Weekly News & Views

Argentina, Minerva, Pemex, Mercado Libre, Telecom Argentina

Market Snapshot

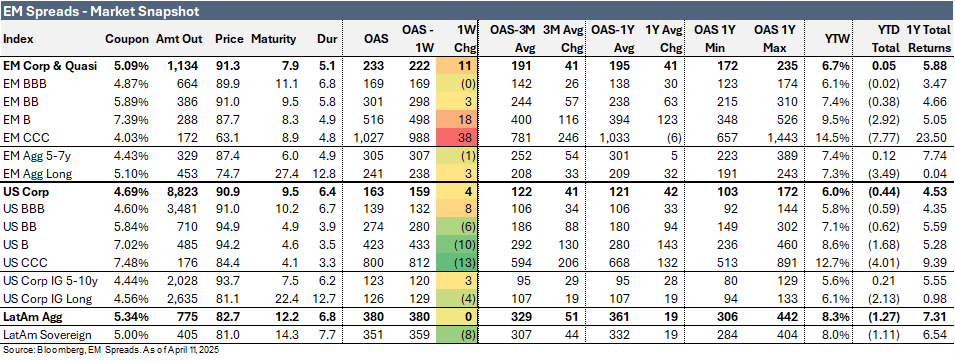

The LatAm Aggregate Index remained stable at 380 bps in the week ending Friday, April 11, 2025, however, it is trading 51 bps wider than its 3-month average of 329 bps. The broader Emerging Market Index increased by 11 bps to 233 bps, up 41 bps compared to its 3-month average, while the U.S. Aggregate Index widened by 4 bps to 163 bps, reflecting a 41 bps increase from its 3-month average of 122 bps. Notably, the US CCC Index posted the largest increase, rising by 38 bps to 1,027 bps, and is now trading 246 bps wider than its 3-month average.

Equity markets in the region posted positive performances. Argentina's Merval Index increased 6.7%, Brazil's Ibovespa Index rose 0.3%, and Mexico's Mexbol Index edged up 0.1%. In the U.S., the S&P 500 Index advanced 5.7% for the week.

In commodities, WTI crude oil traded at $61.5 per barrel (-0.8% weekly), while Brent crude settled at $64.8 per barrel (-1.3%).

Turning to bond yields, U.S. Treasuries saw mixed movements. The 10-year yield increased by 50 bps to 4.49%, while the 5-year yield rose 45 bps to 4.16%. In Latin America, the yield on the 10-year Mexican government bond increased 43 bps to 6.66%, the 10-year Brazilian government bond rose 24 bps to 6.75%, and the 10-year Argentine government bond surged 139 bps to 12.91% over the week.

Argentina Secures US$20bn IMF Deal with Currency Controls Eased

Argentina has reached a landmark agreement with the International Monetary Fund, securing a US$20 billion Extended Fund Facility that includes an unusually large initial disbursement of US$12 billion. In return, the government has committed to ending most currency controls and adopting a more flexible exchange rate regime.

Starting April 14, Argentina will shift to a managed float, allowing the peso to trade within a band of 1,000 to 1,400 per US dollar. The central bank will intervene to keep the peso within this range, with the band widening by 2% per month as the floor drops and the ceiling rises. This replaces the crawling peg system in place since early 2024.

Under the new agreement, the IMF will disburse another US$3 billion later this year, while Argentina expects an additional US$6.1 billion in loans from multilateral agencies in 2025 and a new US$2 billion central bank repo line. Despite this support, reserves will remain below the IMF’s estimated ideal for sustaining a fully free float, especially as US$12 billion in repayments from the previous 2022 deal begin coming due in 2026.

The shift aims to restore Argentina’s access to external capital, boost export competitiveness, and attract foreign direct investment. However, the strategy is not without risks. A sharp peso depreciation could reignite inflation, erode real incomes, and raise the burden of dollar-denominated debt. There is also concern that the central bank may lack sufficient reserves to support the band without undermining its credibility.

EM Spreads take: The IMF deal is a significant step forward in restoring macroeconomic order, but the road ahead remains complex. We view the combination of a large upfront disbursement and a shift to a managed float as pragmatic, though ultimately dependent on investor confidence and disciplined policy execution. From a credit perspective, easing FX controls and the gradual normalization of the currency regime could pave the way for improved access to capital markets over time. However, any delay in inflation stabilization or deviation from the agreed path could quickly erode gains.

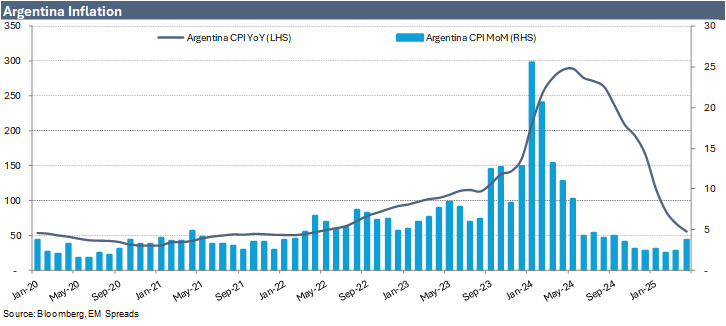

Argentina: March CPI Surprise Adds Pressure

Argentina’s March inflation data came in well above expectations, rising 3.7% MoM vs a consensus of 2.7%. The surprise was led by a 21.6% surge in education prices, but food, apparel, and services also accelerated, suggesting broad-based inflationary pressure. While YoY inflation eased to 55.9% from 66.9% due to base effects, the monthly reading points to rising price momentum.

The data raises questions about President Javier Milei’s strong-peso policy. The peso has only depreciated 1% per month since February, yet tradable goods prices rose 3.6%, up from 2.1% in February. Services inflation also picked up to 4.0%, and core inflation reaccelerated to 3.2% from 2.9%.

EM Spreads take: We see Argentina’s higher-than-expected March CPI print as a setback for the Milei administration’s disinflation narrative. The divergence between the slow peso crawl and still-elevated tradable goods inflation highlights the limitations of the current FX regime. However, the IMF's support and a more flexible exchange rate should improve market confidence.

Weekly News

Initiating Coverage on Telecom Argentina: Solid Market Position but Uncertain Outlook

On April 1, 2025, we published our Initiation report on Telecom Argentina.

We initiated coverage on Telecom with a Market Perform recommendation. We view the notes as fairly valued considering the uncertainty surrounding the potential acquisition of Telefónica. The transaction introduces near-term financial, regulatory, and operational risks, for which the company has not provided details, reflecting the complexity and scale of the deal. Additionally, the Milei administration continues to manage a complex policy mix that includes capital controls, inflation stabilization, and reserve accumulation ahead of the October 2025 mid-term elections. This contributes to elevated political and macroeconomic risk, which further compounds Telecom’s significant currency exposure. That said, improving macro indicators such as falling inflation, declining interest rates, and a stronger reserve position suggest a more supportive backdrop for investment and growth. We think this could help drive a recovery in ARPUs in USD terms and support Telecom’s network expansion plans. We believe Telecom is well-positioned to benefit from these trends but see a better entry point once there is greater clarity on the acquisition’s implications.

Telecom maintains a strong market position, supported by its broad service scale and integrated offerings, which enhance customer retention and operational efficiency. The repeal of Decree No. 690/20 has improved pricing flexibility, though regulatory pressures and competitive dynamics remain key challenges. Nationwide coverage contributes to revenue stability, but profitability continues to be constrained by high inflation and currency devaluation. Ongoing investment in fiber and 5G infrastructure, along with effective macro risk management, will be critical to preserving Telecom’s market leadership.

On February 24, 2025, Telecom Argentina announced the US$1.245 billion acquisition of 99.9% of Telefónica Móviles Argentina, aiming to strengthen its position as an integrated telecom provider. The deal was financed through a mix of debt assumption and loans totaling US$1.17 billion and could significantly expand Telecom's reach across mobile, broadband, and video services. Complete disclosures remain pending. However, on March 21, 2025, the government suspended the transaction due to antitrust concerns raised by the CNDC, which cited risks of excessive market concentration. Telecom has proposed remedies, including expanded MVNO access and infrastructure sharing, but regulatory uncertainty remains high.

Minerva Announces Capital increase Backed by Sponsors

On April 7th, 2025, Minerva announced that its Board of Directors approved a proposed capital increase of up to R$2 billion through the private subscription (limited to the current shareholder base) of up to 386.8 million new ordinary shares at R$5.17 per share. This price reflects the average of the last 60 trading sessions and represents a 19.7% discount from the April 7th closing price of R$6.44 per share. The proceeds are expected to be allocated entirely to debt repayments.

The proposal is subject to approval at the April 29th extraordinary shareholders’ meeting. Shareholders Salic International (31% stake) and VDQ Holdings (23%) have committed to ensuring that the minimum subscription of R$1 billion is reached. In addition to the capital increase, subscribers of the new shares will be granted a Subscription Bonus issued by Minerva at a ratio of 1 for every 2 shares subscribed. If fully exercised, this could raise an additional R$1 billion, with a strike price of R$5.17 per share to be exercised over the next 3 years.

EM Spreads take: We see the capital increase as a positive development that strengthens the company’s highly leveraged position while significantly easing pressure on cash generation by lowering elevated interest expenses as it manages integration costs from the recently acquired Marfrig assets. This additional liquidity provides greater confidence in Minerva’s deleveraging path forward, particularly in the current high-interest rate environment, which has remained a concern for investors since the acquisition was announced.

We calculate that the R$2 billion capital increase would reduce net leverage by 0.5x, bringing it down to around 4.4x as of December 2024, or 3.2x pro forma when including 12 months of EBITDA from the recently acquired Marfrig assets. Including the potential exercise of the warrants, the total R$3 billion capital increase could bring pro forma net leverage down further to 3.0x. According to Minerva, the debt reduction should result in around R$300 million in savings in financial expenses, translating into a meaningful improvement in free cash flow and supporting faster deleveraging.

We also view the level of sponsor support as positive. Commitments from controlling shareholders cover at least half of the base R$2 billion capital raise, with VDQ Holdings (23% stake) pledging R$700 million and SALIC (31% stake) committing R$300 million. Depending on the final subscription outcome, the founding family may increase its stake.

Pemex Credit Risk Driven More by Low Investment Than Tariffs, Says Moody’s

On Moody’s has warned that Mexico’s state oil company Pemex faces greater pressure on its credit profile from insufficient investment in crude production than from potential trade tariffs. According to the agency, the lack of upstream investment remains one of Pemex’s most significant intrinsic risks. Potentially, increasing fuel output at the Dos Bocas refinery will reduce Mexico’s reliance on US crude exports. However, this shift is expected to weigh further on Pemex’s dollar-denominated cash flow, given reduced crude volumes available for export.

Pemex currently produces 1.6 million barrels per day of crude and condensates, falling short of the government’s target of 1.8 million barrels per day set by President Claudia Sheinbaum. The administration has committed to an annual investment of US$16.9 billion for the company over the six-year term, citing environmental and energy policy objectives.

Despite government assurances of continued support, Pemex faces mounting financial stress. The company holds US$97.6 billion in debt, with over US$20 billion in 2025 and 2026, making it the most indebted oil company globally.

Moody’s also noted that any retaliatory tariffs from Mexico could pose additional risks for Pemex, which relies heavily on fuel imports to meet domestic demand. Currently, approximately 60 percent of gasoline and 50 percent of diesel consumed in Mexico is imported.

EM Spreads take: As we have been reporting, we agree that low investment in upstream production remains a pressing credit challenge for Pemex. While US trade actions could complicate matters, they are not the primary driver of Pemex’s weak dollar cash flows. The outlook hinges on the company’s ability to balance its growing refining ambitions with the need to stabilize production and reduce debt.

Relevant to readers: Pemex Monthly Report: February

Mercado Libre Expands Regional Footprint with $9 Billion in 2025 Investments Across Brazil, Argentina, and Chile.

MercadoLibre is ramping up its regional presence with a combined investment of nearly US$9 billion across Brazil, Argentina, and Chile in 2025, signaling strong confidence in Latin America's digital economy. The largest share of this investment, US$5.8 billion, will go to Brazil, where the company plans to boost spending by 48% in local currency, focusing on logistics, technology, and marketing. It also intends to hire 14,000 additional employees, increasing its Brazilian workforce to 50,000 by year-end.

In Argentina, the e-commerce giant will invest US$2.6 billion, a 53% increase from the prior year. Funds will be allocated to strengthening logistics, tech platforms, and marketing. MercadoLibre plans to add 2,000 employees in Argentina in 2025, lifting its local headcount to 14,000. CEO Marcelo de los Santos expressed optimism about the country's improving macro environment, highlighting 18% YoY growth in items sold during 4Q24.

Chile will also see a sizable increase, with a planned investment of US$550 million, up 18% from 2024. According to President Gabriel Boric, this will result in over 900 new formal jobs and have a direct impact on Chile’s economy.

EM Spreads take: MercadoLibre's 2025 investment plans, totaling nearly US$9 billion across Brazil, Argentina, and Chile, reinforce its dominant regional position and suggest confidence in macro stabilization across Latin America. While logistics and credit expansion could pressure margins, the scale of these investments underscores a long-term growth strategy. MELI’s healthy liquidity, solid leverage, and strong cash generation remain supportive.

See Also:

Telecom Argentina (April 1, 2025): Initiation coverage report.

Pemex (March 27, 2025): Pemex Monthly Report: February

Minerva (March 23, 2025): Minerva 4Q24: Acquisition Outlook and Market Tailwinds Support Credit Upgrade

YPF (March 11, 2025): YPF 4Q24: Macro Tailwinds and Strategic Progress Offset a Weak Quarter

Pemex (March 5, 2025): PEMEX 4Q24: High Carry, But Risks Outweigh Rewards

Vista Energy (February 27, 2025):Vista Energy 4Q24: Solid Expectations Despite Short-Term Cost Headwinds

Mercado Libre (February 24, 2025): MELI 4Q24: Strong Results, While Leverage Remains Stable Amid Higher Debt

Vista Energy (February 19, 2025): Vista Energy: Strong Reserves Growth Continues

Suzano (February 14, 2025) Suzano 4Q24: 2031s & 2032s Offer Value as Fundamentals Strengthen

Cemex (February 7, 2025): Cemex 4Q24: A Solid EM Credit, But Tariff Overhang Limits Near-Term Potential.

Cemex & Pemex (February 5, 2025): U.S. Tariffs and Their Potential Impact on Cemex and Pemex.

Pemex (January 31, 2025): Lack of Concrete Action Weights on the Outperform Thesis.

Suzano (January 30, 2025) Initiation coverage report.

YPF (January 8, 2025): Recommendation on YPF's new USD 9NC4 unsecured notes.

Vista Energy (December 18, 2024): New issue snapshot.

YPF (December 3, 2024): Initiation coverage report.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.