Market Snapshot

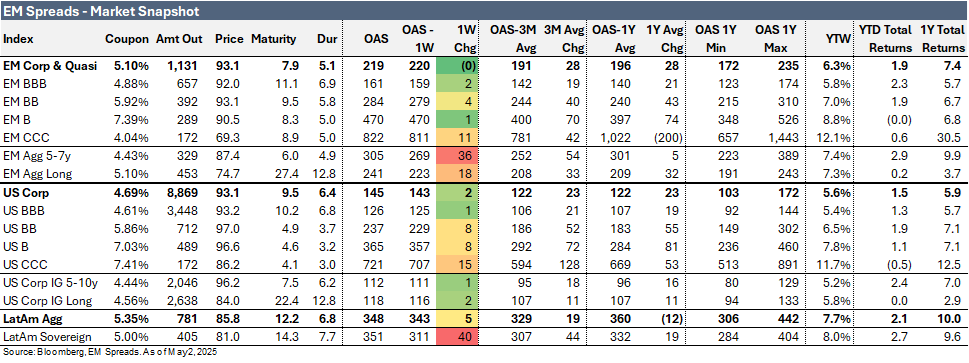

The LatAm Aggregate Index widened by 5 bps to 348 bps in the week ending Friday, May 2, 2025, and is now trading 19 bps above its 3-month average of 329 bps. The broader Emerging Market Index remained relatively stable at 219 bps, though this is 28 bps wider than its 3-month average of 191 bps. Meanwhile, the U.S. Aggregate Index widened by 2 bps to 145 bps, reflecting a 23 bps increase from its 3-month average of 122 bps. Notably, the LatAm Sovereign Index posted the largest spread move, widening 40 bps to 351 bps and trading 44 bps above its 3-month average.

Equity markets in the region posted mixed performances. Argentina’s Merval Index declined 5.6%, Brazil’s Ibovespa Index rose 0.3%, and Mexico’s Mexbol Index fell 1.6%. In the U.S., the S&P 500 Index advanced 2.9% for the week.

In commodities, WTI crude oil traded at $58.3 per barrel, down 7.5% on the week, while Brent crude settled at $61.3 per barrel, down 8.3%.

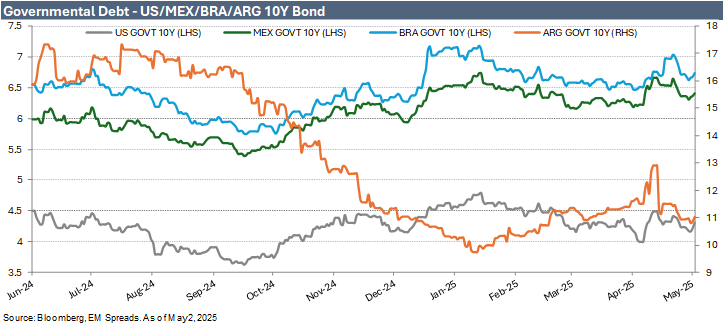

Turning to bond yields, U.S. Treasuries saw an increase across the curve. The 10-year yield rose 7 bps to 4.31%, while the 5-year yield increased 6 bps to 3.92%. In Latin America, the yield on the 10-year Mexican government bond rose 5 bps to 6.41%, the 10-year Brazilian government bond increased 2 bps to 6.74%, and the 10-year Argentine government bond widened 8 bps to 11.03%.

Weekly News

Cemex 1Q25: Credit Strength Persists, but No Catalyst for Spread Compression

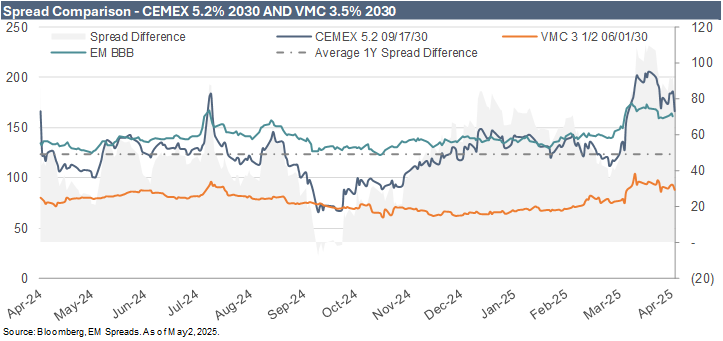

On April 29, 2025, we published our report on Cemex 1Q25 results.

Cemex reported weak 1Q25 results. Revenues totaled $3.65 billion, reflecting a 7.4% YoY decline (l-t-l: -1% YoY), missing consensus expectations by 1.2%, primarily due to top-line deterioration in Mexico (down 25.3%) and the US (down 3.5%), partially offset by improvements in EMEA (up 2.3%) and SCAC (up 2.5%). The company generated adjusted EBITDA of $601 million in the quarter, reflecting declines of 11.7% QoQ and 17.7% YoY (l-t-l: -10%), missing consensus expectations by 3.3%. The EBITDA margin contracted to 16.5% in 1Q25 from 17.9% in 4Q24 and from 18.5% in 1Q24. The margin was supported by higher prices and lower energy and freight costs, offset by the impact of lower volumes, higher labor costs, and maintenance work. Cemex reaffirmed its guidance for flat EBITDA in 2025 despite the soft quarter, supported by cost-cutting initiatives targeting $150 million in EBITDA savings and improving trends expected in the second half of the year.

From a credit perspective, the results reflected a 4.1% sequential decline in LTM EBITDA, which was mostly offset by a 3.2% decrease in net debt and a 4.9% reduction in LTM interest paid. Consequently, gross leverage increased modestly by 0.1x to 2.9x, net leverage remained stable at 2.5x, and EBITDA coverage improved by 0.0.x to 4.3x as of March 2025. FFO to debt also showed modest improvement, increasing by 0.1 pp to 17.6% as of March 2025.

Weaker EBITDA and significantly higher expansion capex weighed on cash generation, offsetting the benefit of lower interest paid and taxes, and resulting in a net free cash outflow of $473 million in 1Q25. Including “other net” items, adjusted free cash flow was an outflow of $610 million in the quarter. However, after accounting for the $862 million inflow from asset sales, the company generated $252 million, which led to net debt reduction and relatively stable leverage metrics.

We continue to view Cemex as an attractive and resilient Latam credit, with a focus on profitability and deleveraging, supported by a management team that appears committed to maintaining healthy credit metrics, reducing debt, and improving free cash flow generation. However, we maintain our Market Perform recommendation, as we do not expect clear outperformance given the challenging outlook in the company’s two main markets, Mexico and the US, where volume demand is being affected by post-election dynamics in Mexico and weather-related issues in the US.

Pemex 1Q25: Upgraded to Market Perform, but Structural Risks Persist

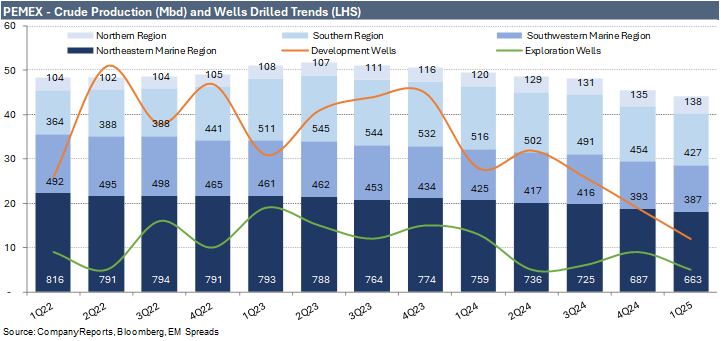

On May 1, 2025, we published our report on Pemex 1Q25 results.

Pemex reported mixed 1Q25 results. The company’s top line declined 11.0% QoQ and 19.0% YoY to $19.35 billion, primarily due to ongoing production declines, lower sales volumes, and weaker pricing. However, a significant reduction in costs led to adjusted EBITDA reaching $6.08 billion in the quarter, marking a substantial sequential increase from a recent low of $726 million in 4Q24 and an 11.7% YoY improvement. The adjusted EBITDA margin expanded by 28.1 pp QoQ and 8.7 pp YoY to 31.4%. Despite this improvement in operating profitability, production continues to deteriorate. In 1Q25, Pemex’s oil and condensate production averaged 1,596 kbpd excluding partners, down 3.4% QoQ and 11.3% YoY. Including partners, total production reached 1,621 kbpd, reflecting a 3.4% QoQ and 11.4% YoY decline.

From a credit perspective, the results were marked by a 4.6% QoQ increase in LTM EBITDA and a 3.3% decline in LTM cash interest paid, while gross and net debt decreased by 5.5% and 1.2%, respectively. Free cash flow was an outflow of $471 million in 1Q25, as higher EBITDA was insufficient to cover increased capex and interest paid. However, net cash generation turned positive sequentially, driven mainly by governmental contributions and tax benefits. This underscores Pemex’s vulnerability and continued reliance on government support. As a result, gross leverage increased modestly QoQ to 7.1x from 7.0x, while net leverage improved to 6.4x from 6.6x, and interest coverage rose by 0.1x sequentially to 1.8x as of March 2025. Liquidity remained weak, with short-term debt representing over 300% of the company’s cash and short-term investments.

Pemex’s 10-year bonds offer an attractive carry, with hard-to-ignore spread levels currently at 637 bps. We remain concerned about the deterioration in operating and credit metrics, including ongoing production declines and the absence of a clear financial plan. The company’s debt service capacity continues to depend heavily on governmental support, while oil price trends remain unfavorable. However, Pemex demonstrated some ability to reduce costs and improve profitability, while government support remained strong through contributions and tax benefits, reinforced by a clear political commitment and management’s stated intention to pursue credit-positive actions. Consequently, following the recent spread widening and a number of supportive developments, we no longer see Pemex underperforming relative to Mexican sovereign debt at current levels and upgrade the credit to Market Perform. In our view, current spreads already reflect the extent of government support, but meaningful compression will require tangible credit-positive measures.

YPF and Globant Sign Agreement to Modernize Supply Chain with AI

Buenos Aires, April 30, 2025 – In a strategic move to strengthen operational efficiency and competitiveness, YPF, Argentina’s state-controlled energy giant and the world’s largest shale oil operator outside the United States, signed a Memorandum of Understanding with Globant, a leading Argentine tech firm specializing in digital reinvention through AI and software development.

The agreement focuses on modernizing YPF’s complex supply chain, comprising over 5,000 suppliers and more than 100,000 products and services, by integrating advanced Artificial Intelligence and AI Agent technologies developed by Globant. The collaboration aims to implement an adaptive, expert-supervised model capable of optimizing procurement, automating decision-making, and ensuring full policy compliance.

“Efficiency is core to YPF’s competitiveness, and this partnership is part of our broader effort to become a global player,” said YPF CEO Horacio Marín. “Globant’s capabilities will help us gain real-time visibility and control over our entire value chain.”

Globant CEO Martín Migoya praised the partnership as both a challenge and a national achievement. “It’s a privilege to help modernize a company that’s over 100 years old and central to Argentina’s energy future, especially using AI developed in Argentina.”

EM Spreads take: This initiative marks a credit-positive step in YPF’s long-term transformation plan. While the deal does not alter near-term financials, it underscores management’s commitment to sustainable cost efficiency and digital modernization. Under its “Plan 4x4,” YPF aims to quadruple exports to $30 billion by 2030. We see technology-driven supply chain optimization as a necessary pillar to achieve that target and enhance YPF’s resilience in volatile market conditions.

See Also:

Pemex (May 1, 2025): Pemex 1Q25: Upgraded to Market Perform, but Structural Risks Persist

Cemex (April 29, 2025): Cemex 1Q25: Credit Strength Persists, but No Catalyst for Spread Compression

Vista Energy (April 25, 2025): Vista 1Q25: Strategic Petronas Acquisition Strengthens Credit and Growth Outlook

Vista Energy (April 17, 2025): Vista Energy Expands Vaca Muerta Footprint with Strategic Petronas Deal

Minerva (April 9, 2025): Minerva Announces Capital Increase Backed by Sponsors

Telecom Argentina (April 1, 2025): Initiation coverage report.

Pemex (March 27, 2025): Pemex Monthly Report: February

Minerva (March 23, 2025): Minerva 4Q24: Acquisition Outlook and Market Tailwinds Support Credit Upgrade

YPF (March 11, 2025): YPF 4Q24: Macro Tailwinds and Strategic Progress Offset a Weak Quarter

Pemex (March 5, 2025): PEMEX 4Q24: High Carry, But Risks Outweigh Rewards

Vista Energy (February 27, 2025):Vista Energy 4Q24: Solid Expectations Despite Short-Term Cost Headwinds

Mercado Libre (February 24, 2025): MELI 4Q24: Strong Results, While Leverage Remains Stable Amid Higher Debt

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.