Weekly News & Views

Election risks hit Argentina, Suzano prices new 2036s, Pemex buyback underscores state backing, while Moody’s upgrade highlights sovereign support.

Market Snapshot

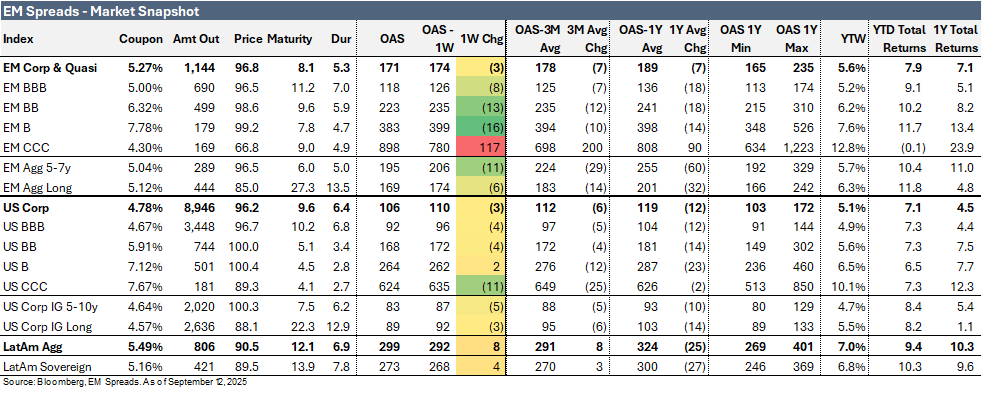

The LatAm Aggregate Index widened by 8 bps to 299 bps in the week ending Friday, September 12, 2025, and is now trading 8 bps below its 3-month average of 291 bps. The broader Emerging Market Index contracted 3 bps to 171 bps, 7 bps tighter than its 3-month average of 178 bps. Meanwhile, the U.S. Aggregate Index narrowed by 3 bps to 106 bps, 6 bps below its 1-year average of 112 bps.

Notably, the EM CCC Index widened by 117 bps to 898 bps and is now 200 bps above its 3-month average of 698 bps and 90 bps higher than its 1-year average of 808 bps. In contrast, the U.S. CCC Index contracted 11 bps to 624 bps, 25 bps tighter than its 3-month average of 649 bps. The EM CCC Index was primarily affected by the repricing of Argentine risk following the provincial elections.

Equity markets in the region posted mixed performance. Argentina’s Merval Index fell 19.6%, while Brazil’s Ibovespa increased 4.3% and Mexico’s Mexbol gained 6.2%. In the U.S., the S&P 500 Index rose 1.8% over the week.

In commodities, WTI crude closed at $62.7/b, down 2.0% on the week, while Brent settled at $67.0/b, up 0.2% over the same period.

Turning to bond yields, the 10-year U.S. Treasury yield contracted 22 bps to 4.06%, while the 5-year yield declined 18 bps to 3.63%. In Latin America, the 10-year Mexican government bond yield narrowed 26 bps to 5.61%, the Brazilian 10-year rose 18 bps to 6.11%, and Argentina’s 10-year jumped to 13.28% from 11.35%.

Weekly News

Argentina: Election Setback Highlights Elevated Political Risk

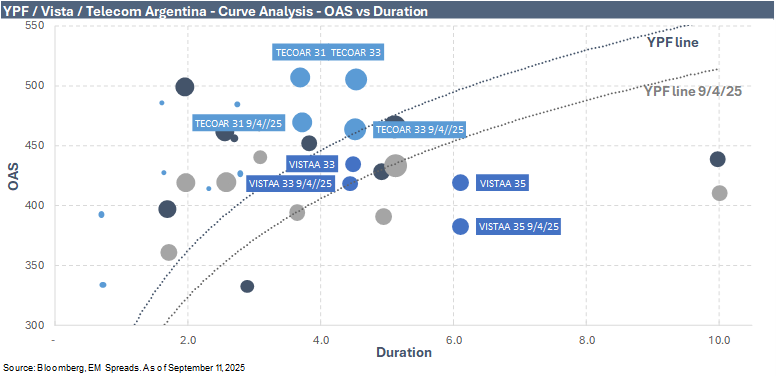

On September 7, 2025, President Javier Milei’s Libertad Avanza party suffered a heavy defeat in Buenos Aires provincial elections, losing to the Peronist opposition by nearly 14 points. The setback, coming a month ahead of congressional midterms, raised doubts about Milei’s political capacity to advance structural reforms. Axel Kicillof’s potential return to national politics also revives memories of his 2012 YPF expropriation, sovereign default, and currency controls. The loss underscores Milei’s weakened political capital heading into October’s midterms, where his ability to secure congressional support for fiscal and labor reforms will be tested. Investors are recalibrating expectations, with many viewing Kicillof’s rise as a signal that heightened political risk premia could persist.

We view Milei’s electoral defeat and the emergence of “Kicillof risk” as material headwinds for Argentine spreads in the near term, adding a premium to Argentine risk given heightened uncertainty around policy continuity, reform execution, and investor confidence. While the administration has delivered progress on disinflation and reserve accumulation, the political setback raises the risk of legislative gridlock and complicates Argentina’s ability to sustain reforms, particularly with $4 billion in maturities approaching in January 2026. The consolidation of Axel Kicillof’s leadership within Peronism further clouds the medium-term outlook, intensifying concerns about a potential populist resurgence in 2027.

As a result, markets reacted sharply on Monday. Argentina’s hard-currency bonds dropped up to 7 cents to around 55 cents on the dollar, pushing yields near 12.7% in the steepest decline in two years. The peso weakened to a new all-time low, sliding as much as 7% past ARS1,400 per USD, while the Merval equity index fell 13% in its worst single-day performance since 2020.

To access the full report, including our recommendations, click here.

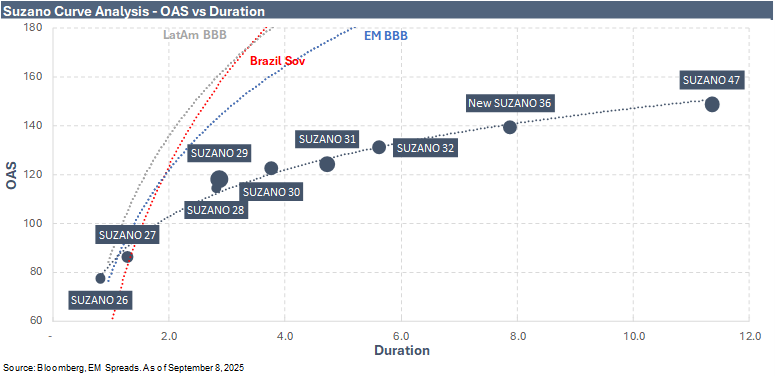

Suzano Priced US$1bn 5.500% 2036 Unsecured Notes

On September 3, 2025, Suzano Netherlands B.V., guaranteed by Suzano S.A., priced US$1 billion senior unsecured notes due January 2036 at 98.714 to yield 5.667%, equivalent to T+145bps. This came tighter than the +150bps guidance and well inside the +180bps initial price talk. The coupon was set at 5.500%, with semiannual payments beginning January 15, 2026. The bonds are rated Baa3/BBB-/BBB-.

The notes are governed by New York law and feature a make-whole call at T+25bps plus accrued and unpaid interest until October 15, 2035, after which a par call applies. They also include an 85% clean-up call provision. Gross proceeds totaled US$987.1 million (before fees and expenses). Proceeds will be used to repurchase Suzano’s 2026 and 2027 notes pursuant to ongoing tender offers, followed by potential make-whole redemptions, subject to market conditions.

We think the transaction reinforces Suzano’s proactive liability management and supports its credit trajectory. Pricing well inside IPT highlights strong demand for Suzano paper and favorable market access, consistent with the issuer’s solid position within the LatAm BBB peer group. The new 2036s extend the maturity profile and facilitate refinancing of nearer-term debt without increasing overall leverage. We note that while Suzano has pursued strategic M&A recently, including the Kimberly-Clark tissue assets, management remains committed to deleveraging, which should help contain balance sheet risks.

To access full report, including our recommendations, click here.

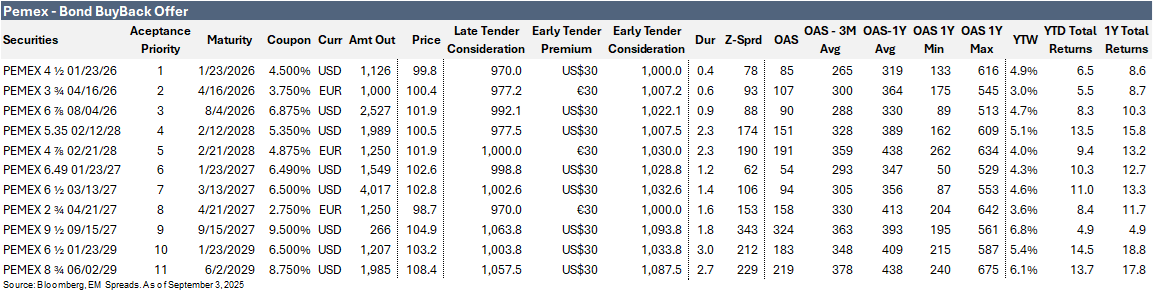

Pemex: Bond Buyback Offer Highlights Sovereign Support and Debt Relief

On September 2, 2025, Pemex announced the launch of a buyback offer of up to US$9.9 billion across 11 bonds. The program targets front-end maturities, specifically USD-denominated bonds due 2026–2029 and EUR-denominated bonds due 2026–2028. A priority framework will govern acceptance of tenders, beginning with the 4.500% 2026s, followed by the EUR 3.750% 2026s and the USD 6.875% 2026s. The offer includes an Early Tender Premium of 30 per 1,000, with withdrawal and early tender deadlines set for September 15 and final expiration on September 30.

Pemex may exercise an Early Settlement Right after the Early Tender Date, subject to conditions. Consideration will be paid in cash plus accrued interest, with proration applied if tenders exceed the cap. The buyback follows Mexico’s recently announced sovereign-backed financing to support Pemex, including the July–August issuance of pre-capitalized securities and related treasury-collateralized funding, which authorities have signaled will help cover 2025–2026 maturities.

To access full report, including our recommendations, click here.

YPF Advances LNG Push with New Partners Sought for $25bn Projects

YPF is in talks to add one or two new partners to its LNG ventures with Shell and Eni, CEO Horacio Marín confirmed at the Gastech conference in Milan. The projects, with an estimated cost of $25bn, aim to monetize Vaca Muerta shale gas with exports to Europe and Asia. YPF expects to complete technical studies by year-end, with Wison Group conducting engineering for Eni’s portion, and to secure financing starting in 2026. The company could hold a 25–30% equity stake, with the remainder funded through partners and a typical 70/30 debt–equity structure. First production is targeted for 2029–2030.

The LNG plan builds on YPF’s accelerated pivot to unconventional resources. The company has already divested 18 conventional blocks under its Mature Fields Exit Program, with two-thirds of its US$5bn 2025 capex directed toward shale. LNG exports would be a structural shift, moving Argentina from net importer to niche exporter, complementing recent upstream and midstream expansion.

MercadoLibre Fintech Momentum, CEO Transition, and New Growth Pilots

MercadoLibre CEO Marcos Galperin said at an event in Mexico City that Mercado Pago, the company’s fintech arm, is expanding faster than its core e-commerce business. Mexico country head David Geisen added that the local market is projected to grow 10% through year-end. Ariel Szarfsztejn, President of Commerce and incoming CEO from January, highlighted that AI developments are expected to reshape user interaction with the company’s platforms in as little as 2–3 years. Galperin stated he is handing over leadership at the “best moment” for the company as he moves into the chairman role.

Separately, CFO Martin de los Santos confirmed that MercadoLibre is testing pilot programs in pharma and food delivery. He said pharma is attractive given the high frequency of purchases despite its regulatory complexity, while food delivery could enhance ecosystem stickiness. These initiatives follow the company’s acquisition of a pharmacy in Brazil earlier this year, as reported locally.

Moody’s Upgrades Pemex to B1, Stable Outlook

On September 8, 2025, Moody’s Ratings upgraded Pemex’s Corporate Family Rating and senior unsecured ratings to B1 from B3, while affirming its Baseline Credit Assessment (BCA) at ca. The outlook was revised to Stable from “under review for upgrade.” Moody’s cited the Mexican government’s stronger commitment to supporting Pemex through its Strategic Plan 2025–2035, which includes equity-like contributions via the $12 billion P-CAP structure, an Investment Fund for upstream capex and suppliers, and a $9.9 billion debt tender backed by sovereign issuance.

Despite the uplift, Moody’s noted that Pemex continues to face structural challenges, including negative free cash flow, declining production, weak refining economics, and large cash requirements estimated at $7 billion annually in 2026–27. Liquidity remains thin, with $5.1 billion in cash and limited revolver capacity against heavy short-term obligations. The B1 rating reflects six notches of uplift from government support, assuming Very High default correlation and Very High probability of state backing, while the company’s standalone credit remains distressed.

Mexico – S&P Affirms ‘BBB’/‘BBB+’, Stable Outlook On Policy Prudence And Solid External Position

On September 8, 2025, S&P affirmed Mexico’s long-term foreign currency rating at BBB and local currency at BBB+ with a stable outlook, citing prudent monetary policy, moderate fiscal deficits ahead, and a solid external position; short-term ratings remain A-2 and the T&C assessment at A. The committee expects pragmatic management of U.S.–Mexico disputes and views sovereign support for Pemex and CFE as “almost certain,” keeping both aligned with the sovereign despite weaker standalone profiles. S&P projects net general government debt around 50% of GDP and interest near 15% of revenues in 2025, with the deficit narrowing toward 4% of GDP as fiscal consolidation resumes.

The decision lands alongside Banxico’s 25 bp cut in August to 7.75%, which supports a measured easing cycle as inflation moderates. S&P’s rationale underscores Mexico’s access to deep local markets, with most debt fixed-rate and long-tenor, and notes policy uncertainties from institutional reforms and contingent liabilities at state-owned energy firms. The reaffirmation follows fresh sovereign-backed support channels for Pemex, including the $12 billion P-CAP structure, reinforcing the agency’s view of extraordinary support.

See Also:

Argentina (September 11, 2025): Argentina: Election Setback Highlights Elevated Political Risk

Suzano (September 8, 2025): Suzano Priced US$1bn 5.500% 2036 Unsecured Notes

Pemex (September 3, 2025): Pemex: Bond Buyback Offer Highlights Sovereign Support and Debt Relief

Telecom (August 21, 2025): Telecom 2Q25: Neutral Amid Uncertainties While Upside Remains Limited

Suzano (August 19, 2025): Suzano 2Q25: Credit Resilient but Curve Positioning Shift

YPF (August 15, 2025: YPF 2Q25: Encouraging Strategic Progress Supports Overweight View

Minerva (August 12, 2025): Minerva 2Q25: Strong Results and Deleveraging Support Overweight Call

Mercado Libre (August 10, 2025): MELI 2Q25: Constructive on Growth Prospects, Limited Spread Compression

CSN (August 6, 2025): CSN 2Q25: Stable Credit Metrics and Attractive Carry Support Overweight

Gerdau (August 4, 2025): Gerdau 2Q25: Credit Resilience Supported by US Exposure

Pemex (July 31, 2025): Pemex 2Q25: Strong Government Backing Anchors Credit

Cemex (July 28, 2025): Cemex 2Q25: Resilient Credit Navigates Soft Results, but Tight Spreads Limit Upside

Market Commentary (July 16, 2025): U.S. Tariff Escalation: Credit Implications for Brazilian Companies in Our Coverage

Vista (July 14, 2025): Vista 2Q25: Results Reinforce Overweight, But Cash Burn and Liquidity Weaken Buffer

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.