Market Snapshot

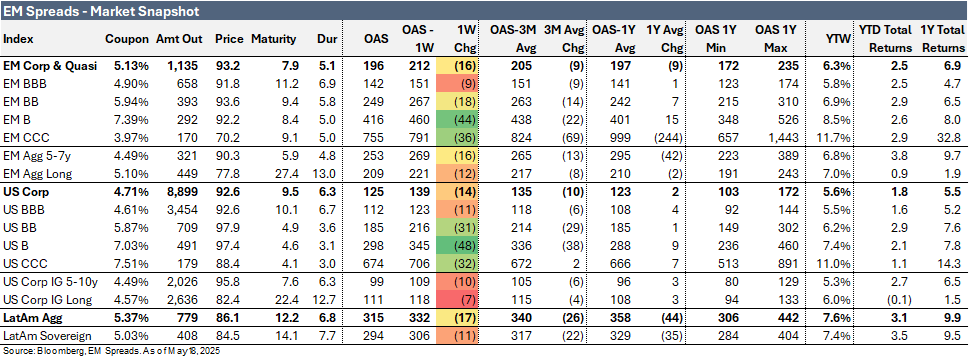

The LatAm Aggregate Index contracted by 17 bps to 315 bps in the week ending Friday, May 16, 2025, and is now trading 26 bps below its 3-month average of 340 bps. The broader Emerging Market Index decreased 16 bps to 196 bps, reflecting a 9 bps contraction from its 3-motnh average of 205 bps. Meanwhile, the U.S. Aggregate Index fell by 14 bps to 125 bps, and is now 10 bps below its 3-month average of 135 bps. Notably, the EM B and US B Indices contracted 44 bps and 48 bps, respectively, and are now trading 22 bps and 38 bps below their 3-month averages.

Equity markets in the region posted positive performances. Argentina’s Merval Index increased 9.6%, Brazil’s Ibovespa Index rose 2.0%, and Mexico’s Mexbol Index improved 2.5%. In the U.S., the S&P 500 Index advanced 5.3% for the week.

In commodities, WTI crude oil traded at $62.5 per barrel, up 2.4% on the week, while Brent crude settled at $65.4 per barrel, up 2.3%.

Turning to bond yields, U.S. Treasuries saw an increase across the curve. The 10-year yield rose 10 bps to 4.48%, while the 5-year yield increased 9 bps to 4.09%. In Latin America, the yield on the 10-year Mexican government bond decreased 3 bps to 6.36%, the 10-year Brazilian government bond declined 4 bps to 6.72%, and the 10-year Argentine government bond widened 7 bps to 10.81%.

Moody’s Downgrades U.S. Credit Rating to Aa1 on Worsening Fiscal Outlook

Moody’s Ratings downgraded the long-term issuer and senior unsecured ratings of the United States from Aaa to Aa1 on May 16, 2025, citing a decade-long deterioration in fiscal metrics. The outlook was revised to stable from negative, signaling no further near-term changes despite rising debt burdens.

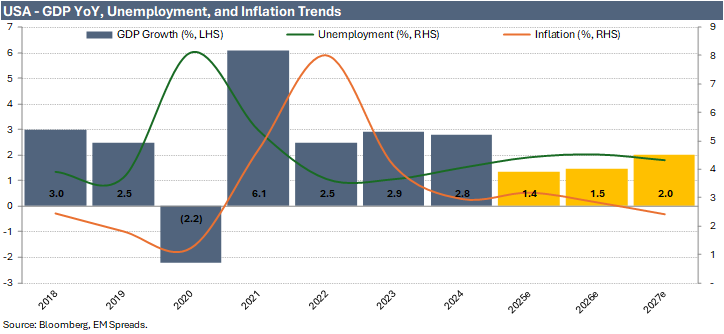

The one-notch downgrade reflects the U.S. government's persistent failure to address structural fiscal deficits and rising interest costs. Moody’s expects federal deficits to widen to nearly 9% of GDP by 2035, up from 6.4% in 2024, with the debt burden projected to surge to 134% of GDP from 98%. This path is driven by increasing entitlement spending and stagnant revenue growth, particularly if the 2017 tax cuts are extended, adding an estimated $4 trillion to deficits over the next decade.

Moody’s highlighted that interest payments are set to absorb 30% of federal revenue by 2035, a sharp increase from 18% in 2024 and just 9% in 2021, straining fiscal flexibility. Although U.S. Treasury assets continue to enjoy strong demand and the country retains unmatched economic scale and the global reserve currency, these strengths no longer fully offset weakening debt affordability and fiscal dynamics compared to other top-rated sovereigns.

Despite the downgrade, Moody’s affirmed the U.S.'s long-term country ceilings at Aaa, citing minimal risk of currency or balance of payment crises and strong policy institutions, notably the Federal Reserve’s independence and the resilience of U.S. governance frameworks. The stable outlook assumes no significant erosion in institutional strength or investor confidence in the U.S. dollar.

Moody’s indicated a future upgrade would require structural reforms to reverse fiscal deterioration, while further downgrades could occur if fiscal performance worsens significantly or institutional effectiveness weakens.

EM Spreads take: Moody’s downgrade underscores a structural fiscal unraveling that markets can no longer ignore. The federal deficit has grown significantly, and Moody’s projects it to approach 9% of GDP by 2035, driving debt to 134% of GDP from 98% in 2024. More concerning is the rising interest burden: interest payments are set to eclipse Medicare and defense outlays. Moody’s makes clear there is no credible path to reform, bluntly stating that “material multi-year reductions” in spending and deficits are unlikely under current policy proposals. This is not just a technical judgment, but an indictment of U.S. political functionality.

Moody’s also flagged "less foreign demand" for Treasurys as a rising risk, challenging the long-held assumption of infinite global appetite for U.S. debt. The refinancing wall is growing, while buyers are thinning. While we do not expect near-term disruption given institutional strength and the dollar’s entrenched role, the downgrade reinforces long-term risks.

Weekly News

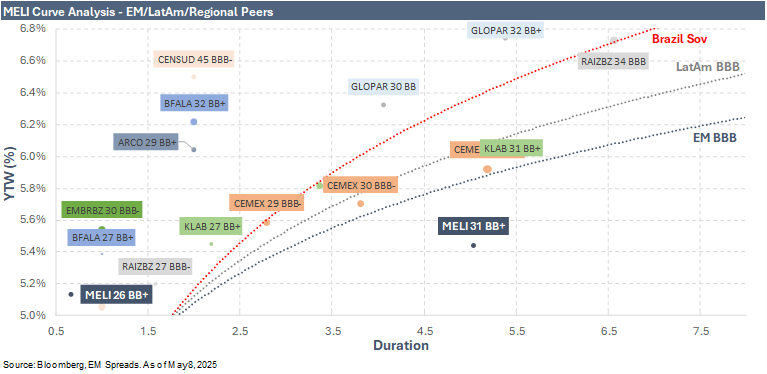

MELI 1Q25: Impressive Growth, Little Room for Further Spread Compression

On May 8, 2025, we published our report on MercadoLibre1Q25 results.

MercadoLibre reported another solid set of results in 1Q25. Revenues increased 37.0% YoY (FX-neutral up 64% YoY), supported by a 17.3% increase in GMV (FX-neutral up 40% YoY) and 43.2% growth in TPV (FX-neutral up 72% YoY). Healthy growth across key markets drove revenues 7.9% above market expectations, with both Commerce and Fintech posting strong YoY growth of 32.3% and 43.3% respectively. The highlight was the continued recovery and strong performance in Argentina, which generated $1.4 billion in revenues, reflecting a 124.7% YoY increase. We note that NIMAL declined sequentially to 22.7% in 1Q25, mostly due to a higher share of lower-NIMAL credit cards in the portfolio, which rose to 42% in 1Q25 from 32% in 1Q24. NPLs increased sequentially to 8.2% but remained within the same range observed over the past 12 months. The company generated adjusted EBITDA of $935 million in the quarter, up 37.1% YoY and exceeding consensus expectations by 16.2%. EBITDA margins remained stable and healthy at 15.8%.

From a credit perspective, the results were marked by a 12.8% sequential increase in total debt and a 35.7% increase in net debt, partially offset by a 7.8% improvement in LTM EBITDA. Operating cash flow was $1.0 billion in 1Q25, down 31.8% YoY, while capital expenditures increased 83.8% YoY, resulting in free operating cash flow of $759 million, down 44.4% YoY and 71.0% QoQ. Adjusted free cash flow was a $10 million outflow, down from $160 million in 1Q24 and $680 million in 4Q24. As a result, net debt increased by 0.2x to 0.8x as of March 2025, though it remains at very healthy levels. However, liquidity remained adequate but showed signs of deterioration, with total liquidity covering short-term debt by 1.1x. This coverage declined from 1.3x in December 2024 and 1.7x in March 2024, driven by a 25.5% QoQ increase in short-term debt.

We continue to view MELI as an attractive emerging market credit story and remain constructive on its financial and business risk profile. The company’s leadership in the Latin American e-commerce and fintech sectors positions it well to capture value and manage operational risks effectively. MELI benefits from a strong operating profile, solid geographic diversification across the region, and a healthy liquidity position supported by substantial cash generation. Given its competitive advantage, we remain optimistic about the company’s fundamentals and expect continued growth and positive operating performance, which should support further improvements in credit metrics.

YPF 1Q25: Margin Expansion and Strategic Progress Back Outperformance View

On May 11, 2025, we published our report on YPF 1Q25 results.

We maintain our Outperform recommendation on YPF (Caa1/B-/CCC), with a preference for the YPFDAR (Caa1/B-/CCC) 8.500% 2029s, YPFDAR 9.000% 2029s, YPFDAR 9.500% 2031s, and YPFDAR 8.250% 2034s.

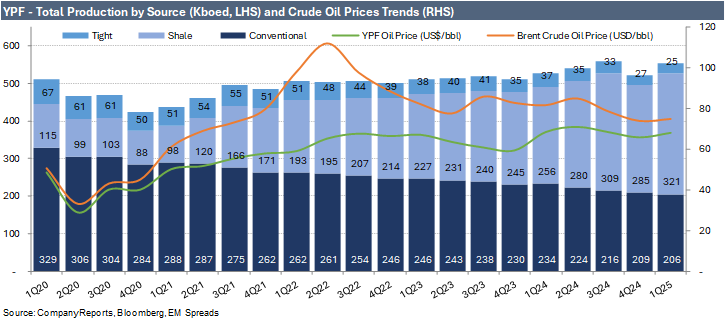

YPF reported solid operating results in 1Q25, with total production volumes increasing 6.1% sequentially, driven by higher unconventional oil production (up 6.0% QoQ) and unconventional natural gas production (up 12.6% QoQ). Revenues declined 3.0% QoQ, pressured by a 2.9% drop in Downstream revenues, although Upstream revenue improved 5.0% over the same period. Despite the revenue decline, adjusted EBITDA rose 48.8% QoQ, exceeding consensus expectations by 9.2%, with EBITDA margin expanding 9.4 percentage points following a weak 4Q24. The improvement was supported by higher fuel prices, with realized crude oil prices averaging $67.9/b in 1Q25, up 3.4% QoQ, along with a 28% QoQ increase in refining and marketing margins, which reached $14.3/b. Cost savings from the divestment of mature fields also contributed, helping reduce lifting costs to $15.3/boe in 1Q25, down 11.8% QoQ. The cost of sales declined 11.4% QoQ, outpacing the drop in revenues and supporting gross margin expansion. As a result, Upstream EBITDA increased 28.2% QoQ, while Downstream EBITDA jumped 35.8% QoQ.

From a credit perspective, the results reflected a 5.6% increase in total debt, a 10.0% increase in net debt, and a 2.1% rise in LTM interest paid compared to the previous quarter. At the same time, LTM adjusted EBITDA remained stable sequentially, and LTM funds from operations improved by 4.0% over the period. As a result, gross leverage increased 0.1x sequentially to 2.2x as of March 2025, net leverage worsened by 0.2x to 1.9x, and cash interest coverage declined 0.1x to 4.1x. Liquidity remains weak, with short-term debt representing 165% of its cash position, further pressured by continued negative free cash flow. However, YPF has maintained relatively stable access to international capital markets. We also note that management expects net leverage to return to the 1.5x to 1.6x range after the company completes the mature fields transaction, but also considering the annual average Brent of $75.5/b.

Additionally, Argentina’s improving macroeconomic environment supports a stronger sovereign credit profile. Rising U.S. dollar reserves and the recent easing of capital controls are enhancing credibility and bolstering confidence in the country’s ability to meet its debt obligations. In this context, we expect YPF to continue advancing its strategy of expanding lower cost unconventional production and investing in midstream infrastructure, while divesting from mature fields. Combined with reduced country risk, these efforts should drive outperformance in YPF bonds over the next 9 to 12 months.

Minerva 1Q25: Integration and Deleveraging Underpin Outperformance View

On May 14, 2025, we published our report on Minerva 1Q25 results.

We maintain our Outperform recommendation on Minerva (BB/BB), with a preference for the BEEFBZ 8.875% 2033 bonds, yielding 7.4% with a 4.5-year duration, as we find them more attractive than the BEEFBZ 4.375% 2031 bonds, which yield 6.9% with a 4.9-year duration

Minerva reported solid operating results in 1Q25, primarily driven by the ongoing integration of acquired assets from Marfrig. The company generated revenues of R$11.20 billion, reflecting a 4.5% QoQ and 55.8% YoY increase, but missing market expectations by 1.8%. The top line benefited from R$2.01 billion in revenue generated by newly acquired assets in Brazil and Argentina, which also contributed 79.0k tons in volume. Revenues were also supported by a 1.2% QoQ and 19.8% YoY increase in volumes sold to 415k tons, and a 3.0% QoQ and 29.5% YoY increase in average price to R$28.8/kg. This was mainly driven by a healthy domestic supply of raw materials and a favorable international environment that supported higher export prices. Adjusted EBITDA increased 2.0% QoQ and 53.1% YoY to R$963 million, but came in 1.9% below market expectations. The EBITDA margin contracted 21 bps QoQ and 15 bps YoY to 8.6% in the quarter. Management noted that the new assets were operating at EBITDA margins around 250 bps below consolidated levels, at approximately 6%, but improving sequentially.

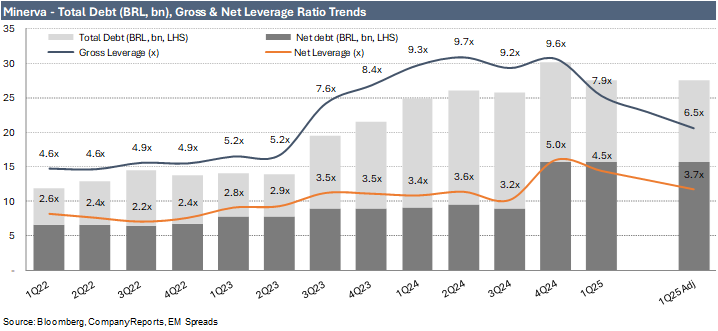

From a credit perspective, the results reflected a 10.7% increase in LTM EBITDA, an 8.8% reduction in total debt, and a 0.4% decrease in net debt, while LTM interest expense increased 3.0%. As a result, gross leverage decreased 1.7x sequentially to 7.9x as of March 2025, net leverage improved 0.5x QoQ to 4.5x, and interest expense coverage increased by 0.1x to 1.1x. Adjusting these metrics to include EBITDA generated from newly acquired assets, adjusted gross leverage improved 0.6x to 6.5x, adjusted net leverage remained stable at 3.7x, and adjusted interest expense coverage was unchanged at 1.4x. Minerva’s liquidity remained strong, with R$11.9 billion in total liquidity, covering short-term debt by 3.8x and sufficient to meet maturities through 2029. Despite improved EBITDA, significant interest expenses, capex, and working capital requirements kept cash generation negative. Management explained that working capital consumption was related to a tactical increase in inventories, aimed at boosting profitability.

We have a positive level of confidence in Minerva’s deleveraging path, supported by expected cash generation despite integration costs and higher interest expenses. A favorable international market environment, combined with a healthy domestic supply of raw materials, should further support Minerva’s operating performance in 2025. Our view is reinforced by the company’s clear commitment to deleveraging, reflected in an approved capital increase aimed at debt reduction and the stated intention to allocate future cash generation toward further deleveraging. While Minerva has a solid track record in asset integration, we will closely monitor the pace of ramp-up execution, which we see as a key factor underpinning our constructive outlook. We continue to see substantial value in the acquired assets, with meaningful synergies expected to support sustained EBITDA margin expansion. The company’s larger scale and improved diversification should further strengthen its overall credit profile. We believe these factors will support outperformance in Minerva’s bonds over the next 9–12 months.

Suzano 1Q25: Credit Metrics Improve Despite EBITDA Miss, Remain Outperform

On May 16, 2025, we published our report on Suzano 1Q25 results.

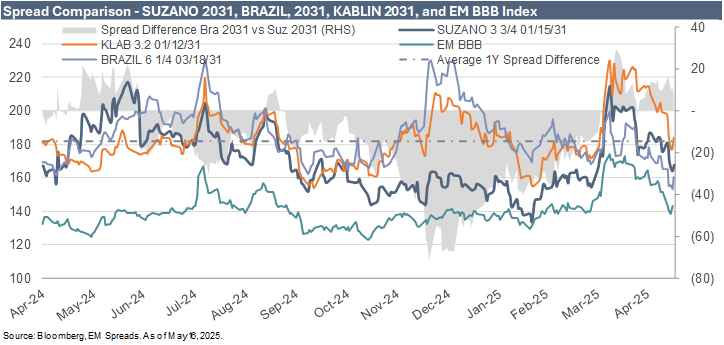

We maintain our Outperform recommendation on Suzano’s 2031s and 2032s, while keeping the rest of the curve at Market Perform.

Suzano delivered weak 1Q25 results with EBITDA margin contraction driven by higher costs. The company generated revenues of R$11.55 billion, reflecting an 18.5% sequential decline but a 22.1% YoY increase, missing market consensus by 3.6%. Pulp revenues decreased 23.1% QoQ but increased 17.0% YoY, while Paper revenues declined 1.3% sequentially but improved 40.1% YoY. The sequential deterioration was primarily caused by an 18.1% decrease in sales volumes to 3,041kt, with Pulp sales volume down 19.3% and Paper sales volume down 9.4%, largely due to seasonal factors and strategic inventory rebuilding. Average prices declined 0.5% QoQ, with Pulp prices down 4.7%, reflecting the invoicing of backlogs at lower price levels, partially offset by an 8.9% increase in Paper average prices.

Adjusted EBITDA was R$4.87 billion in 1Q25, representing a sequential decline of 24.9% but a YoY improvement of 6.8%, significantly missing consensus expectations by 15.0%. Pulp EBITDA decreased 25.8% QoQ but improved 9.0% YoY, while Paper EBITDA declined 18.6% QoQ and 6.7% YoY. The adjusted EBITDA margin contracted by 3.6 pp sequentially and 6.1 pp YoY to 42.1% in 1Q25, primarily pressured by an 8.2% increase in cash COGS per ton, reflecting higher wood and input costs, as well as the negative impact of concentrated maintenance downtimes on fixed costs.

From a credit perspective, the results were marked by a 1.3% increase in LTM adjusted EBITDA, a 9.7% reduction in total debt, and a 5.8% decrease in net debt. However, cash interest coverage was negatively affected by a 5.1% increase in LTM interest payments. As a result, gross leverage improved 0.5x sequentially to 4.1x, net leverage decreased 0.3x to 3.4x, but interest coverage worsened by 0.2x to 4.4x. Suzano’s liquidity remained strong, with R$24.15 billion in total liquidity, covering short-term debt by 5.6x and sufficient to meet its debt obligations through most of 2028. We note that management reiterated its priority of deleveraging, balancing shareholder returns with financial prudence. In 1Q25, Suzano limited share buybacks, focusing instead on not increasing net leverage.

We expect the combination of healthier pulp prices, higher sales volumes from the Ribas unit, normalized capital expenditures, lower costs, and a clear commitment to deleveraging to strengthen Suzano’s credit profile in 2025. This trend is likely to persist in the coming years, as no significant additional supply is projected to come online.

See Also:

Pemex (May 1, 2025): Pemex 1Q25: Upgraded to Market Perform, but Structural Risks Persist

Cemex (April 29, 2025): Cemex 1Q25: Credit Strength Persists, but No Catalyst for Spread Compression

Vista Energy (April 25, 2025): Vista 1Q25: Strategic Petronas Acquisition Strengthens Credit and Growth Outlook

Vista Energy (April 17, 2025): Vista Energy Expands Vaca Muerta Footprint with Strategic Petronas Deal

Minerva (April 9, 2025): Minerva Announces Capital Increase Backed by Sponsors

Telecom Argentina (April 1, 2025): Initiation coverage report.

Pemex (March 27, 2025): Pemex Monthly Report: February

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.