Market Snapshot

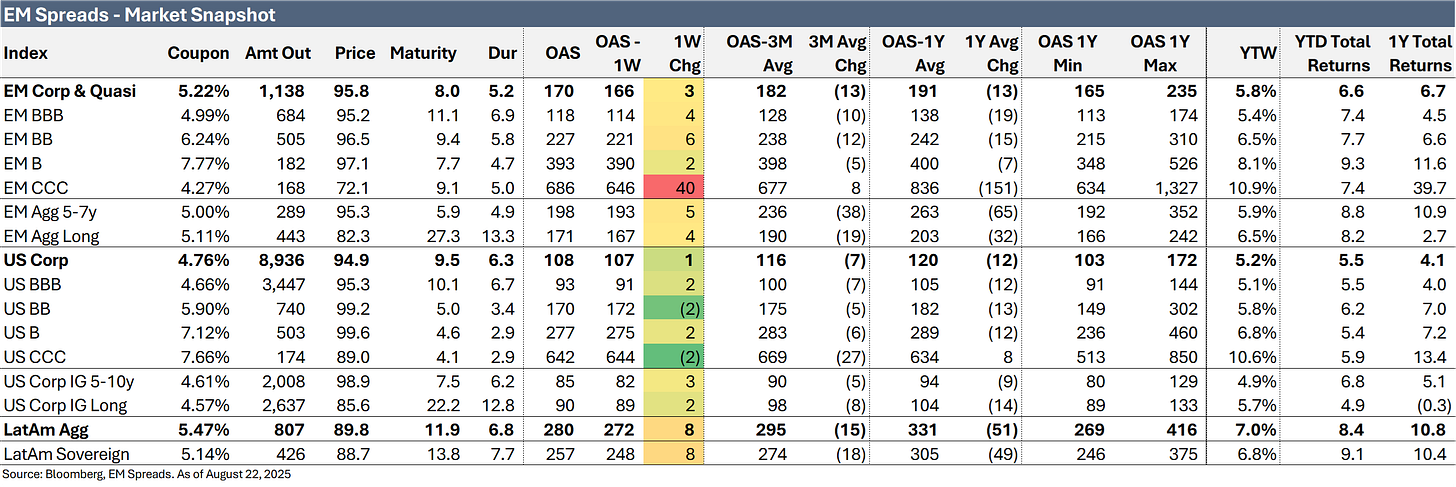

The LatAm Aggregate Index widened by 8 bps to 280 bps in the week ending Friday, August 22, 2025, and is now trading 15 bps below its 3-month average of 295 bps. The broader Emerging Market Index expanded 3 bps to 170 bps, reflecting a 13 bps contraction from its 3-month average of 182 bps. Meanwhile, the U.S. Aggregate Index increased by 1 bps to 108 bps, 7 bps below its 3-month average of 116 bps. Notably, the EM CCC Index widened by 40 bps to 686 bps and is now 8 bps below its 3-month average of 677 bps, while the U.S. CCC Index contracted 2 bps to 642 bps, 27 bps tighter than its 3-month average of 669 bps.

Equity markets in the region posted mixed performance. Argentina’s Merval Index fell 3.8%, while Brazil’s Ibovespa increased 1.2% and Mexico’s Mexbol improved 1.6%. In the U.S., the S&P 500 Index gained 0.3% on the week.

In commodities, WTI crude closed at $63.7/b, up 1.4% on the week, while Brent settled at $67.7/b, up 2.9% over the same period.

Turning to bond yields, the 10-year U.S. Treasury yield contracted 6 bps to 4.25%, while the 5-year yield declined 8 bps to 3.76%. In Latin America, the 10-year Mexican government bond yield increased 2 bps to 5.90%, the Brazilian 10-year rose 6 bps to 6.40%, and Argentina’s 10-year jumped 25 bps to 11.66%.

2Q25 Earnings Recap

Telecom 2Q25: Neutral Amid Uncertainties While Upside Remains Limited

On August 21, we published our report on Telecom 2Q25 results.

We maintain our Neutral recommendation on Telecom Argentina (B2/B-/B). The notes offer attractive yields, and we think Telecom’s strategy is well positioned to leverage its strong market presence, with leverage metrics appearing solid and expected to improve further as the Telefónica integration progresses. However, we think a better entry point may emerge once there is greater clarity on regulatory, acquisition, and political fronts, while the 2031 and 2033 notes trade above par at $105.9 and $104.6, respectively, limiting near-term upside.

Telecom Argentina reported below expectations 2Q25 results. Consolidated revenue increased 32.3% QoQ and 61.0% YoY to P$1,912 billion, modestly missing market expectations by 0.3%. The top-line performance was supported by higher ARPU across all business lines and the consolidation of Telefónica Móviles Argentina (TMA), which provided a meaningful boost to reported figures. Reported EBITDA reached P$528 billion in 2Q25, up 10.2% QoQ and 41.0% YoY, but came in 5.0% below consensus expectations. The EBITDA margin contracted 5.5 pp QoQ to 27.6% and 3.9 pp YoY. EBITDA growth reflected stronger revenues, though margins compressed as certain costs grew faster than revenues, particularly severance charges at TMA, as well as bad debt expenses, regulatory taxes and fees, commissions and advertising, and other operating expenses. Management highlighted that excluding TMA severance charges, the theoretical margin would have been around 31.6%.

Suzano 2Q25: Credit Resilient but Curve Positioning Shift

On August 19, we published our report on Suzano 2Q25 results.

We downgrade Suzano’s (Baa3/BBB-/BBB-) 2031s and 2032s to Neutral and upgrade the 2029s to Overweight, as these notes offer a comparable yield while meaningfully reducing duration risk. We continue to view Suzano’s business and financial risks positively, supported by expectations of healthier pulp prices, higher sales volumes, and lower costs with reduced reliance on third-party purchases. However, at current spread levels, we see limited further upside for the 2031 and 2032 bonds. Management’s focus on deleveraging, cost efficiency, and executing strategic initiatives should further reinforce the company’s credit profile.

Suzano delivered healthy results, with stronger volumes and positive net free cash flow, though limited by lower prices. The company reported revenues of R$13.30 billion, up 15.1% QoQ and 15.7% YoY, exceeding market expectations by 3.8%. Sequential revenue growth was primarily driven by a 21.0% increase in sales volumes to 3,680kt in 2Q25, supported by higher Pulp (up 23.3%) and Paper (up 5.4%) volumes. This was partially offset by a 4.9% decline in average prices to R$3,613/t, with Pulp down 3.1% and Paper down 3.0%. Compared to 2Q24, revenue growth was underpinned by a 27.9% increase in sales volumes, reflecting a 28.4% rise in Pulp and a 23.5% increase in Paper. The top line was also supported by the 8.6% appreciation of the USD against the BRL and the start-up of Suzano Packaging US operations, partially offset by a 13.3% decline in Pulp prices (USD: down 20.1%).

YPF 2Q25: Encouraging Strategic Progress Supports Overweight View

On August 15, we published our report on YPF 2Q25 results.

We maintain an Overweight view on YPF (B2/B-/CCC+), supported by mature field divestments, lower lifting costs, and a strategic focus on expanding unconventional production and midstream/export infrastructure. These initiatives, along with a more favorable macroeconomic backdrop, should strengthen the credit profile and support bond outperformance. Risks include the October 2025 midterm elections and the unresolved Petersen/Eton Park legal dispute. We favor the YPFDAR 9.500% 2031 notes (8.1% yield, 2.7-year duration) and the 9.000% 2029 notes (7.7% yield, 2.0-year duration) for their attractive yields and limited duration risk.

YPF reported weak operating results in 2Q25, though in line with expectations. Total production volumes declined 1.2% QoQ, primarily due to the continued divestment of mature fields, where hydrocarbon production fell 26% sequentially to 72 kboed, representing only 13% of total production in the quarter. Revenues increased 0.7% QoQ to $4.64 billion, exceeding market consensus by 8.5%, supported by strong seasonal sales of natural gas and fuels, as well as higher crude oil and agricultural exports. These gains were partly offset by lower seasonal gasoline demand and Brent-driven declines in refined product prices, particularly for local fuels. Despite the sequential revenue increase, adjusted EBITDA declined 9.7% QoQ to $1.12 billion in 2Q25, though it exceeded market consensus expectations by 1.1%. The adjusted EBITDA margin contracted 2.8 pp QoQ and 0.2 pp YoY to 24.2%. The sequential decline was mainly driven by Brent contraction impacting refined product prices, the exit from mature fields, and inventory valuation effects, partially offset by lower lifting costs from reduced exposure to mature fields. Upstream EBITDA improved 0.7% QoQ, while Downstream EBITDA decreased 13.1% QoQ. We note that excluding mature fields, 2Q25 adjusted EBITDA would have been $1.25 billion, representing an 11.3% increase compared to the reported figure including mature fields.

Minerva 2Q25: Strong Results and Deleveraging Support Overweight Call

On August 12, we published our report on Minerva 2Q25 results.

We maintain an Overweight on Minerva’s 2033 bonds, which offer a 6.7% yield for a 4.0-year duration, providing higher yield with less duration risk than the 2031 notes and fair relative value to benchmarks and comparable notes. The view is supported by favorable beef market conditions, the company’s ability to offset U.S. tariffs, its track record of deleveraging, and successful asset integration, which we expect will drive further spread compression over the next 9–12 months.

Minerva reported solid operating results in 2Q25, generating net revenues of R$13.20 billion, up 24.3% QoQ and 81.6% YoY, exceeding market expectations by 11.0%. Growth was driven by higher sales volumes and prices in both domestic and export markets, including R$3.01 billion in revenue and 119.1k tons in volumes from newly acquired assets. Average prices increased 0.8% QoQ and 28.9% YoY to R$29.0/kg, while total volumes rose 22.3% QoQ and 39.8% YoY to 507k tons. Adjusted EBITDA increased 35.3% QoQ and 74.9% YoY to R$1.30 billion, exceeding consensus expectations by 14.8%. The adjusted EBITDA margin expanded 76 bps sequentially to 9.4% but contracted 35 bps YoY. Sequential margin expansion was mainly driven by cost dilution from higher volumes and revenues as the new assets ramped up, along with a 225 bps reduction in operating expenses as a percentage of revenue to 10.1%. The YoY contraction reflected higher cattle prices in several regions, which outpaced the increase in average selling prices. Management expects further cost dilution and margin support through year-end as utilization rates at the new plants improve.

MELI 2Q25: Constructive on Growth Prospects, Limited Spread Compression

On August 10, we published our report on Mercado Libre 2Q25 results.

We maintain our Neutral recommendation on MELI’s 2031 bonds, as relative value comparisons place them close to fair value, albeit on the expensive side. While we remain constructive on MELI’s operating profile and growth prospects, we see limited potential for further spread compression over the next 9–12 months given persistent margin pressure from new marketing and shipping initiatives, higher debt, and a tighter liquidity profile.

MercadoLibre delivered strong topline growth in 2Q25, although EBITDA missed market expectations. Revenues increased 14.4% QoQ and 33.8% YoY (FX-neutral: up 53% YoY) to $6.79 billion, supported by a 14.5% QoQ and 20.6% YoY increase in gross merchandise volume (FX-neutral: up 37.2% YoY) and a 10.8% QoQ and 39.4% YoY increase in total payment volume (FX-neutral: up 60.9% YoY). Healthy growth across key markets drove revenues 3.1% above consensus, with Brazil up 12.7% QoQ and 24.7% YoY, Mexico up 23.2% QoQ and 25.4% YoY, and Argentina up 10.5% QoQ and 76.9% YoY. By segment, Commerce revenues grew 16.2% QoQ and 29.3% YoY to $3.84 billion, while Fintech revenues increased 12.1% QoQ and 40.3% YoY to $2.95 billion.

CSN 2Q25: Stable Credit Metrics and Attractive Carry Support Overweight

On August 6, we published our report on CSN 2Q25 results.

We maintain our Overweight recommendation, favoring the CSNBZ 4.625% 2031s (yielding 9.1%, priced at $80.0) and CSNBZ 5.875% 2032s (yielding 9.3%, priced at $83.3) for their attractive carry, potential price upside, and wide spreads versus the LatAm BB curve. We believe CSN’s credit metrics will remain broadly stable, while spread compression could be supported by Brazilian protectionist measures on steel imports, a possible recovery in steel prices from Chinese production cuts, asset sales, anticipated domestic rate cuts, and improving global trade sentiment.

CSN delivered positive 2Q25 operating results despite headwinds. The company reported consolidated revenues of R$10.69 billion, down 2.0% QoQ and 1.7% YoY, coming in 2.0% below market expectations. The sequential decline was primarily driven by lower iron ore prices, which offset operational improvements, while steel revenues were affected by CSN’s decision to prioritize margin over volume amid a surge in low-priced imports. Adjusted EBITDA totaled R$2.64 billion, up 5.3% QoQ but down 0.1% YoY, exceeding consensus expectations by 6.4%. The adjusted EBITDA margin expanded 1.7 pp QoQ and 0.4 pp YoY to 24.7%. In the steel segment, the EBITDA margin increased 2.8 pp QoQ and 5.0 pp YoY to 10.8%, despite lower steel sales and revenues, as the company targeted the domestic market with more resilient pricing and lower costs, offsetting the 11.4% QoQ and 9.7% YoY decline in shipments caused by import competition. In the mining segment, EBITDA was pressured by lower prices, higher sea freight costs, and increased third-party purchases, while improved iron ore production contributed to cost dilution, helping to reduce C1 costs.

Gerdau 2Q25: Credit Resilience Supported by US Exposure

On August 4, we published our report on Gerdau 2Q25 results.

We maintain our Neutral recommendation on Gerdau. While we continue to hold a constructive view of Gerdau’s credit profile, the outlook for its Brazilian operations remains challenged, and we see limited room for further spread compression at current levels. That said, we find the GGBRBZ 5.750% 2035 and 7.250% 2044 bonds more attractive across the curve, offering yields of 5.6% and 6.0%, respectively, and trading wide to the US BBB curve. For US investors, this presents a noteworthy yield pickup opportunity within the investment-grade space.

Gerdau’s 2Q25 results were once again driven by North America, while performance in Brazil remained under pressure. The company reported revenues of R$17.53 billion, up 0.9% QoQ and 5.5% YoY, broadly in line with consensus, exceeding expectations by 0.3%. The sequential improvement was supported by stronger performance in North America, where higher shipments and price adjustments offset weaker trends in Brazil and South America. On a YoY basis, revenue growth was driven by an 8.6% USD appreciation and a 4.1% increase in consolidated shipments, primarily from volume growth in North and South America. This helped mitigate ongoing pricing and import-related pressures in Brazil.

Pemex 2Q25: Strong Government Backing Anchors Credit

On July 31, we published our report on Pemex 2Q25 results.

We recommend a selective Overweight on Pemex’s curve, supported by strong government backing evidenced by the $12 billion issuance and openness to private-sector funding, which effectively improves liquidity, reduces interest expense, and diversifies funding sources.

Pemex reported mixed 2Q25 results. The company’s top line increased 3.8% QoQ but declined 15.6% YoY to $20.09 billion. The sequential improvement was primarily driven by an 11.2% increase in domestic revenues, while the YoY decline was marked by a 24.8% drop in export revenues. Pemex generated $3.90 billion in adjusted EBITDA, down 51.7% QoQ but up 22.3% YoY. The adjusted EBITDA margin contracted 12.0 pp QoQ but expanded 5.5 pp YoY to 19.4%. The sequential deterioration was mainly due to a 25.0% increase in cost of sales and an 18.6% rise in operating expenses. On a YoY basis, the margin expansion was supported by a 19.2% decrease in cost of sales, partially offset by a 12.1% increase in operating expenses. After seven consecutive quarters of sequential production declines, Pemex’s oil and condensate production averaged 1,621 kbpd in 2Q25 (excluding partners), up 1.6% QoQ but down 8.2% YoY. Including partners, total production reached 1,638 kbpd, reflecting a 1.1% QoQ increase and an 8.6% YoY decline.

Cemex 2Q25: Resilient Credit Navigates Soft Results, but Tight Spreads Limit Upside

On July 28, we published our report on Cemex 2Q25 results.

We maintain our Neutral recommendation on Cemex. While we continue to view Cemex as an attractive and resilient LatAm credit, we see limited room for further spread compression at current levels, given macro uncertainty and a lack of near-term catalysts.

Cemex reported somewhat expected weak 2Q25 results. Revenues totaled $4.13 billion, reflecting a 5.3% YoY decline (l-t-l: -4% YoY), missing consensus expectations by 1.8%. The topline contraction was primarily driven by lower revenues in Mexico (down 23.3%) and the US (down 6.2%), partially offset by improvements in Europe (up 7.3%) and the Middle East and Africa (up 38.0%). The company generated EBITDA of $823 million, down 10.8% YoY (l-t-l: -9%), broadly in line with consensus, missing by just 0.6%. The EBITDA margin contracted 1.2 pp YoY to 20.0%, reflecting the drag from Mexico and the US, where weaker volumes and FX headwinds diluted otherwise solid pricing and cost-efficiency efforts. Cemex reaffirmed its flat EBITDA guidance for 2025, supported by accelerated cost-efficiency measures. Its Project Cutting Edge program raised the 2025 EBITDA savings target to $200 million, up from the initial $150 million, and aims for a $400 million run rate by 2027.

Vista 2Q25: Results Reinforce Overweight, But Cash Burn and Liquidity Weaken Buffer

On July 14, we published our report on Vista 2Q25 results.

We maintain our Overweight recommendation on Vista Energy, with a preference for the 2033 notes, which offer a modestly higher yield despite lower duration risk.

Vista reported 2Q25 results marked by a strong operational ramp-up and the first quarter of consolidated results following the PEPASA acquisition. The company delivered adjusted EBITDA of $405 million, up 46.9% QoQ and 40.3% YoY, coming in 2.0% above consensus, supported by a 46% sequential increase in production to 118.0 Mboe/d. This reflected the inclusion of 50% of La Amarga Chica, which returned to 4Q24 production levels. Despite a 9.3% sequential decline in realized oil prices, adjusted EBITDA margin expanded 3.4 pp QoQ to 66.3%, driven by the elimination of trucking costs and continued operating efficiency. In 2Q25, 84% of domestic oil volumes were sold at export parity-linked prices, while the remaining 16% of total oil sales were exports. As a result, all of Vista’s oil volumes, both domestic and exported, were effectively sold at export parity pricing.

Weekly News

MercadoLibre Launches Credit Card in Argentina

MercadoLibre’s fintech unit Mercado Pago announced the launch of its first credit card in Argentina, backed by Mastercard. The card, available in both physical and virtual formats, will be gradually distributed via its app in the coming weeks. It carries no issuance or maintenance fees and offers up to three interest-free installments on purchases over P$30,000 made on MercadoLibre’s marketplace or at merchants using Mercado Pago’s QR system. According to company president Juan Martin de la Serna, the initiative builds on the strong growth of MercadoLibre’s credit portfolio and aims to expand financing access for users with limited or no credit history. The product is fully integrated with Mercado Pago’s digital account, enabling end-to-end management through the app.

EM Spreads’ take: We think the launch of a credit card in Argentina reinforces Mercado Pago’s strategy of deepening financial inclusion and expanding its consumer credit footprint in a market with limited access to traditional banking. The absence of fees and installment incentives could drive adoption, while digital account integration should support usage and data collection.

Fitch Affirms Minerva at BB; National Scale Upgraded to AAA(bra)

Fitch Ratings affirmed Minerva’s Long-Term Foreign and Local Currency IDRs at BB and maintained a Stable Outlook, while upgrading the National Scale rating to AAA(bra) from AA+(bra). The senior unsecured notes rating at Minerva Luxembourg S.A. was also affirmed at BB. The upgrade on the National Scale reflects Fitch’s view of Minerva’s enhanced scale and geographic diversification following the acquisition of Marfrig’s beef assets at YE24, which boosted capacity by 42%. Fitch projects EBITDA margins to remain above industry averages and expects positive FCF to support net leverage at around 3.0x YE25, down from gross leverage of 5.2x.

Fitch highlighted Minerva’s competitive positioning as Latin America’s largest beef exporter, operating 43 plants across Brazil, Argentina, Uruguay, Paraguay, Colombia, Chile, and Australia. Export volumes are forecast to increase to 1.9 billion metric tons in 2025 from 1.5 billion in 2024. While U.S. tariffs on Brazilian beef are seen as credit neutral, Fitch noted Minerva’s ability to mitigate risks through exports from other geographies. Liquidity is considered strong, with R$12.6 billion in cash against R$27.2 billion in debt as of June 2025. The rating agency projects EBITDA of R$4.9 billion and CFFO of R$1.2 billion in 2025, with positive FCF supported by modest capex (1.8% of revenues) and a minimum dividend payout policy.

Government’s PEMEX Support Credit Neutral for Mexican Banks

Fitch said PEMEX’s new financial plan is broadly credit neutral for Mexican commercial and development banks. The plan should reduce commercial bank exposure to the public sector via loan repayments, though sovereign and GRE exposures will remain significant, accounting for about 26% of total assets, or 2.8x CET1 at 1Q25. The measures include the creation of Eagle Funding, which issued US$12bn in P-Caps, and a new P$250bn PEMEX Investment Fund, financed by development and commercial banks through sovereign-guaranteed loans.

Commercial banks’ direct exposure to PEMEX remains low, but supplier financing could add to asset-quality pressures, with NPLs in this segment rising to 3.4% in June 2025 from 0.2% in March. Banks are unlikely to increase PEMEX exposure due to prudential lending standards and internal risk guidelines. Development banks, however, are expected to maintain and possibly increase participation, given their policy mandate and strong capital positions (Banobras 24.6%, Bancomext 17.3%, Nafin 18.1% capital ratios at 1Q25). Fitch also noted PEMEX’s rating was upgraded to BB from B+ after the USD12bn P-Cap issuance, with sovereign support viewed as neutral for Mexico’s BBB-/Stable rating.

See Also:

Telecom (August 21, 2025): Telecom 2Q25: Neutral Amid Uncertainties While Upside Remains Limited

Suzano (August 19, 2025): Suzano 2Q25: Credit Resilient but Curve Positioning Shift

YPF (August 15, 2025: YPF 2Q25: Encouraging Strategic Progress Supports Overweight View

Minerva (August 12, 2025): Minerva 2Q25: Strong Results and Deleveraging Support Overweight Call

Mercado Libre (August 10, 2025): MELI 2Q25: Constructive on Growth Prospects, Limited Spread Compression

CSN (August 6, 2025): CSN 2Q25: Stable Credit Metrics and Attractive Carry Support Overweight

Gerdau (August 4, 2025): Gerdau 2Q25: Credit Resilience Supported by US Exposure

Pemex (July 31, 2025): Pemex 2Q25: Strong Government Backing Anchors Credit

Cemex (July 28, 2025): Cemex 2Q25: Resilient Credit Navigates Soft Results, but Tight Spreads Limit Upside

Market Commentary (July 16, 2025): U.S. Tariff Escalation: Credit Implications for Brazilian Companies in Our Coverage

Vista (July 14, 2025): Vista 2Q25: Results Reinforce Overweight, But Cash Burn and Liquidity Weaken Buffer

Gerdau (June 23, 2025): Initiating Coverage on Gerdau: IG Credit with US Exposure, Limited Spread Upside

CSN (June 13, 2025): Initiating Coverage on CSN: Overweight on Risk-Reward

Suzano (June 6, 2025): Suzano to Acquire 51% of Kimberly-Clark’s International Tissue Business for $1.73bn

Vista (June 5, 2025): Vista Priced US$500mn 2033 Unsecured Notes at Par to Yield 8.5% (IPT: mid-8%)

Cemex (June 4, 2025): Cemex Launches US$1bn Perpetual NC5 Notes to Yield 7.2% (IPT: 7.625%)

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.