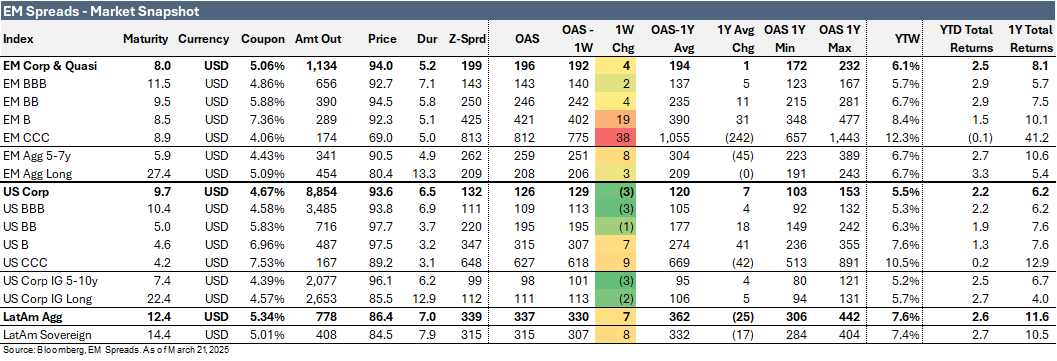

Market Snapshot

The LatAm Aggregate Index expanded by 7 bps to 337 bps in the week ending Friday, March 21, 2025. Meanwhile, the broader Emerging Market Index widened by 4 bps to 196 bps, while the broader U.S. Index also increased by 8 bps to 126 bps. Notably, the EM CCC Index widened significantly by 38 bps to 812 bps.

Equity markets in the region showed positive performances. Argentina's Merval Index improved 7.1%, Brazil's Ibovespa Index increased 6.8%, and Mexico's Mexbol Index rise 1.2%. In the U.S., the S&P 500 Index was up 1.2% for the week.

In commodities, WTI crude oil traded at $67.7 per barrel (+0.9% weekly), while Brent crude settled at $71.0 per barrel (+1.7%).

Turning to bond yields, U.S. Treasuries saw modest declines. The 10-year yield fell 7 bps to 4.25%, while the 5-year yield declined also by 7 bps to 4.00%. In Latin America, the yield on the 10-year Mexican government bond dropped 6 bps to 6.25%, the 10-year Brazilian government bond fell 7 bps to 6.52%, while the 10-year Argentine government bond increased 21 bps to 11.09% over the week.

Argentina 4Q24 GDP Beats Expectations, but Outlook Hinges on Policy and IMF Deal

Argentina’s economy surprised to the upside in 4Q24, with GDP growing 1.4% QoQ and 2.1% YoY, outperforming expectations. However, the full-year figure showed a 1.7% contraction, marking the sixth GDP decline in the past decade, underscoring the fragility of the recovery. The 4Q rebound was driven by stronger domestic demand, with investment jumping 11.3% QoQ and private consumption up 3.2%, despite continued weakness in public spending and construction.

External dynamics also supported the recovery. Exports rose 27.1% YoY, helped by a 54% peso devaluation, while imports climbed 12.9% QoQ on rising domestic demand. Ten of sixteen sectors grew YoY, with hospitality, financial intermediation, and mining leading gains. Construction, however, dropped 12.4% YoY due to stalled public infrastructure works. Looking ahead, 2025 GDP could grow 2.7% if the economy sustains its 4Q24 activity level. Still, the outlook remains highly contingent on policy stability, particularly progress in IMF negotiations and currency management.

In a key development this week, Argentina’s lower house of Congress approved President Javier Milei’s emergency decree authorizing the government to negotiate a new IMF agreement. The decree passed with 129 votes in favor and 108 against, bypassing further Senate debate. The move sparked protests outside Congress, reflecting growing public resistance to austerity, particularly recent changes to pension rules.

Despite the unrest, markets responded positively. The S&P Merval index rose 4.5% on the day of the vote, while sovereign bonds advanced 0.4%, signaling cautious optimism around the prospect of an IMF deal and macro stabilization.

EM Spreads Comment: Argentina’s stronger-than-expected 4Q24 GDP print came as a positive surprise. Fiscal-driven investment and consumption may provide near-term support, but policy uncertainty and ongoing IMF negotiations remain central to credit performance. Although markets welcomed Congressional approval of Milei’s decree, bond upside appears limited until there is greater clarity on FX policy, external financing, and social stability. That said, if progress continues with the IMF, we see room for further tightening in Argentina’s sovereign spreads.

Weekly News

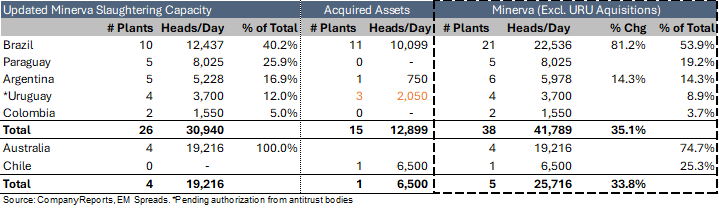

Minerva 4Q24: Acquisition Outlook and Market Tailwinds Support Credit Upgrade

On March 23, 2025, we published our report on Minerva 4Q24 results.

We upgrade Minerva to Outperform, reflecting greater confidence in the company’s deleveraging trajectory, supported by expected cash generation despite integration costs and higher interest expenses. Favorable market conditions for Brazilian beef exports in 2025 and meaningful synergies from the recently acquired assets reinforce our view. A clear focus on debt reduction, coupled with higher EBITDA, should support balance sheet improvement. Taken together, solid operational performance, favorable market dynamics, and rising volumes from the acquired assets should support outperformance in Minerva’s bonds over the next 9–12 months.

Minerva reported strong 4Q24 results, with revenue up 26.0% QoQ and 73.8% YoY to R$10.7 billion, beating expectations by 6.7%, driven by robust regional performance and initial contributions from acquired assets. Adjusted EBITDA rose 16.1% QoQ and 55.8% YoY to R$944 million, exceeding expectations by 20.9%, though the margin narrowed to 8.8%. Export momentum to NAFTA markets continued, with revenue share rising to 19% as the company capitalizes on U.S. supply-demand imbalances.

From a credit perspective, net debt increased by R$6.7 billion to R$15.7 billion, pushing net leverage to 5.0x as of December 2024, from 3.2x in September, following the acquisition of Marfrig’s assets. LTM EBITDA rose 12.1% sequentially to R$3.1 billion. On a pro forma basis, adjusting EBITDA to include expected contributions from the acquired assets, net leverage rises more modestly to 3.7x. Liquidity remains solid at R$14.5 billion, covering short-term debt by 2.8x and sufficient to meet all maturities through 2029.

YPF 4Q24: Macro Tailwinds and Strategic Progress Offset a Weak Quarter

On March 11, 2025, we published our report on YPF 4Q24 results.

We maintain our Outperform recommendation on YPF. In our view, improving macroeconomic conditions in Argentina should provide a supportive backdrop for the company’s operations. This, combined with the company’s strategic focus and progress on expanding unconventional, lower-cost production and investing in infrastructure, particularly export capacity, is expected to enhance YPF’s credit profile and drive outperformance in its bonds over the next 9–12 months.

YPF posted weak 4Q24 results. Adjusted EBITDA dropping 38.6% QoQ and 22.5% YoY to $839 million, missing consensus by 19.7%. The decline was driven by weaker Upstream performance amid lower crude prices ($65.7/b, -3.8% QoQ) and a 49.8% QoQ drop in seasonal natural gas sales, dragging Upstream EBITDA down 23.8% QoQ. The Gas & Power segment also struggled, with a 46.5% QoQ decline in natural gas sales causing EBITDA to plunge 75.1%. Despite a 10.3% QoQ revenue decline, cost of goods sold rose 2.1% and operating expenses surged 76.3%. Lifting costs reached $17.3/boe (+7.4% QoQ) partially due to inflation, though shale core hub costs fell 8.1% QoQ to $4.2/boe. Consequently, the adjusted EBITDA margin contracted 8.1 pp QoQ to 17.6%.

From a credit perspective. YPF’s results showed weakening fundamentals, with LTM EBITDA down 5.0% and total debt rising 4.6%, and a significant drop in LTM funds from operations. Gross leverage increased 0.2x QoQ to 2.1x as of December 2024, while net leverage worsened 0.1x to 1.8x, and cash interest coverage declined 0.2x to 4.2x. However, liquidity improved after the $1.1 billion issuance, which facilitated the repayment of YPF’s 2025 bonds, effectively reducing short-term debt and increasing cash on hand.

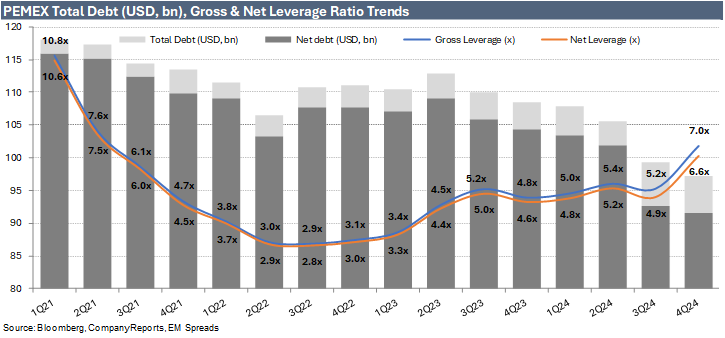

Pemex 4Q24: High Carry, But Risks Outweigh Rewards

On March 5, 2025, we published our report on Pemex 4Q24 results.

We downgrade Pemex to Underperform. In our view, the absence of a clear financial plan under the current circumstances significantly undermines Pemex’s management credibility in addressing its serious debt challenges. We note that while Pemex’s bonds offer an attractive carry, we do not find them compelling given the deteriorating operating and credit metrics, the lack of concrete actions to resolve its debt with suppliers and contractors, and the absence of a clear financial plan.

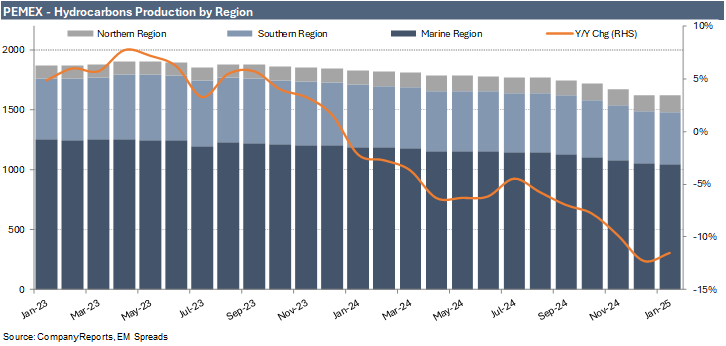

Pemex reported a very weak 4Q24, highlighting its vulnerability and heavy reliance on government support. Adjusted EBITDA plunged to $726 million, an 83.9% QoQ and 87.7% YoY decline, marking a recent low. The sharp drop was driven by significantly higher costs despite falling revenues (-3.5% QoQ, -10.4% YoY), with cost of sales and operating expenses rising, pushing EBIT negative to -$2.1 billion. The company failed to clearly explain these cost increases. Production volumes also declined, averaging 1,653 kbpd (-5.4% QoQ, -9.9% YoY), another recent low. As a result, the adjusted EBITDA margin fell sharply to 3.3% from 20.0% in 3Q24 and 24.3% in 4Q23.

From a credit perspective, results were marked by a 27.1% sequential decline in LTM adjusted EBITDA, while total debt decreased by $2.1 billion. Despite weak operating performance, net free cash flow remained manageable at an outflow of $934 million, supported by a $3.1 billion inflow from financial instruments, $3.0 billion in positive working capital, $299 million in government contributions, and lower capital expenditures, reinforcing Pemex’s heavy reliance on government support. However, significant taxes and profit-sharing payments further pressured cash generation despite Pemex’s outstanding obligations to suppliers. Gross leverage increased to 7.0x from 5.2x in the prior quarter, while net leverage rose to 6.6x from 4.9x. Liquidity remained weak, with short-term debt representing 365% of cash and short-term investments.

Sheinbaum Restructures Pemex to Strengthen State Control

March 19, 2025 – In a decisive move to consolidate state control over Mexico’s oil industry, President Claudia Sheinbaum has initiated a sweeping restructuring of Petróleos Mexicanos (Pemex). The reforms, implemented through new energy legislation signed on the 87th anniversary of Mexico's oil expropriation, eliminate Pemex’s subsidiary companies and emphasize vertical integration.

According to El Financiero, the restructuring will dissolve Pemex Transformación Industrial, Pemex Exploración y Producción, and Pemex Logística. Pemex Director General Víctor Rodríguez Padilla stated that the company is focused on reintegrating operations, improving budgetary control, and enhancing efficiency. While vertical integration is expected to cut costs, energy specialist Arturo Carranza cautioned that Pemex’s struggling refining business could negatively impact its exploration and production operations. The company continues to face daunting financial challenges, with nearly $100 billion in debt and approximately MXN506 billion ($25 billion) owed to suppliers and contractors.

To mitigate the supplier debt crisis, the Mexican government plans to allocate $6.4 billion in payments between March and April 2025, which represents around 25% of the total debt to suppliers. Rocío Abreu, chair of the Chamber of Deputies' Energy Commission, emphasized that small and medium-sized enterprises, particularly in states like Campeche, will be prioritized.

Pemex’s operational struggles have been compounded by declining oil production, which has fallen to nearly half its peak levels from two decades ago. However, Rodríguez Padilla pointed to recent successes, including three new discoveries with estimated reserves of 100 million barrels. Additionally, the company has improved its refining capacity, increasing distillate yields above 60% and producing higher-value fuels such as gasoline, diesel, and jet fuel.

Despite the government’s push for greater state control, private investment has not been entirely excluded. President Sheinbaum confirmed ongoing discussions with billionaire Carlos Slim regarding potential partnerships. Any such agreements, she clarified, would require Pemex board approval and include a 30% payment under the newly introduced ‘petroleum welfare rights’ framework. Slim has expressed interest in the Lakach deepwater gas project, though he acknowledged its significant technical challenges.

Sheinbaum has framed the restructuring as a corrective measure to past mismanagement, criticizing previous administrations for increasing Pemex’s debt burden despite favorable oil prices. Meanwhile, the Mexican Association of Energy has signaled its willingness to collaborate with the government to ensure regulatory stability and legal certainty for public-private investments in the energy sector.

EM Spreads Comment: Sheinbaum’s restructuring plan underscores the administration’s intent to consolidate control over the energy sector and reinforce Pemex’s role as a vertically integrated state operator. We think the elimination of subsidiaries could support tighter budgetary oversight and reduce redundancies, but the impact on efficiency and transparency remains uncertain. The MXN120 billion (~$6.4 billion) supplier payment program provides near-term liquidity relief, and recent operational gains in refining yields and upstream discoveries offer incremental support. Still, Pemex’s elevated leverage, continued E&P underperformance, and exposure to refining losses remain key concerns. While we view the administration’s openness to selective private investment, such as potential involvement in Lakach, as a constructive signal, the success of this policy reset will ultimately hinge on improved governance, execution, and financial discipline. We continue to monitor supplier payments, oil output trends, and board-level reform implementation.

CGC Partners with YPF to Develop Argentina's Vaca Muerta Shale Formation

Argentine energy company CGC announced on March 22, 2025, a strategic partnership with state-owned oil firm YPF to jointly develop the Aguada del Chañar area within the Vaca Muerta shale formation, one of the largest shale oil and gas reserves in the Americas. Under the agreement, YPF will retain a 51% operating stake, while CGC will hold the remaining 49% and provide capital for the project, though financial details were not disclosed.

CGC, a subsidiary of Corporación América, operates more than 60 energy projects, with a significant presence in Argentina’s Northwest and Neuquén basins, the latter home to Vaca Muerta. This new partnership adds to the companies’ existing collaboration on the Palermo Aike project in southern Argentina. The move underscores ongoing efforts to expand Argentina’s domestic energy output and strengthen its standing in the global energy sector by unlocking the potential of its vast unconventional hydrocarbon resources.

Argentina Suspends Telecom Argentina's Acquisition of Telefónica's Local Unit Amid Monopoly Concerns

On March 21, 2025, Argentina's presidential office announced a preventive suspension of Telecom Argentina's planned $1.245 billion acquisition of Telefónica's local unit, citing concerns over potential market monopolization. The decision follows a recommendation from the National Commission for the Defense of Competition, which highlighted that the merger could result in significant market concentration:

Mobile Telephony: 61% market share

Fixed-Line Services: 69% market share

Residential Internet: Up to 80% market share in certain regions

Telecom Argentina, partially owned by the Clarín Group, has expressed its commitment to continue investing in the country's telecommunications infrastructure, particularly in expanding 5G and fiber optic networks. The company stated it had not been formally notified of the suspension but would cooperate with authorities during the review process.

This suspension will remain in effect pending a more detailed analysis to ensure fair competition and prevent excessive market dominance in Argentina's telecommunications sector.

See Also:

Minerva (March 23, 2025): Minerva 4Q24: Acquisition Outlook and Market Tailwinds Support Credit Upgrade

YPF (March 11, 2025): YPF 4Q24: Macro Tailwinds and Strategic Progress Offset a Weak Quarter

Pemex (March 5, 2025): PEMEX 4Q24: High Carry, But Risks Outweigh Rewards

Vista Energy (February 27, 2025):Vista Energy 4Q24: Solid Expectations Despite Short-Term Cost Headwinds

Mercado Libre (February 24, 2025): MELI 4Q24: Strong Results, While Leverage Remains Stable Amid Higher Debt

Vista Energy (February 19, 2025): Vista Energy: Strong Reserves Growth Continues

Suzano (February 14, 2025) Suzano 4Q24: 2031s & 2032s Offer Value as Fundamentals Strengthen

Cemex (February 7, 2025): Cemex 4Q24: A Solid EM Credit, But Tariff Overhang Limits Near-Term Potential.

Cemex & Pemex (February 5, 2025): U.S. Tariffs and Their Potential Impact on Cemex and Pemex.

Pemex (January 31, 2025): Lack of Concrete Action Weights on the Outperform Thesis.

Suzano (January 30, 2025) Initiation coverage report.

YPF (January 8, 2025): Recommendation on YPF's new USD 9NC4 unsecured notes.

Vista Energy (December 18, 2024): New issue snapshot.

YPF (December 3, 2024): Initiation coverage report.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.