Weekly News & Views

Argentina, Vista Energy, Mercado Libre, Suzano, Cemex, Pemex

Market Snapshot

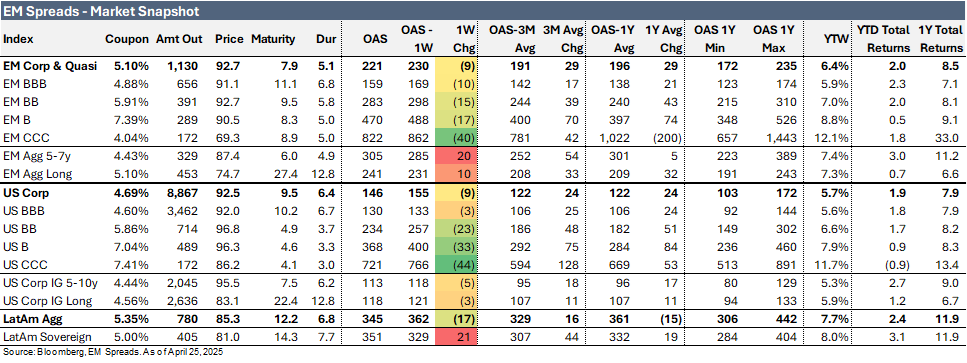

The LatAm Aggregate Index contracted by 17 bps to 345 bps in the week ending Friday, April 15, 2025, and it is now trading 16 bps wider than its 3-month average of 329 bps. The broader Emerging Market Index decreased by 9 bps too 221 bps, 29 bps higher that its 3-month average, while the U.S. Aggregate Index narrowed by 9 bps to 146 bps, reflecting a 24 bps increase from its 3-month average of 122 bps. Notably, the US CCC Index posted the largest spread decline, falling by 44 bps to 721 bps, and is now trading 128 bps wider than its 3-month average.

Equity markets in the region posted positive performances. Argentina's Merval Index increased 2.2%, Brazil's Ibovespa Index rose 3.9%, and Mexico's Mexbol Index increased 6.8%. In the U.S., the S&P 500 Index advanced 4.6% for the week.

In commodities, WTI crude oil traded at $63.0 per barrel (-2.6% weekly), while Brent crude settled at $66.9 per barrel (-1.6%).

Turning to bond yields, U.S. Treasuries saw yield reductions. The 10-year yield decreased by 9 bps to 4.24%, while the 5-year yield declined 8 bps to 3.86%. In Latin America, the yield on the 10-year Mexican government bond contracted 17 bps to 6.36%, the 10-year Brazilian government bond fell 25 bps to 6.72%, and the 10-year Argentine government bond was 57 bps lower to 10.95% over the week.

Argentina’s Economy Grows Above Expectations in February

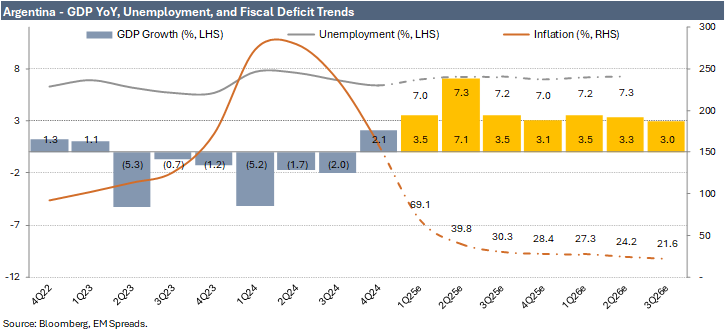

Argentina’s economy expanded 5.7% YoY in February 2025, surpassing the median forecast of 5.5% and reinforcing signs of recovery under President Javier Milei’s administration. On a sequential basis, economic activity increased 0.8% in February after a 0.6% improvement in January, according to government data released Tuesday.

The financial sector led growth, while the social services sector contracted. February’s outperformance follows two quarters of contraction in 2024, when Milei’s austerity measures weighed heavily on domestic activity. Since the second half of 2024, however, the economy has demonstrated greater resilience, supported by stronger exports, government spending, consumer demand, and capital expenditures.

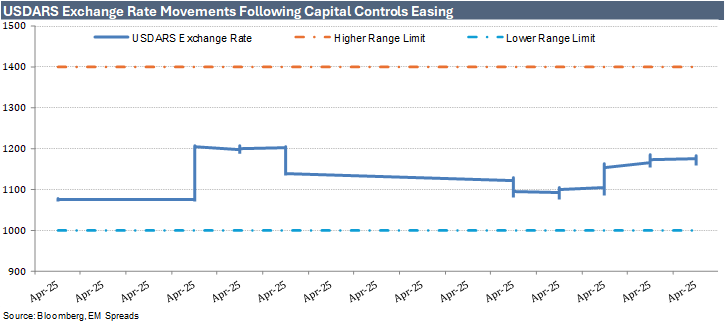

The recovery is occurring alongside sharp disinflation. Annual inflation cooled to 55.9% in March from a peak of 211% in December 2024, helped by Milei’s reforms and the easing of capital controls. The loosening of capital controls has contributed to a stronger FX market, narrower parallel exchange rate gaps, and renewed investor appetite for local assets, supporting improved market liquidity and lower sovereign spreads. The recent $20 billion IMF financing package, with $12 billion disbursed upfront, has further bolstered confidence by stabilizing reserves and easing FX restrictions without destabilizing the peso.

Looking ahead, economists surveyed by Argentina’s central bank expect the economy to grow 5% in 2025, reflecting growing optimism around the country's near-term prospects. Market consensus anticipates a strong rebound, with projected growth of 3.5% in 1Q25, 7.1% in 2Q25, and 3.5% in 3Q25. Despite the previous recession, unemployment has remained relatively stable, staying below 8% and projected to remain in the low-7% range in the coming quarters. Market expectations also point to quarterly inflation declining below 30% by the end of 4Q25 and to around 22% by 3Q26.

Weekly News

Vista 1Q25: Strategic Petronas Acquisition Strengthens Credit and Growth Outlook

On April 25, 2025, we published our report on Vista 1Q25 results.

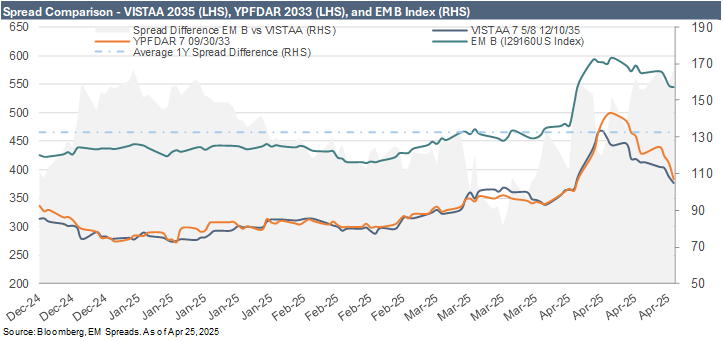

Vista reported 1Q25 results largely in line with expectations. The company generated an adjusted EBITDA of $275 million in the quarter, reflecting a 0.8% sequential improvement and modestly missing consensus expectations by 0.3%. The adjusted EBITDA margin expanded by 4.8 pp QoQ to 62.8%, primarily driven by higher realized prices and lower trucking volumes, representing a $14 million sequential reduction in selling expenses as the Oldelval expansion came online. Vista’s production declined 5.1% sequentially to 80.9 kbpd in 1Q25 as the company backloaded activity to optimize the use of the Oldelval pipeline expansion and minimize trucking. Financially, Vista maintains healthy credit metrics and a high EBITDA margin, supported by its low-cost production profile, while 78% of domestic volumes were sold at export parity-linked pricing, bringing the total share of oil volumes sold at export parity pricing to 90%.

From a credit perspective, the results reflected a 15.2% QoQ rise in Vista’s total debt balance, coupled with a 15.3% sequential increase in LTM interest payments, partially offset by a 5.0% sequential improvement in LTM EBITDA. Consequently, gross leverage increased modestly by 0.1x to 1.6x, net leverage worsened by 0.2x to 0.9x, and EBITDA coverage declined 0.9x to 9.0x as of March 2025. Nevertheless, credit metrics remain solid.

Petronas acquisition. Vista Energy announced the acquisition of 100% of Petronas E&P Argentina. We view the acquisition as a strategically sound move that aligns with Vista’s long-term growth strategy and materially enhances the company’s production profile, midstream capacity, and P1 reserves. The La Amarga Chica block has demonstrated consistent production growth at low operating costs, offering compelling growth potential. The transaction also improves Vista’s profitability and cash flow profile, with a pro forma EBITDA margin of 68%, and strengthens its portfolio of ready-to-drill locations in the core area of Vaca Muerta. The acquired assets are high-margin and low-breakeven, with meaningful potential synergies across existing operations. These synergies could help reduce capex requirements, which is particularly relevant in the current global macro and oil price environment.

While we expect capex needs and total debt to rise, the long-dated structure of the deferred payments, coupled with the equity contribution and the uplift in pro forma EBITDA to $1.81 billion, should provide sufficient flexibility to maintain credit metrics at manageable levels. We also view the acquisition as attractive from a valuation standpoint. Based on 2024 metrics, La Amarga Chica was acquired at 2.06x EV/EBITDA versus Vista’s 4.9x, and at 34.6x EV/kbpd compared to Vista’s 62.8x EV/kbpd.

Fitch Affirms Cemex at 'BBB-'; Stable Outlook Reflects Resilient Credit Profile

Fitch Ratings has affirmed Cemex’s Long-Term Foreign and Local Currency Issuer Default Ratings (IDRs) at 'BBB-' with a Stable Outlook, citing the company's solid liquidity, manageable leverage, and resilient business model amid macroeconomic headwinds. The ratings on Cemex’s senior unsecured notes were also affirmed at 'BBB-' while its hybrid subordinated issuance remains at 'BB'.

Fitch expects Cemex to maintain its net adjusted leverage between 2.0x and 2.5x over the next few years, supported by strong operating cash flows, disciplined capex management, and geographic diversification. Although 2025 is expected to be challenging, particularly in Mexico and the U.S., the company’s pricing strategy and operational efficiencies should help sustain free cash flow generation. Adjusted EBITDA is projected to range between USD2.7 billion and USD3.2 billion, with margins near 17% to 18%. Cemex continues to prioritize strategic growth through bolt-on acquisitions and targeted capex, allocating USD600 million out of a USD1.4 billion total budget to growth initiatives in 2025. It is also preparing to issue a new subordinated bond by year-end following the April redemption of a USD1 billion hybrid note.

Fitch highlights Cemex’s strong liquidity, backed by USD864 million in cash and undrawn credit facilities totaling USD2.3 billion, with no significant maturities until 2026. Cemex’s business remains well diversified across markets and products, with Mexico and the U.S. contributing a combined 74% of EBITDA in 2024. While a deterioration in U.S. or Mexican macro conditions, rising leverage above 2.5x, or lower pricing power could pressure the rating, stronger EBITDA performance and sustained leverage near 1.5x could lead to an upgrade.

EM Spreads take: We think Cemex’s affirmed rating reflects a balanced credit profile that continues to benefit from geographic diversification, stable cash flow generation, and financial discipline. While we acknowledge the near-term pressure on volumes in key markets, we view the company’s financial flexibility and strong liquidity position as key credit strengths. The disciplined approach to capex and leverage management supports our view that Cemex can navigate cyclical pressures while preserving investment-grade metrics.

Suzano Evaluates International Paper’s Pulp Assets

Suzano is reportedly evaluating the acquisition of International Paper’s (IP) North American pulp assets, according to sources cited by Valor. The potential transaction would align with Suzano’s strategy to expand its international footprint, although it could temporarily divert the company from its deleveraging path, as reiterated during its Investor Day and Q4 2024 earnings call.

The sale process follows IP’s October 2024 announcement of a strategic revision aimed at exiting its Global Cellulose Fibers (GCF) business to focus on sustainable packaging solutions. The GCF operations span three countries and consist of eight mills and two conversion facilities, with operations in the United States, Canada, and Poland. During its March 2025 Investor Day, IP guided for the GCF business to generate approximately USD2.5 billion in revenue and USD300 to 400 million in adjusted EBITDA.

While Suzano is among the companies reportedly considering the acquisition, along with Chile’s CMPC and Singapore-based Royal Golden Eagle (RGE), deal execution could be challenged by geopolitical uncertainties, including the recent imposition of tariffs on imports from Brazil and other countries.

A successful acquisition would mark another step in Suzano’s international expansion strategy. However, the company has emphasized its commitment to maintaining financial discipline and deleveraging, particularly after the strategic shift that followed its unsuccessful USD15 billion bid for International Paper in 2024. Suzano has since focused on smaller, scale-enhancing acquisitions, including the purchase of Kimberly-Clark’s Brazilian hygiene paper operations for USD175 million and selected assets from Pactiv Evergreen and Lenzing.

Suzano declined to comment on the matter.

EM Spreads take: We view Suzano’s potential acquisition of IP’s GCF assets as strategically consistent with its international growth objectives. However, given management’s reiterated focus on balance sheet strength and deleveraging, we believe any bid would require compelling operational synergies and financial accretion to justify a temporary pause in its deleveraging trajectory. Execution risks, including trade policy volatility, will also be important factors to monitor.

MercadoLibre CEO Sees U.S.-China Trade War as Major Opportunity

MercadoLibre CEO and founder Marcos Galperin believes the escalating U.S.-China trade tensions present a significant long-term opportunity for Latin America, particularly for countries like Mexico that are well positioned to benefit from supply chain shifts. Speaking at Riverwood Capital Management’s LatAm Tech Forum in Miami, Galperin said he expects a “permanent shift” in global trade dynamics, with Latin America playing an increasingly important role.

"If Latin America plays its cards well, I think it could benefit from this volatility," Galperin told CNBC. He highlighted that American companies have already begun relocating manufacturing operations from China to Mexico, leveraging Mexico’s free trade agreement with the U.S., which protects certain imports from steep tariffs. Meanwhile, U.S. trade policies have hit Chinese goods hardest, facing a 145% tariff. Shares of MercadoLibre, Latin America’s leading e-commerce and payments platform, have risen nearly 30% year-to-date, outperforming Amazon, whose stock is down 15% amid heavy tariff exposure.

Galperin also commented on the domestic situation in Argentina, praising President Javier Milei’s free-market reforms. Since taking office in late 2023, Milei has moved to eliminate tariffs and import restrictions, a stark reversal from Argentina’s traditionally protectionist stance. "I think what Milei is doing is great for Argentina," Galperin said, though he acknowledged that the reforms would come with near-term challenges. "Changes are painful, and I hope that people have the patience and the time to give him to see that these changes in the medium and long term really create benefits for everyone," he added. Galperin, Argentina’s richest person with an estimated fortune of USD8.7 billion, remains optimistic that both the regional and domestic policy shifts will drive long-term benefits for Latin America’s competitiveness in global trade.

EM Spreads take: We believe the structural shift in global trade dynamics presents a medium-term tailwind for MercadoLibre’s expansion and broader Latin American economic integration. While short-term volatility remains a risk, the combination of reshoring trends, Milei’s market-friendly reforms, and growing e-commerce penetration supports a constructive long-term outlook for MercadoLibre’s operating environment.

Pemex Rig Suspensions Highlight Ongoing Operational and Financial Risks

Pemex’s tight budgetary conditions have led to the suspension of four offshore drilling rigs operated by Grupo Mexico, company executives said during their 1Q25 earnings call. Discussions between Grupo Mexico and Pemex are ongoing, with expectations that the rigs could return to operation later this year, although no firm timeline has been provided.

The rig suspensions contributed to an 8.1% YoY decline in Grupo Mexico’s infrastructure sales in 1Q25 and underscore the broader operating challenges facing Pemex. We see this development as further evidence of Pemex’s constrained financial flexibility, amid continued reliance on government support and an absence of clear financial planning. While management remains focused on preserving upstream production levels, suspending drilling activities risks exacerbating Pemex’s structural production declines, particularly given the company’s heavy exposure to mature fields.

The situation follows a series of budget-related operational disruptions, including curtailed refinery runs at Tula earlier this year, highlighting Pemex’s persistent operational and financial vulnerabilities. Although management has reiterated its commitment to stabilizing operations, the company's weak liquidity position, mounting supplier debts, and dependence on external support continue to pose substantial risks.

EM Spreads take: We view the suspension of four offshore rigs as a clear signal of Pemex’s ongoing budgetary pressures and their operational consequences. While the expected reactivation of the rigs would provide some relief, the broader picture remains concerning. Pemex’s financial and operational flexibility remains limited, and its ability to stabilize production volumes without further interruptions appears uncertain. We maintain a cautious view on Pemex’s credit profile pending concrete actions to address these underlying challenges.

See Also:

Vista Energy (April 25, 2025): Vista 1Q25: Strategic Petronas Acquisition Strengthens Credit and Growth Outlook

Vista Energy (April 17, 2025): Vista Energy Expands Vaca Muerta Footprint with Strategic Petronas Deal

Minerva (April 9, 2025): Minerva Announces Capital Increase Backed by Sponsors

Telecom Argentina (April 1, 2025): Initiation coverage report.

Pemex (March 27, 2025): Pemex Monthly Report: February

Minerva (March 23, 2025): Minerva 4Q24: Acquisition Outlook and Market Tailwinds Support Credit Upgrade

YPF (March 11, 2025): YPF 4Q24: Macro Tailwinds and Strategic Progress Offset a Weak Quarter

Pemex (March 5, 2025): PEMEX 4Q24: High Carry, But Risks Outweigh Rewards

Vista Energy (February 27, 2025):Vista Energy 4Q24: Solid Expectations Despite Short-Term Cost Headwinds

Mercado Libre (February 24, 2025): MELI 4Q24: Strong Results, While Leverage Remains Stable Amid Higher Debt

Vista Energy (February 19, 2025): Vista Energy: Strong Reserves Growth Continues

Suzano (February 14, 2025) Suzano 4Q24: 2031s & 2032s Offer Value as Fundamentals Strengthen

Cemex (February 7, 2025): Cemex 4Q24: A Solid EM Credit, But Tariff Overhang Limits Near-Term Potential.

Cemex & Pemex (February 5, 2025): U.S. Tariffs and Their Potential Impact on Cemex and Pemex.

Pemex (January 31, 2025): Lack of Concrete Action Weights on the Outperform Thesis.

Suzano (January 30, 2025) Initiation coverage report.

YPF (January 8, 2025): Recommendation on YPF's new USD 9NC4 unsecured notes.

Vista Energy (December 18, 2024): New issue snapshot.

YPF (December 3, 2024): Initiation coverage report.

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.