Market Snapshot

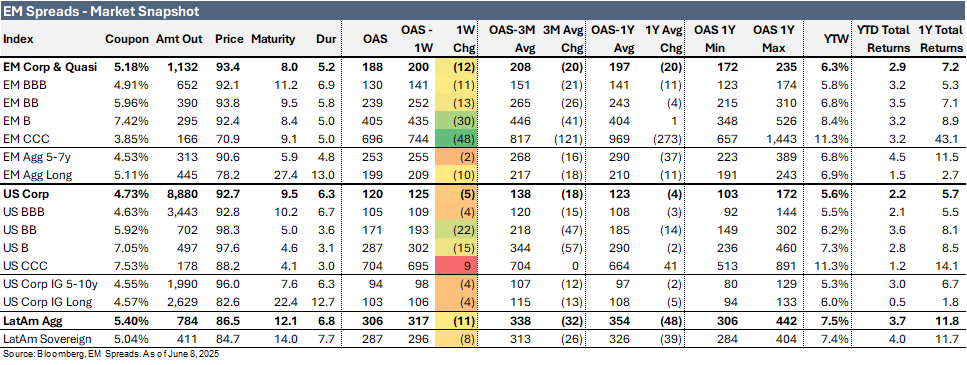

The LatAm Aggregate Index contracted by 11 bps to 306 bps in the week ending Friday, June 6, 2025, and is now trading 32 bps below its 3-month average of 338 bps. The broader Emerging Market Index decreased 12 bps to 188 bps, reflecting a 20 bps contraction from its 3-motnh average of 208 bps. Meanwhile, the U.S. Aggregate Index fell by 5 bps to 120 bps, and is now 18 bps below its 3-month average of 138 bps. Notably, the EM CCC Index contracted 48 bps and are now trading 121 bps below its 3-motnh average of 817 bps.

Equity markets in the region posted mixed performances. Argentina’s Merval Index fell 5.4%, Brazil’s Ibovespa Index decreased 0.7%, while Mexico’s Mexbol Index improved 0.4%. In the U.S., the S&P 500 Index advanced 1.5% for the week.

In commodities, WTI crude oil traded at $64.6/b, up 6.2% on the week, while Brent crude settled at $66.5/b, up 4.0%.

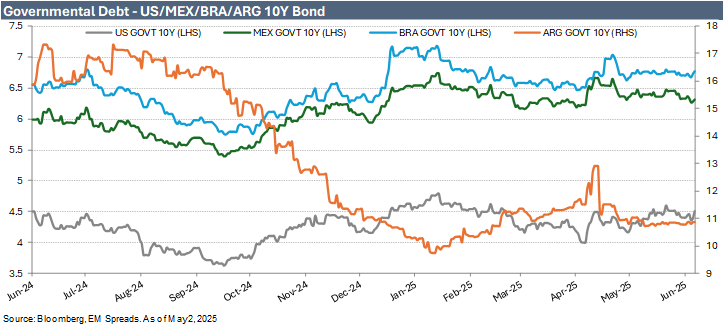

Turning to bond yields, U.S. Treasuries saw an increase across the curve. The 10-year yield rose 11 bps to 4.51%, while the 5-year yield increased 16 bps to 4.12%. In Latin America, the yield on the 10-year Mexican government bond decreased 2 bps to 6.31%, the 10-year Brazilian government bond increased 7 bps to 6.77%, and the 10-year Argentine government bond widened 8 bps to 10.87%.

Weekly News

Suzano to Acquire 51% of Kimberly-Clark’s International Tissue Business for $1.73bn

Suzano announced the acquisition of a 51% stake in a newly formed international tissue company through a $1.734 billion cash transaction with Kimberly-Clark, subject to certain adjustments. The agreement, disclosed on June 5, is expected to close in mid-2026 following regulatory approvals and the restructuring of assets by Kimberly-Clark in select jurisdictions. It contemplates an enterprise value of $3.4 billion for Kimberly-Clark’s International Family Care and Professional (IFP) business.

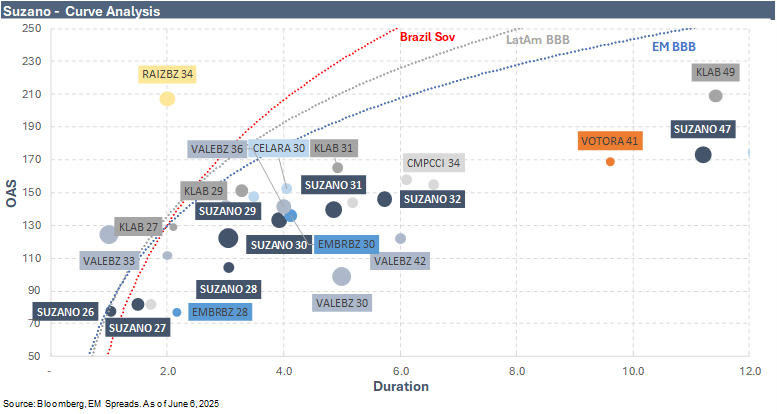

EM Spreads take: We assess the credit impact of the transaction as positive for Suzano. The acquisition is strategically sound, as it improves the company’s scale and expands its presence in the more stable tissue market while leveraging its competitive cost advantage in pulp. It also supports Suzano’s broader transition from a pure commodity exporter to a vertically integrated global player with branded consumer exposure by reducing its significant reliance on market pulp. Over time, we believe successful execution of the acquisition could contribute to a more diversified and resilient business profile. We also think the structure of the transaction, which includes the joint venture, helps mitigate integration and execution risk by facilitating a smoother operational transition.

Additionally, based on our calculations, the acquisition is being carried out at 4.9x including synergies, which we view as attractive given that tissue companies typically trade at higher multiples than pulp companies. Another positive is the minimal impact on leverage, as illustrated by the table. Lastly, management noted that further M&A is highly unlikely over the next 2 to 3 years, as the focus will be on creating value from the acquired assets, which largely removes the M&A risk from the credit for the time being.

We continue to expect that the combination of healthier pulp prices, higher sales volumes from the Ribas unit, normalized capital expenditures, lower costs, and a clear commitment to deleveraging will strengthen Suzano’s credit profile in 2025. This trend is likely to persist in the coming years, as no significant additional supply is projected to come online.

We maintain our Outperform recommendation for the Suzano (Baa3/BBB-/BBB-) 3.750% 2031 bonds, yielding 5.6% for a 4.9-year duration, and the Suzano 3.125% 2032 bonds, yielding 5.8% for a 5.7-year duration, while maintaining a Market Perform rating for the rest of the curve. Additionally, Suzano’s 2031 and 2032 bonds trade well below par at $91.2 and $85.7, respectively, while most of the rest of Suzano’s curve is priced close to or above par.

Vista Priced US$500mn 2033 Unsecured Notes at Par to Yield 8.5% (IPT: mid-8%)

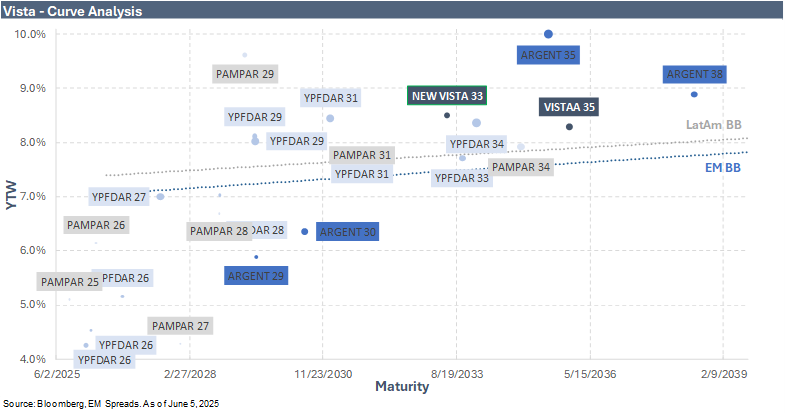

On June 4, 2025, Vista Energy successfully priced a US$500 million 2033 senior unsecured bond at par to yield 8.5%. The final pricing is in line with the initial price talk of mid 8% and the guidance of 8.5%. The notes are expected to be rated BB- by Fitch. Proceeds are expected to be used for general corporate purposes, including the refinancing of existing debt and capital expenditures. The notes are governed by NY law.

The notes have a 7-year weighted average life, with semiannual interest payments and soft bullet amortization through three equal annual installments in 2031, 2032, and 2033.

We recommend a BUY on the new bonds yielding 8.5% for a 2033 maturity, which compares favorably to the VISTAA (Caa1/BB-) 7.625% 2035 notes yielding 8.3%. The new bonds offer additional yield with lower duration risk. We believe these bonds provide a more appealing yield within Vista’s debt capital structure and screen wide relative to the broader EM BB and Latam BB curves. This presents an attractive entry point for yield-focused investors comfortable with Argentina’s improving, though still fragile, macro backdrop.

Cemex Launches US$1bn Perpetual NC5 Notes to Yield 7.2% (IPT: 7.625%)

Cemex is launching a US$1 billion perpetual NC5 unsecured subordinated notes issuance to yield 7.2%, following an initial price talk of 7.625%. The notes are subordinated to all existing and future senior indebtedness, ranking senior only to capital stock. They are expected to be rated BB by S&P and Fitch. Proceeds are expected to be used for general corporate purposes, including the repayment of debt or other financial obligations.

We continue to view Cemex as an attractive and resilient LatAm credit, with a focus on profitability and deleveraging. This is supported by a management team that appears committed to maintaining healthy credit metrics, reducing debt, and improving free cash flow generation, while benefiting from a strong liquidity profile and geographic diversification.

We believe uncertainties around U.S.-Mexico relations have eased in recent weeks. Mexico is advocating for an early review of the US-Mexico-Canada Agreement, and the U.S. Department of Agriculture has committed $21 million to expand a screwworm eradication facility in Mexico, which could lead to the resumption of cattle imports. Additionally, the Mexican president has actively engaged with U.S. leadership to address bilateral concerns. That said, while challenges persist, recent developments indicate a concerted effort by both countries to strengthen their partnership.

We recommend a BUY on the new US$1 billion NC5 perpetual notes. At 7.2%, we find the bonds attractive relative to the CEMEX 5.20% 2030 unsecured notes, which yield 5.3%, and the CEMEX 3.875% 2031 unsecured notes, which yield 5.4%. We note that the perpetual notes are rated BB/BB and rank senior only to capital stock, compared to the company’s unsecured notes rated BBB-/BBB-. However, we think the perpetual notes are fairly priced given the rating differential and structural subordination.

We note that the credit story is constrained by macroeconomic uncertainties in Mexico, including a widening fiscal deficit, weak GDP growth, exposure to improved but still uncertain U.S.-Mexico relations, and foreign exchange risk.

Telecom 1Q25: Margin Gains Support Credit, But Telefónica Deal Still Central

On May 22, 2025, we published our report on Telecom 1Q25 results.

We maintain our Market Perform recommendation on Telecom Argentina (Caa1/B-/B).

Telecom Argentina reported a positive 1Q25, with healthy organic results and strong consolidated figures including Telefónica’s March numbers. Consolidated revenue increased 18.9% QoQ and 27.8% YoY to P$1,363 billion, exceeding market consensus expectations by 11.3%. The improvement was primarily driven by the integration of Telefónica Argentina, effective March 1, 2025. Service revenue rose 20.0% QoQ and 26.5% YoY to P$1,285 billion. Telecom’s service revenues excluding Telefónica increased 4.9% YoY, while Telefónica’s service revenues improved 17.1% YoY, primarily driven by real ARPU improvements across segments. Reported EBITDA rose significantly, up 50.5% QoQ and 39.9% YoY to P$452 billion. The EBITDA margin expanded 7.0 pp sequentially and 2.9 pp YoY to 33.1%, supported by operating costs increasing meaningfully below revenue growth, enhancing profitability.

From a credit perspective, the results reflected a 38.0% increase in gross debt and a 37.6% increase in net debt in USD terms sequentially. However, this was fully offset by a 56.6% sequential increase in LTM proforma EBITDA, which the company estimated at US$1.77 billion. As a result, gross leverage decreased to 2.3x as of March 2025 from 2.7x in December 2024, and net leverage improved to 2.1x from 2.4x over the same period. The company’s liquidity remains weak, with P$1,348 billion (US$1.26 billion) in short-term debt, representing 2.6x of its cash position and 30.3% of total debt. Telecom’s cash and equivalents totaled P$519 billion (US$483 million). We note that the company lacks committed revolving credit facilities. Consequently, liquidity is not sufficient to cover short-term debt.

We view Telecom Argentina’s acquisition of Telefónica as a potentially transformative transaction for the local telecom landscape, with clear synergies in mobile and broadband services. While the acquisition may make strategic sense in the long run, it introduces immediate financial, regulatory, and operational risks. The government’s decision to suspend the deal underscores elevated regulatory risk, particularly around market concentration concerns. While the financing structure appears manageable in the near term, based on covenant compliance and proforma leverage trends, uncertainty around integration timelines and potential asset divestments to meet antitrust requirements could delay any meaningful credit upside.

Telecom Prices US$800 Million Unsecured Bond Due 2033 at 9.5% Yield

On May 22, 2025, Telecom Argentina (Caa1/B-/B) successfully priced a US$800 million 8Y senior unsecured bond with a 9.25% coupon at 98.862 cents on the dollar, with a final yield of 9.5%. The final price was in line with the initial price talk of mid-9%. The notes will amortize 50% and 50% annual installments in 2032 and 2033, and the proceeds are expected to be used to pay some of the US$1.17 billion in loans issued to finance the acquisition of Telefonica Argentina.

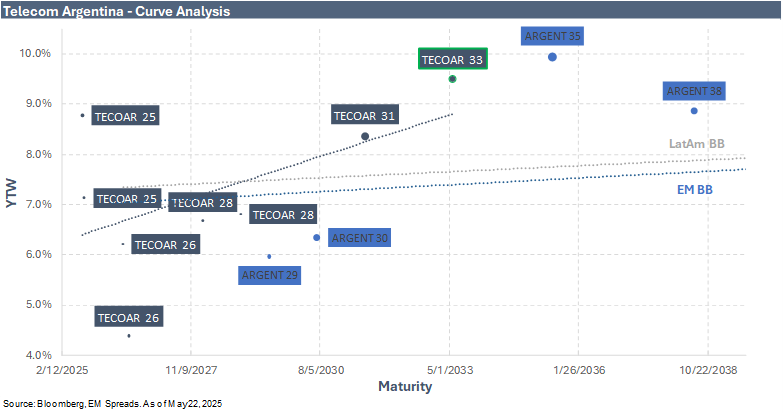

We recommend a BUY on the new TECOAR 2033 notes. At 9.500% for a 5.3-year duration, we find the bonds attractive relative to the TECOR 9.500% 2031 unsecured bonds, which yield 8.5% for a 3.8-year duration, despite the modest extension in duration. We believe these bonds offer an appealing yield within Telecom’s debt capital structure and screen wide relative to the broader Telecom curve. This presents an attractive entry point for yield-focused investors comfortable with Argentina’s improving, though still fragile, macro backdrop.

That said, Telecom’s credit story remains constrained by uncertainty surrounding the acquisition of Telefónica, its exposure to political risk, and the currency mismatch between its revenues and debt. While we expect this transaction to improve liquidity, as of March 2025 the company’s liquidity was weak, with P$1,348 billion (US$1.26 billion) in short-term debt, representing 2.6x its cash position and 30.3% of total debt. Telecom’s cash and equivalents totaled P$519 billion (US$483 million). We note that the company lacks committed revolving credit facilities. Consequently, liquidity was insufficient to cover short-term debt.

We view the refinancing of the acquisition-related loan as credit positive. The new issue also helps extend Telecom’s maturity profile, diversify its funding base, and improve its overall liquidity, which is one of our main concerns. Leverage metrics based on the company’s proforma EBITDA appear robust and are expected to improve as the integration of Telefónica progresses. Additionally, the combination of an improving macroeconomic environment, including the easing of capital controls, declining inflation, and a growing economy, along with the recent local legislative election in Buenos Aires that provided meaningful support to the current administration, has helped reduce political risk ahead of the mid-term elections in October 2025.

All things considered, we believe Telecom is well positioned to capitalize on its strong market presence in the current environment. The notes offer attractive yields, solid leverage metrics, and stand to benefit from Argentina’s improving macroeconomic backdrop, while this transaction should help alleviate some of our liquidity concerns.

See Also:

Suzano (June 6, 2025): Suzano to Acquire 51% of Kimberly-Clark’s International Tissue Business for $1.73bn

Vista (June 5, 2025): Vista Priced US$500mn 2033 Unsecured Notes at Par to Yield 8.5% (IPT: mid-8%)

Cemex (June 4, 2025): Cemex Launches US$1bn Perpetual NC5 Notes to Yield 7.2% (IPT: 7.625%)

Telecom (May 22, 2025): Telecom to Price USD 2033 Unsecured Notes (IPT: mid-9%, Guidance: 9.5%)

Telecom (May 22, 2025): Telecom 1Q25: Margin Gains Support Credit, But Telefónica Deal Still Central

Suzano (May 16, 2025): Suzano 1Q25: Credit Metrics Improve Despite EBITDA Miss, Remain Outperform

Minerva (May 14, 2025): Minerva 1Q25: Integration and Deleveraging Underpin Outperformance View

YPF (May 11, 2025): YPF 1Q25: Margin Expansion and Strategic Progress Back Outperformance View

Mercado Libre (May 8, 2025): MELI 1Q25: Impressive Growth, Little Room for Further Spread Compression

Pemex (May 1, 2025): Pemex 1Q25: Upgraded to Market Perform, but Structural Risks Persist

Cemex (April 29, 2025): Cemex 1Q25: Credit Strength Persists, but No Catalyst for Spread Compression

Vista Energy (April 25, 2025): Vista 1Q25: Strategic Petronas Acquisition Strengthens Credit and Growth Outlook

Vista Energy (April 17, 2025): Vista Energy Expands Vaca Muerta Footprint with Strategic Petronas Deal

Minerva (April 9, 2025): Minerva Announces Capital Increase Backed by Sponsors

Telecom Argentina (April 1, 2025): Initiation coverage report.

Pemex (March 27, 2025): Pemex Monthly Report: February

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.