship.

Speaking on local television, YPF President Horacio Marín framed the initiative as essential for Argentina’s energy future. “If we’re going to double production, we’ll generate 25,000 jobs. We need people trained—not just for productivity, but to avoid accidents,” he said. The institute, led by the YPF Foundation, will offer hands-on instruction using actual drilling equipment, and aims to become a sector-wide standard for hiring and safety certification.

The move reflects YPF’s broader ambition to position Argentina as a competitive global shale player—one that can scale up safely and efficiently. While only TotalEnergies has formally signed onto the project so far, Marín expects full industry buy-in, including from service providers operating across Vaca Muerta.

The timing aligns with increasing interest in Argentina’s unconventional resources. CGC’s entry into Aguada del Chañar marks a further push by domestic and international players to tap into the Neuquén Basin’s vast reserves. By building institutional infrastructure alongside capital investment, YPF is laying the groundwork for more sustainable growth and local capacity building in the shale patch.

EM Spreads Comment: We view the establishment of the Vaca Muerta Institute as credit-neutral in the near term, but a constructive step for long-term industry development. If implemented effectively, it could improve safety, reduce downtime, and support execution as drilling activity intensifies across the basin.

See Also:

Pemex (March 27, 2025): Pemex Monthly Report: February

Minerva (March 23, 2025): Minerva 4Q24: Acquisition Outlook and Market Tailwinds Support Credit Upgrade

YPF (March 11, 2025): YPF 4Q24: Macro Tailwinds and Strategic Progress Offset a Weak Quarter

Pemex (March 5, 2025): PEMEX 4Q24: High Carry, But Risks Outweigh Rewards

Vista Energy (February 27, 2025):Vista Energy 4Q24: Solid Expectations Despite Short-Term Cost Headwinds

Mercado Libre (February 24, 2025): MELI 4Q24: Strong Results, While Leverage Remains Stable Amid Higher Debt

Vista Energy (February 19, 2025): Vista Energy: Strong Reserves Growth Continues

Suzano (February 14, 2025) Suzano 4Q24: 2031s & 2032s Offer Value as Fundamentals Strengthen

Cemex (February 7, 2025): Cemex 4Q24: A Solid EM Credit, But Tariff Overhang Limits Near-Term Potential.

Cemex & Pemex (February 5, 2025): U.S. Tariffs and Their Potential Impact on Cemex and Pemex.

Pemex (January 31, 2025): Lack of Concrete Action Weights on the Outperform Thesis.

Suzano (January 30, 2025) Initiation coverage report.

YPF (January 8, 2025): Recommendation on YPF's new USD 9NC4 unsecured notes.

Vista Energy (December 18, 2024): New issue snapshot.

YPF (December 3, 2024): Initiation coverage report.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.