Weekly News & Views

EM spreads hold steady, Brazil macro update, YPF advances shale pivot, Minerva finalizes Uruguay asset sale, and CSN Cimentos prices R$550mn issue.

Market Snapshot

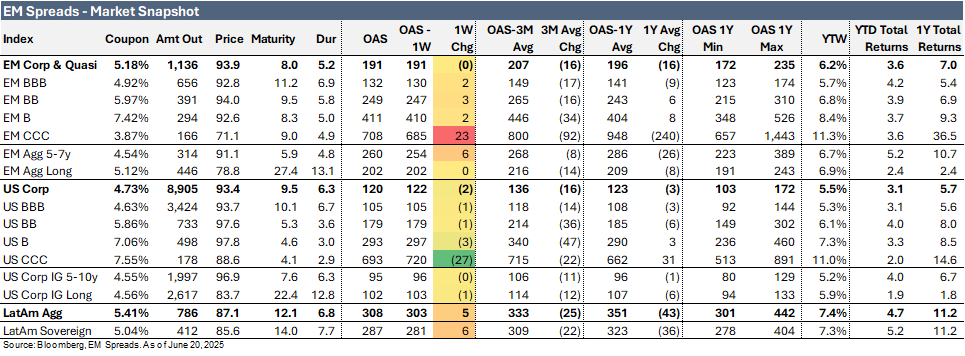

The LatAm Aggregate Index expanded by 5 bps to 308 bps in the week ending Friday, June 20, 2025, and is now trading 25 bps below its 3-month average of 333 bps. The broader Emerging Market Index remained stable at 191 bps, reflecting a 16 bps contraction from its 3-month average of 207 bps. Meanwhile, the U.S. Aggregate Index contracted by 2 bps to 120 bps and is now 16 bps below its 3-month average of 136 bps. Notably, the EM CCC Index expanded 23 bps and is now trading 92 bps below its 3-month average of 800 bps, while the US CCC Index contracted 27 bps and is now at 693 bps, which is 22 bps below its 3-month average of 715 bps.

Equity markets in the region posted negative performances. Argentina’s Merval Index fell 3.0%, Brazil’s Ibovespa Index decreased modestly by 0.1%, while Mexico’s Mexbol Index declined 2.0%. In the U.S., the S&P 500 Index fell 0.2% for the week.

In commodities, WTI crude oil traded at $73.8/b, up 1.2% on the week, while Brent crude settled at $77.0/b, up 3.7% over the same period.

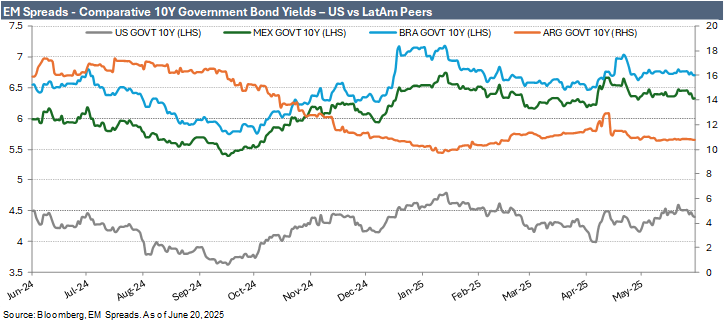

Turning to bond yields, U.S. Treasuries saw declines across the curve. The 10-year yield decreased 2 bps to 4.38%, while the 5-year yield fell 4 bps to 3.96%. In Latin America, the yield on the 10-year Mexican government bond expanded 4 bps to 6.15%, the 10-year Brazilian government bond decreased 4 bps to 6.67%, while the 10-year Argentine government bond contracted 7 bps to 10.87%.

Brazil Macro

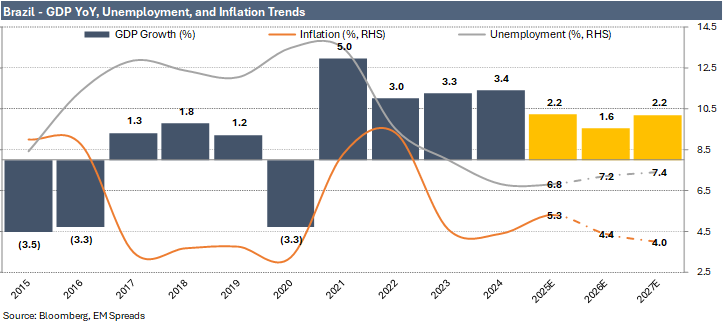

After four consecutive years of GDP growth at or above 3%, Brazil’s economic expansion is expected to moderate as tight monetary policy and a potential slowdown in public spending take effect. GDP growth is projected at 2.2% in 2025, 1.6% in 2026, and 2.2% in 2027. Inflation closed 2024 at 4.4%, exceeding the 3% target band ceiling, as high interest rates have failed to bring it down. Managing inflation in 2025 will likely require a coordinated policy effort, with the 5.3% inflation forecast reflecting anticipated rate hikes and a smaller budget deficit. Inflation is expected to ease to 4.3% in 2026 and 3.8% in 2027. The Brazilian government has also struggled to reduce spending, which has contributed to higher borrowing costs amid already elevated public debt. In May, consumer prices remained high at 5.32% YoY, offering little relief to central bankers debating whether to pause the tightening cycle or deliver another interest rate hike.

Brazil’s unemployment rate is expected to increase after consistent labor market improvement since 2021, reaching 6.8% in 2024. However, ongoing monetary and fiscal tightening is likely to weigh on employment in the coming quarters, keeping the unemployment rate relatively stable in 2025 before rising to 7.2% in 2026 and 7.4% in 2027.

In 2024, the Brazilian real weakened to its lowest nominal level, while the fiscal deficit remained elevated at 8.5% of GDP. Although the currency is expected to stabilize in 2025, the fiscal deficit is projected to remain high at 8.4% in 2025 and 8.0% in 2026. On trade policy, Brazil maintains a trade deficit with the United States, making it unlikely to become a primary focus of the Trump administration. However, if U.S. tariffs were to exert pressure on Brazil, the country’s export sector, one of its key economic drivers, could be negatively affected. This would risk constraining economic growth.

Weekly News

Minerva Announces Divestment of Uruguayan Asset to Allana

On June 13, 2025, Minerva announced that its subsidiary, Athn Foods Holdings S.A., entered into an agreement to sell Establecimientos Colonia S.A., a Uruguayan company, to Allana Magellan S.L. for US$48 million.

The divestment follows the restructuring of the Uruguay Transaction originally announced in February 2025, in which Minerva agreed to acquire multiple assets from a Marfrig subsidiary. In accordance with antitrust guidance from Uruguay’s COPRODEC, Athn Foods will retain the Salto and San José plants, while the Colonia facility must be resold. The closing of the transaction remains subject to customary conditions, including COPRODEC’s final approval of the broader deal.

EM Spreads’ take: We view the announced divestment as credit neutral. The transaction had been largely anticipated. However, the sale removes uncertainty around COPRODEC’s final decision and mitigates the risk of fines or delays. The retained assets, Salto and San José, represent the strategic core of Minerva’s Uruguay footprint, providing scale, export diversification, and EBITDA contribution to Minerva. With the Uruguay integration already underway and synergy benefits from the Marfrig acquisition beginning to materialize, we continue to see value in Minerva’s credit.

YPF Advances Divestment Strategy to Prioritize Vaca Muerta Development

YPF is accelerating its divestment of conventional assets as it intensifies its strategic focus on shale oil development in the Vaca Muerta formation. As part of its Andes Project, the company approved the transfer of 12 additional blocks, including assets in Chubut and Mendoza, bringing the total number of divested areas to 18. Another 21 are in final stages, and 11 remain in progress. These moves align with YPF’s Mature Fields Exit Program, which targets the transfer of 50 conventional blocks.

This strategic pivot is central to the company’s “4x4 Plan,” which prioritizes capital allocation toward high-IRR unconventional assets and the buildout of midstream infrastructure. In 2025, YPF plans to allocate US$3.3 billion, roughly two-thirds of its US$5 billion capex budget, toward Vaca Muerta. In 1Q25, shale oil output reached 149 kbpd, and total oil production from the formation is on track to hit 200 kbpd by year-end.

EM Spreads’ Take: YPF’s asset sales reaffirm its focus on capital discipline and portfolio optimization. The strategy has begun to show tangible results: 1Q25 adjusted EBITDA rose 48% QoQ to $1.25 billion, driven by margin expansion, higher shale output, and cost savings from mature field divestments. Lifting costs fell 11.8% QoQ to $15.3/boe, while gross margin improved by 6.8pp.

Despite a 10% increase in net debt and continued negative free cash flow, we view the divestment program and investment in core shale infrastructure, including the Oldelval and VMOS pipelines, as credit positive. These steps, combined with LNG monetization plans and favorable tailwinds from Argentina’s macro stabilization and the Milei administration’s pro-business reforms (e.g., RIGI), support our constructive view on YPF’s credit trajectory.

CSN Cimentos Brasil Finalizes Terms of R$550 Million Debenture Offering

CSN Cimentos Brasil S.A., a subsidiary of Companhia Siderúrgica Nacional (CSN), has finalized the terms of its fourth public issuance of simple, non-convertible, unsecured debentures with additional surety guarantee. The offering, distributed under Brazil’s automatic registration process, was originally structured for up to R$600 million but was ultimately set at R$550 million, consisting of 550,000 debentures with a face value of R$1,000 each. The issuance date was June 17, 2025.

The transaction is governed by the private instrument of the 4th Debenture Indenture, signed on June 5, 2025, between CSN Cimentos Brasil, Vórtx Distribuidora de Títulos e Valores Mobiliários Ltda. as the trustee, and Elizabeth Cimentos S.A. as guarantor. Elizabeth Cimentos is currently in the early stages of operations and is not yet registered as a securities issuer with the CVM. The debentures are being offered under CVM’s automatic registration regime and are exclusively directed at professional investors. As such, the offer does not require a prospectus or summary document under CVM Resolution 160.

EM Spreads’ take: We view CSN Cimentos Brasil’s R$550 million debenture issuance as a credit-neutral event that reinforces the company's ability to access domestic capital markets under competitive terms. The use of an additional surety guarantee from Elizabeth Cimentos S.A., despite its early operational stage, likely served to enhance investor comfort and pricing efficiency. We will continue to monitor how proceeds are allocated and whether the company maintains a conservative financial policy amid ongoing market expansion.

See Also:

CSN (June 13, 2025): Initiating Coverage on CSN: Overweight on Risk-Reward

Suzano (June 6, 2025): Suzano to Acquire 51% of Kimberly-Clark’s International Tissue Business for $1.73bn

Vista (June 5, 2025): Vista Priced US$500mn 2033 Unsecured Notes at Par to Yield 8.5% (IPT: mid-8%)

Cemex (June 4, 2025): Cemex Launches US$1bn Perpetual NC5 Notes to Yield 7.2% (IPT: 7.625%)

Telecom (May 22, 2025): Telecom to Price USD 2033 Unsecured Notes (IPT: mid-9%, Guidance: 9.5%)

Telecom (May 22, 2025): Telecom 1Q25: Margin Gains Support Credit, But Telefónica Deal Still Central

Suzano (May 16, 2025): Suzano 1Q25: Credit Metrics Improve Despite EBITDA Miss, Remain Outperform

Minerva (May 14, 2025): Minerva 1Q25: Integration and Deleveraging Underpin Outperformance View

YPF (May 11, 2025): YPF 1Q25: Margin Expansion and Strategic Progress Back Outperformance View

Mercado Libre (May 8, 2025): MELI 1Q25: Impressive Growth, Little Room for Further Spread Compression

Pemex (May 1, 2025): Pemex 1Q25: Upgraded to Market Perform, but Structural Risks Persist

Cemex (April 29, 2025): Cemex 1Q25: Credit Strength Persists, but No Catalyst for Spread Compression

Vista Energy (April 25, 2025): Vista 1Q25: Strategic Petronas Acquisition Strengthens Credit and Growth Outlook

Vista Energy (April 17, 2025): Vista Energy Expands Vaca Muerta Footprint with Strategic Petronas Deal

Minerva (April 9, 2025): Minerva Announces Capital Increase Backed by Sponsors

Telecom Argentina (April 1, 2025): Initiation coverage report.

Pemex (March 27, 2025): Pemex Monthly Report: February

Disclaimer

Opinions presented in this report are based on and derived primarily from public information that EM Spreads LLC ("EM Spreads," "We," or "Our") considers reliable. Still, we make no representations or warranty regarding their accuracy or completeness. EM Spreads accepts no liability arising from this report. No warranty, express or implied, as to the accuracy, timeliness, completeness, or fitness for any particular purpose of any such analysis or other opinion or information is given or made by EM Spreads in any form.

All information contained in this document is protected by Copyright law, and none of such information may be copied, repackaged, transferred, redistributed, resold, or stored for subsequent use for any such purpose, in whole or in part, by any person without EM Spreads’ prior written consent. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The content shall not be used for any unlawful or unauthorized purposes.

This content is provided on an "as is" basis and should not be regarded as a substitute for obtaining independent advice. EM Spreads disclaims all express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, freedom from bugs, software errors, or defects, that the content’s functioning will be uninterrupted or that the content will operate with any software or hardware configuration. Investors must determine the appropriateness of an investment in any instruments referred to herein based on the merits and risks involved, their own investment strategy, and their legal, fiscal, and financial position. As this document is for information purposes only and does not constitute or qualify as an investment recommendation or advice or as a direct investment recommendation or advice, neither this document nor any part of it shall form the basis of or be relied on in connection with or act as an inducement to enter, any contract or commitment whatsoever. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise a personal recommendation to you.

The opinion contained in this report may not be suitable for your specific situation. Investors are urged to contact their investment advisors for individual explanations and advice. EM Spreads does not offer advice on the tax consequences of investments, and investors are urged to contact an independent tax adviser for individual explanations and advice. In no event shall EM Spreads be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of this report.

This document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. EM Spreads undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document or to discontinue it altogether without notice. EM Spreads reserves the right to modify the views expressed herein without notice.

The content in this report is provided to you for information purposes only. EM Spreads’ opinions and analysis are not recommendations to purchase, hold, or sell any securities or to make any investment decisions and do not address the suitability of any security. EM Spreads assumes no obligation to update the content following publication in any form or format. The content in the report shall not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and /or clients when making investment and other business decisions. EM Spreads has not taken steps to ensure that the securities referred to in this report are suitable for any investor.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject EM Spreads to any registration or licensing requirement within such jurisdiction. No person should review or rely on this report if such review or reliance would require EM Spreads to obtain any registration or license in any such jurisdiction.

All estimates and opinions expressed in this report reflect the analysts' independent judgment as of the issue's date about the subject company or companies and its or their securities. No part of the analyst's compensation was, is, or will be directly or indirectly related to this report's specific recommendations or views. The research analysts contributing to the report may not be registered /qualified as research analysts with any regulatory or government body or market regulator.